Funding Support for 247 Medium and Small Enterprises

Daedong, SK Shipping, Seojin Auto, M Capital, etc.

Low-Interest Funding Secured for Companies Facing Financing Difficulties

SK Shipping, M Capital, Seojin Automotive, Nepes, and 243 other companies will raise a total of 540 billion KRW using Primary Collateralized Bond Obligations (P-CBO) guaranteed by the Korea Credit Guarantee Fund (KODIT). Companies with low credit ratings or small-scale businesses that find it difficult to raise funds independently will secure liquidity with the support of KODIT guarantees.

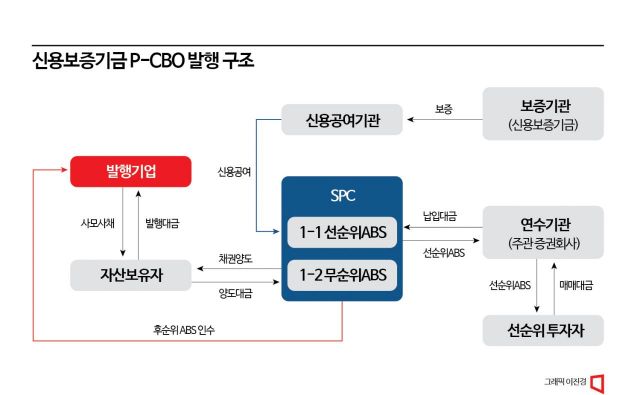

According to the investment banking (IB) industry on the 25th, KODIT will issue P-CBOs worth 540 billion KRW on the 26th. P-CBOs are asset-backed securities (ABS) issued with guarantees provided by KODIT and others on corporate bonds and loan receivables of companies facing difficulties in raising funds. This financing method is frequently used by small and medium-sized enterprises (SMEs) or mid-sized companies struggling to issue corporate bonds.

Securities firms such as Samsung Securities, Kiwoom Securities, IBK Investment & Securities, Kyobo Securities, and Hyundai Motor Securities participated as lead managers. After conducting financial due diligence on the companies in charge of underwriting, the private bonds and loans issued by these companies are transferred to a special purpose company (SPC), and KODIT provides guarantees to reissue them as senior CBOs and subordinated CBOs. Institutional investors purchase the senior CBOs, while the issuing companies underwrite the subordinated CBOs.

This P-CBO supports 22 mid-sized companies with 300 billion KRW and 225 SMEs with 235 billion KRW. Among the mid-sized companies, Daedong, a manufacturer of agricultural machinery (35 billion KRW), SK Shipping, a mid-sized shipping company (30 billion KRW), and Seojin Automotive, an auto parts manufacturer (25 billion KRW), are included as beneficiaries.

Capital companies such as M Capital (22.7 billion KRW), Hiho Wheel, an automotive aluminum company (20 billion KRW), and Sean E&C, an electrical construction specialist (20 billion KRW), receive relatively large support. The interest rates on the funds vary widely from the high 3% range to the low 6% range depending on credit ratings.

Among the SMEs supported by KODIT, many companies in manufacturing and wholesale and retail sectors are included. Construction companies, which were frequent users of P-CBOs, receive funding only in a few cases such as Prime Construction (1 billion KRW) and Midam (1 billion KRW). This is because the risk of P-CBO defaults increases significantly when many construction companies are included. The interest rates for SMEs’ financing are set between the mid-to-high 4% range and the 7% range.

An IB industry official said, "Mid-sized companies that find it difficult to issue corporate bonds on their own or companies that have difficulty obtaining loans from reputable financial institutions can secure urgent liquidity at relatively low interest rates through KODIT guarantees," adding, "As concerns over construction company defaults have increased, the scale of guarantee support for construction companies has drastically decreased." The official also noted, "However, there are limits to how much funding companies can secure through KODIT guarantees."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)