Exchange of Alternative Investment Know-How through CPPIB Visit

More Urgent Need for Returns... '1%P Increase in Returns' in Pension Reform Plan

Completion of US East and West Coast Hub System with Opening of San Francisco Office

Kim Taehyun, Chairman of the National Pension Service (NPS), who departed for the United States to attend the opening ceremony of the San Francisco office, will also visit the Canada Pension Plan Investment Board (CPPIB). This marks a meeting with a 'model student' of alternative investments following the government's announcement of pension reform measures aimed at improving fund returns.

According to the financial investment industry on the 6th, Chairman Kim plans to visit the US and Canada for a week starting from the 2nd. This is his first business trip to North America since taking office. After visiting the San Francisco office and attending the opening ceremony to review the local situation, he will travel to Toronto, Canada, to visit CPPIB and meet with senior officials. Considering the flight time, despite the tight schedule, he will directly visit Toronto, which is quite a distance from San Francisco.

Will Alternative Investments Be the 'Key' to Improving Returns by 1%P?

Kim Tae-hyun, Chairman of the National Pension Service, is delivering a New Year's address at the 2024 opening ceremony.

Kim Tae-hyun, Chairman of the National Pension Service, is delivering a New Year's address at the 2024 opening ceremony. [Photo by National Pension Service]

CPPIB is regarded as an outstanding pension fund in alternative investments. Its overseas investment ratio exceeds 80%, and alternative investments account for more than 50% of its total assets. The total assets under management (AUM) amount to $646.8 billion (approximately 865 trillion KRW), and its 10-year average annual return (2013?2022) was 9.58%, ranking first among major pension funds. During the same period, the NPS's return was 4.99%.

Chairman Kim plans to enhance cooperation with CPPIB, which has excellent know-how in alternative investments, and build a close global network to improve fund returns. Although the NPS is currently sailing smoothly, having achieved a record-high return of 14.14% last year and a profit of 102 trillion KRW in the first half of this year, high returns are always urgently needed. One of the key points of the recent government pension reform plan, which delays the fund depletion point to 2088, is to raise the long-term fund operation return target by more than 1 percentage point from the existing 4.5%. President Yoon Suk-yeol also mentioned in a national briefing that "we will increase fund returns."

There are also talks that the 'benchmark portfolio' that the NPS has confirmed to introduce from next year was referenced from CPPIB. The benchmark portfolio refers to an asset allocation method that divides asset classes into two simple combinations: risky assets and safe assets. CPPIB is famous for managing the benchmark portfolio exemplarily, and the NPS plans to apply it starting with the alternative investment sector next year. The detailed operation plan of the benchmark portfolio is still being refined. An NPS official said, "Isn't it about sharing good things and learning what we need to learn? Thanks to the San Francisco office opening schedule, we also have the opportunity to visit CPPIB."

US West Coast Alternative Investment 'Control Tower' Fully Operational

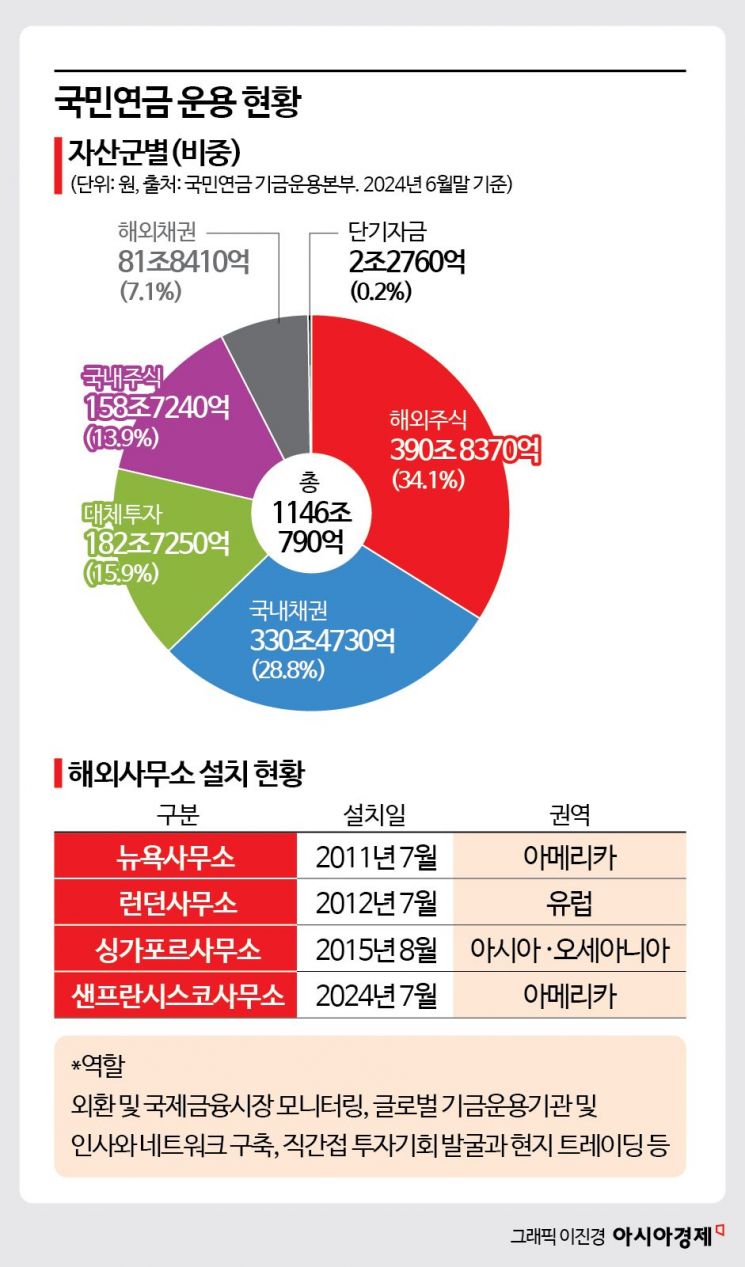

Overseas investment is a key driver of the NPS's returns. Since the fund's establishment in 1988 until 2023, only overseas stocks (11.04%) and alternative investments (9.28%) have exceeded the average fund return of 5.88%. Although alternative investment returns are currently aggregated for both domestic and overseas, a closer look shows that the overseas portion accounts for nearly 80% by amount. Overseas and alternative investments are becoming increasingly important. As of June, the combined assets of the NPS's overseas stocks, overseas bonds, and alternative investments amounted to 655.403 trillion KRW, accounting for 57.1% of total assets (1,146.079 trillion KRW).

Meanwhile, along with Chairman Kim, Hwang Jeonggyu, head of the NPS support division, and Park Minjeong, director of the Pension Finance Division at the Ministry of Health and Welfare, are scheduled to attend the opening ceremony of the NPS San Francisco office on the 5th (local time). About 40 people, including guests and officials, will attend. The office, which was temporarily opened in July, will begin full-scale operations from this day. The resident staff consists of five people, including the inaugural office head, Lim Seonghwan, a former head of the Americas private equity team.

The opening of the NPS overseas office is the first in nine years following New York (2011), London (2012), and Singapore (2015). San Francisco is the core of the US West Coast capital market. Among the Fortune 500 companies headquartered in the US, San Francisco had the highest number last year with 57 companies. It encompasses Silicon Valley, home to big tech companies such as Google Alphabet, Apple, Meta, and Nvidia. The San Francisco office is expected to serve as a western hub for discovering alternative investments and conducting local company research. Additionally, with this opening, a two-top system has been completed, with the New York office leading the East Coast and the San Francisco office leading the West Coast.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)