Korean Air's First Commercial Flight on the 30th

MOU Signed with 9 National Airlines and 5 Oil Companies

Government Announces SAF Expansion Strategy

The government has decided to mandate the use of Sustainable Aviation Fuel (SAF) blends on all international flights departing from South Korea starting in 2027. SAF is an eco-friendly alternative fuel produced using waste cooking oil, agricultural by-products, and waste materials, capable of reducing carbon emissions by up to 80% compared to conventional jet fuel. The government aims to participate in the global carbon neutrality movement by reducing carbon emissions and to secure a leading position in the SAF market.

On the 30th, the Ministry of Trade, Industry and Energy and the Ministry of Land, Infrastructure and Transport jointly announced a SAF expansion strategy at Incheon International Airport Terminal 2, attended by representatives from the refining and aviation industries. Accordingly, from 2027, all international flights departing domestically must mandatorily use a blend containing 1% SAF mixed with conventional jet fuel.

Korean Air began commercial operations between Incheon and Haneda using SAF produced by S-Oil and SK Energy (1% blend, refueled once a week), marking the first domestic use of SAF. Since the SAF used is certified by the International Civil Aviation Organization (ICAO), South Korea will be listed as the 20th country worldwide to refuel SAF on the ICAO website.

Along with Korean Air, nine domestic airlines including Asiana, Jeju Air, Jin Air, Eastar Jet, T'way Air, Air Busan, Air Premia, and Aero K signed a memorandum of understanding (MOU) on the same day with five domestic refiners?SK Energy, GS Caltex, S-Oil, HD Hyundai Oilbank, and Hanwha Total Energies?to commence commercial SAF operations.

The Ministries of Trade, Industry and Energy and Land, Infrastructure and Transport plan to enforce mandatory SAF blending for all international flights departing from South Korea starting in 2027. This is expected to reduce carbon emissions by approximately 160,000 tons annually, equivalent to the carbon emissions of about 53,000 passenger cars over one year. The blending ratio will be gradually increased considering international trends.

Anticipating a rise in airfares due to mandatory SAF use, the Ministry of Land, Infrastructure and Transport plans to reduce the burden on airlines and the public by improving international air traffic rights allocation methods, considering the introduction of an aviation carbon mileage system, and lowering airport facility usage fees. The Ministry of Trade, Industry and Energy announced plans to expand investment tax credits and provide incentives to boost SAF production.

Incheon-Paris Airfare Rises by 6,000 KRW... Government Reviews Mileage Benefits

Following the commercial operation of SAF by airlines and refiners, the government's move to mandate SAF blending from 2027 aligns with the global trend of strengthening carbon regulations.

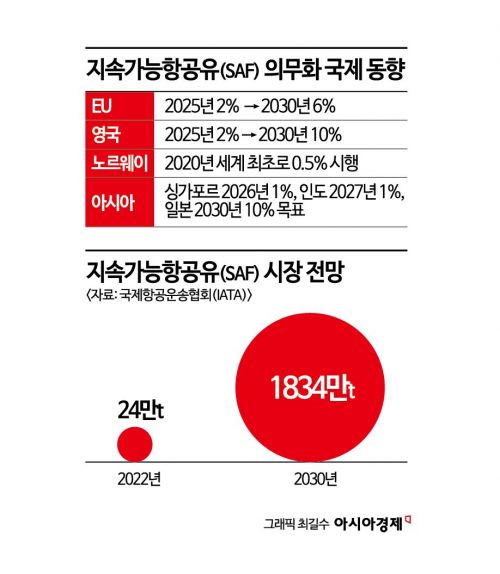

SAF can reduce carbon emissions without modifying aircraft structures, prompting airlines worldwide to adopt it. Currently, 19 countries use SAF as part of climate crisis responses, with some mandating SAF blending. France has required a 1% blend for international flights since 2022, and Japan aims for a 10% blend by 2030. The European Union (EU) plans to increase SAF blending ratios from 2% in 2025 to 6% in 2030, 34% in 2040, and 70% by 2050.

The International Civil Aviation Organization (ICAO) operates the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) among its 193 member states, planning to mandate SAF blending (around 1%) on all international flights departing domestically starting in 2027. South Korea cannot avoid joining this international trend.

Moreover, as the world's largest jet fuel exporter, SAF expansion is crucial for South Korea's industrial competitiveness. According to the International Air Transport Association (IATA), the SAF market is expected to grow from 240,000 tons in 2022 to 18.34 million tons by 2030, an approximately 70-fold increase. An official from the Ministry of Trade, Industry and Energy explained, "The capability to supply both jet fuel and SAF in a one-stop manner will directly affect export competitiveness." SAF use is also essential for maintaining Incheon International Airport's status as a global hub airport.

However, several challenges exist in expanding SAF. Currently, SAF is more expensive than conventional jet fuel at the current technological level, implying inevitable airfare increases. As of 2022, SAF production costs are $2,500 per ton, two to three times higher than conventional jet fuel at $892 per ton.

A government official explained, "Blending 1% SAF could increase airfare by 1,000 to 2,000 KRW for Incheon-Haneda flights and about 6,000 KRW for Incheon-Paris flights." Increasing the blend ratio would further raise airfares, potentially causing resistance from airlines and consumers. The Ministry of Land, Infrastructure and Transport plans to review measures such as linking the extent of SAF cost reflection in fares with international air traffic rights allocation or awarding mileage or points to passengers who use SAF flights.

6 Trillion KRW Investment in Refiners' SAF Production... "Incentives Needed Including National Strategic Technology Designation"

Securing dedicated domestic production facilities is urgent to blend 1% SAF. Based on the peak jet fuel consumption in 2018, the estimated SAF demand is 70,000 tons, which is 1% of 7 million tons (total jet fuel and bunkering exports and domestic consumption). Currently, refiners produce only small amounts of SAF using co-processing methods that utilize existing refining processes.

According to the Ministry of Trade, Industry and Energy, four refiners plan to invest about 6 trillion KRW by 2030 to build dedicated SAF production facilities. Given the enormous investment costs, active government support is essential. While the refining industry positively evaluates the government's SAF mandate policy, it emphasizes the urgent need for additional incentives such as designation as a national strategic technology. If recognized as a national strategic technology, a 15% tax credit on facility investments can be received.

An official from the Korea Petroleum Association said, "To maintain South Korea's position as the world's top jet fuel exporter, it is necessary to promptly introduce cost-relief support measures already implemented in other countries," adding, "We will continuously propose concrete incentives such as the national strategic technology investment tax credit system." The United States operates a SAF production tax credit of 630 KRW per liter, and Japan offers 260 KRW per liter.

An official from the Ministry of Trade, Industry and Energy stated, "SAF is currently designated as a new growth engine technology, allowing a 3% tax credit on facility investments," and added, "We will strive to have it additionally designated as a national strategic technology through consultations with the Ministry of Economy and Finance and other related ministries."

The government also plans to ease regulations to allow bio-based waste to be used as SAF raw materials and to form a dedicated task force (TF) to support SAF production plant projects. An official from the Ministry of Trade, Industry and Energy said, "In addition to waste cooking oil, the main raw material for SAF production, we will jointly survey overseas bio-resources currently usable with existing technology, such as animal fats and palm by-products, and secure next-generation raw material-based SAF production technologies like microalgae and green hydrogen to strengthen raw material supply capabilities."

◆

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)