The 75-year joint business relationship between Youngpoong and Korea Zinc has come to an end due to a management rights dispute. Regarding the responsibility for the conflict, Youngpoong points to the unethical management of Choi Yoon-beom, chairman of Korea Zinc, while Korea Zinc highlights environmental pollution issues caused by Youngpoong. Although civil and criminal legal disputes over securing management rights are intensifying, there is speculation that financial mobilization power will determine the outcome of the dispute.

‘Predicted Dispute’ Amid Moral Controversy

The Youngpoong Group has been jointly operated by the Jang and Choi families for 75 years since the late founders Jang Byung-hee and Choi Ki-ho established Youngpoong Enterprises together in 1949. These founders also established Korea Zinc in 1974. Over the years, the Jang family managed Youngpoong, and while Youngpoong remained the largest shareholder of Korea Zinc, the management was entrusted to the Choi family, maintaining a form of joint business relationship.

However, as the Choi family increased their stake in Korea Zinc and showed intentions to become independent from Youngpoong, the joint business relationship between the two families began to deteriorate. Eventually, Youngpoong initiated a management rights dispute by securing shares of Korea Zinc through a public tender offer with MBK Partners.

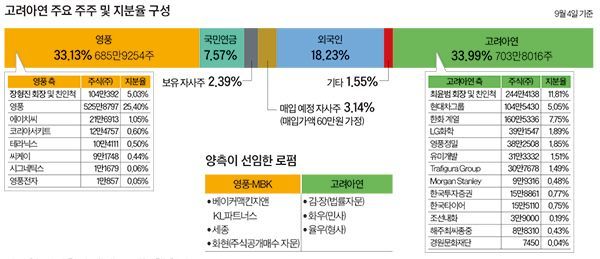

On the 12th, MBK announced that through a shareholder agreement with Youngpoong and the advisory family of Jang Hyung-jin, they would jointly exercise voting rights as the largest shareholder of Korea Zinc. Youngpoong and the advisory family transferred Korea Zinc shares amounting to half of their ownership plus one share to MBK. Youngpoong and MBK have announced a public tender offer for Korea Zinc shares from the 13th until July 4th. The tender offer price is 660,000 KRW per share.

Both Youngpoong and Korea Zinc accuse each other of unethical management while asserting the legitimacy of their claims to management rights.

Youngpoong criticizes Chairman Choi for misusing Korea Zinc’s funds and disregarding shareholder interests. Regarding the public tender offer on the 23rd, Youngpoong stated, “We conceded the position of the largest shareholder to MBK to prevent Chairman Choi’s arbitrary actions and to normalize management.” On the 21st, MBK issued a statement criticizing, “If the Korea Zinc board had functioned properly, there would have been no △560 billion KRW investment by One Asia Partners △investment used for market manipulation of SM Entertainment, etc.”

Korea Zinc defines Youngpoong and MBK’s attempts to secure management rights as “predatory acts” and strongly opposes them. They point to environmental pollution and serious accident issues at Youngpoong’s Seokpo smelter and argue that they cannot hand over Korea Zinc’s management rights to the failed Youngpoong management. On the 24th, Lee Jae-joong, vice chairman of Korea Zinc, held a press conference stating, “Advisor Jang Hyung-jin tried to offload hazardous waste stored at the Seokpo smelter’s waste storage site onto Korea Zinc, attempting to turn Korea Zinc into Youngpoong’s waste disposal site.”

Some speculate that Korea Zinc’s judgment that it can no longer bear the role of handling hazardous substances from the Seokpo smelter is also a background factor in the management rights dispute. The Seokpo smelter has been identified as a source of environmental pollution in the Nakdong River and Andong Dam areas. Recently, two executives of the smelter were arrested and indicted on charges of violating the Serious Accident Punishment Act.

On the morning of the 19th, at Lotte Hotel in Jung-gu, Seoul, Kim Kwang-il, Vice Chairman of MBK Partners, held a press conference regarding MBK Partners' public tender offer for Korea Zinc (center in the left photo). To his left is Kang Sung-doo, President of Young Poong, and to his right is Lee Sung-hoon, a lawyer at Baker McKenzie Korea. [Image source=Yonhap News]

On the morning of the 19th, at Lotte Hotel in Jung-gu, Seoul, Kim Kwang-il, Vice Chairman of MBK Partners, held a press conference regarding MBK Partners' public tender offer for Korea Zinc (center in the left photo). To his left is Kang Sung-doo, President of Young Poong, and to his right is Lee Sung-hoon, a lawyer at Baker McKenzie Korea. [Image source=Yonhap News]

The photo on the right shows Lee Je-jung, Vice Chairman of Korea Zinc (center), and employees holding a press conference on the 24th at Grand Seoul in Jongno-gu, Seoul, in protest against the public tender offer arising from the management rights dispute with MBK and Youngpoong.

The photo on the right shows Lee Je-jung, Vice Chairman of Korea Zinc (center), and employees holding a press conference on the 24th at Grand Seoul in Jongno-gu, Seoul, in protest against the public tender offer arising from the management rights dispute with MBK and Youngpoong. [Image source=Yonhap News]

Ultimately, Financial Mobilization Power is Key

Although both families claim legitimacy in the management rights dispute, it appears that financial mobilization power will ultimately determine the outcome. Currently, the outlook favors Youngpoong, backed by MBK. The variable is whether Korea Zinc can secure stronger allies than MBK. MBK has announced it will invest up to 2.1332 trillion KRW in this public tender offer.

Large corporations such as Hanwha, Hyundai Motor, and LG are mentioned as friendly shareholders of Korea Zinc, but there is speculation that they may find it difficult to inject additional funds due to concerns over breach of fiduciary duty and other issues.

Kim & Chang, HwaWoo VS BMKL, Sejong

Major law firms are also joining the management rights dispute one after another.

Kim & Chang is handling Korea Zinc’s defense of management rights. Kim & Chang is known to be advising Korea Zinc and functioning as the control tower. Civil lawsuits are handled by HwaWoo, and criminal cases by YulWoo. Korea Zinc has filed injunctions and criminal complaints, arguing that Youngpoong’s transfer of shares to MBK was unlawful. They also reported Advisor Jang Hyung-jin and MBK to the Seoul Central District Prosecutors’ Office on charges of breach of fiduciary duty.

Youngpoong and MBK have appointed Baker McKenzie & KL Partners (BMKL), Sejong, and HwaHyun to respond.

On the 13th, Youngpoong filed an injunction application with the Seoul Central District Court to inspect and copy Korea Zinc’s accounting books.

Lim Hyun-kyung, Lee Jin-young, Legal Times reporters

※This article is based on content supplied by Law Times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)