‘Global M&A Trends’ Report

“With Elections Concluded Worldwide and Interest Rate Cuts

...Investment Sentiment Expected to Revive Afterwards”

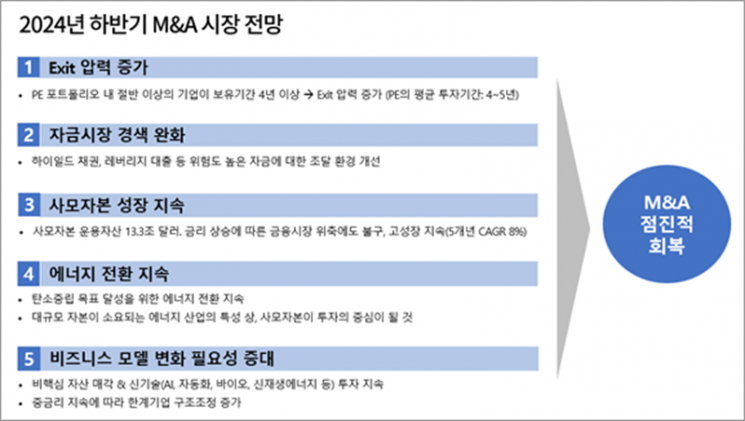

As the negative impact of major macroeconomic variables decreases, there is a forecast that the mergers and acquisitions (M&A) market will recover after the fourth quarter of this year. As key elections in major countries, including the U.S. presidential election, conclude toward the end of the year and interest rate cuts proceed, uncertainty is expected to diminish, revitalizing investment sentiment.

On the 13th, Samil PwC announced the publication of the report titled “Midterm Review of 2024 Global M&A Trends,” which contains these insights. The report reviews the status of the M&A market in the first half of this year and presents market forecasts and sector-specific investment strategies for the second half.

According to the report, in the early part of this year, delayed interest rate cuts and deteriorating investment sentiment led to continued sluggishness in the M&A market. However, in the second half, as high interest rates and political issues such as elections come to a close, the environment surrounding the M&A market is expected to improve, and investment sentiment is anticipated to recover.

Looking at investment entities, private equity has continuously grown despite the two and a half years of stagnation, holding abundant funds. Corporations are increasing demand to divest non-core assets to raise acquisition funds and invest in new technologies centered on artificial intelligence (AI).

The report states, “Companies holding abundant cash will emerge as key players in M&A by focusing on deals that accelerate revenue growth and enable innovation,” adding, “In the private equity market, the timing for divesting existing portfolios is approaching, and with an improved financing environment, transactions are expected to become more active.”

By sector, in the financial field, demand for digital innovation and ESG (environmental, social, and governance) remains strong. The information technology (IT), telecommunications, and media sectors are also seeing increased investment and interest as demand grows to integrate AI technologies. In healthcare, divestitures of non-core business units to secure new investment funds continue, with more attention on small- and medium-sized deals rather than large-scale ones. In the consumer goods sector, as the number of distressed companies rises from well-known brands to small and medium enterprises, acquisition opportunities for brands and intellectual property are expected to increase.

Min Jun-seon, head of the Deal Division at Samil PwC, said, “Although the timing is somewhat delayed compared to early-year expectations, the outlook that the M&A market has entered a recovery phase remains unchanged,” adding, “As the macro environment improves toward the end of the year, companies aiming to innovate their business models and private equity funds seeking to adjust their investment portfolios will actively consider investments.”

Detailed information about the report is available on the Samil PwC website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)