New York Palace and Seattle Hotel Raise $130 Million

KB Securities and NH Securities Lead... Hotel Lotte Provides Side Support

Borrowing Burden Increases Due to Delayed Profitability Improvement of Overseas Hotels

Two hotels of Lotte Group in the United States have consecutively secured dollar-denominated loans with the support of their parent company, Hotel Lotte. Although the revenue of overseas hotels, which had been halved due to COVID-19, is improving, they are still unable to escape losses. Meanwhile, as investments continue for remodeling and other purposes, the burden from overseas hotel operations is steadily increasing.

According to the investment banking (IB) industry on the 13th, Lotte Hotel Newyork Palace, LLC recently received a dollar loan worth $120 million (approximately 164 billion KRW) under the lead management of KB Securities. KB Securities executed the loan through a special purpose company (SPC) and raised funds by issuing Korean won securitized bonds backed by this loan as collateral. To hedge against exchange rate fluctuations, the SPC simultaneously entered into a foreign currency swap (CRS) contract with IBK Investment & Securities.

Earlier, Lotte Hotel Seattle, LLC obtained a similar loan of $11 million (15 billion KRW) with a six-month maturity. NH Investment & Securities led the funding and simultaneously signed an SPC and CRS contract. The lead manager is responsible for any gains or losses arising from exchange rate fluctuations.

Both the New York and Seattle hotels are 100% owned by Lotte Hotel USA Holdings, the North American hotel operating holding company of Hotel Lotte. Hotel Lotte operates hotels in New York, Seattle, and Guam in the United States. Recently, with the addition of a hotel in Chicago, the number of hotels operated in the U.S. has increased to four.

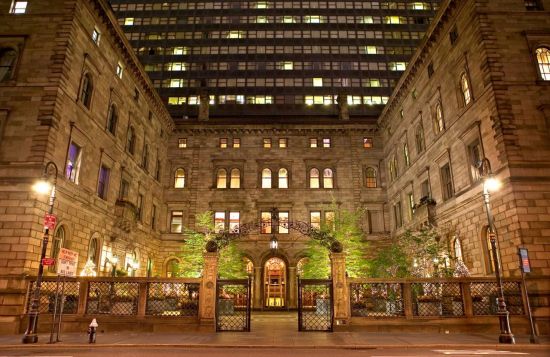

The New York hotel is a luxury hotel located in Midtown, the heart of Manhattan, within walking distance to Times Square, Rockefeller Center, the United Nations, and Central Park. The Seattle hotel was invested in to target business travelers and tourists in Seattle, one of the representative cities in the U.S. Northwest.

After the COVID-19 endemic, the revenue of the American hotels has steadily increased, improving their performance. For example, the New York Plaza, which has the largest revenue scale, saw its revenue rise from 77.6 billion KRW in 2021 to 209.5 billion KRW in 2022 and 240.9 billion KRW in 2023. However, net profit briefly turned positive in 2022 but recorded a net loss of 59.6 billion KRW last year.

Despite poor performance, increased fundraising has not improved the financial structure. At the end of last year, total assets were below 1 trillion KRW, but liabilities stood at 1.1589 trillion KRW, resulting in a capital deficit. The Seattle hotel has also continued to operate at a loss.

The funds raised by the two hotels are reportedly planned to be used for repaying maturing debts and operating expenses. Although remodeling and additional investments continue to require funds, the burden of borrowings for overseas hotels is expected to persist due to delayed performance improvements.

Hotel Lotte’s borrowing burden is also not decreasing. With support for Lotte Construction and delays in performance improvements in the hotel and duty-free businesses, total borrowings have remained around 9 trillion KRW for an extended period. The performance, which had been improving after the endemic, returned to an operating loss in the first quarter of this year.

An IB industry official said, "Hotel Lotte continues to invest in overseas hotels to solidify its position as a global brand hotel," adding, "With the peak seasons in the second and third quarters of this year, the performance of affiliated hotels is expected to improve, leading to some improvement in the financial situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)