"Excessive Economic Benefits Provided to Son's Company in Management Succession"

Sampyo Industry·SP Nature

Prosecutors File Charges and Impose 11.6 Billion KRW Fine

The Fair Trade Commission (FTC) has decided to refer Sampyo Industrial, which unfairly supported a company where Vice Chairman Jeong Dae-hyun, at the top of the Sampyo Group succession structure, is the largest shareholder, to the prosecution. Additionally, the FTC imposed corrective orders and a fine of 11.62 billion KRW on Sampyo Industrial and Espinature, the company that received the unfair support.

On the 8th, the FTC announced that it imposed corrective orders and a fine of 11.62 billion KRW for violations of Article 23, Paragraphs 1 and 2 of the Monopoly Regulation and Fair Trade Act (Fair Trade Act) by Sampyo Industrial and Espinature, affiliates of the corporate group Sampyo, and decided to refer Sampyo Industrial, the supporting entity, to the prosecution.

According to the FTC, Sampyo Industrial purchased powder, a raw material for ready-mixed concrete manufacturing, at a high price from Espinature, where Vice Chairman Jeong, the eldest son of Chairman Jeong Dowon of Sampyo Group, is the largest shareholder. From January 2016 to December 2019, over four years, it procured a volume equivalent to 7-11% of the domestic powder market transactions. The purchase price was set higher than the price Espinature charged to non-affiliated companies.

Yoo Sung-wook, Director of the Corporate Group Surveillance Bureau at the FTC, explained, "Sampyo Industrial and Espinature signed an annual powder supply contract with a fixed annual supply price, but at the end of the year, if the difference compared to the average supply price to Espinature’s non-affiliated companies exceeded 4%, the amount exceeding 4% was settled. The annual supply contract and the settlement and deduction conditions effectively resulted in a significant increase in Sampyo Industrial’s powder purchase price."

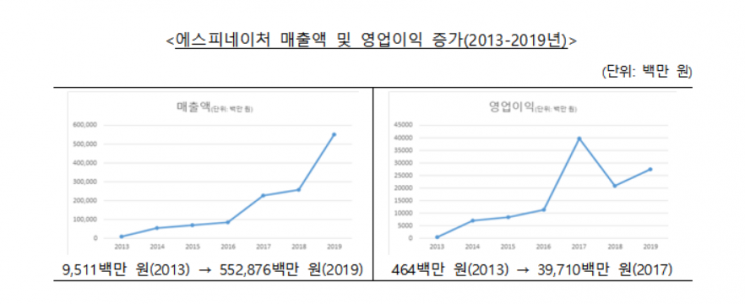

The FTC estimated that the unfair internal transactions resulted in gains of approximately 7.496 billion KRW for Espinature. Broken down by year, this corresponds to 5.1-9.6% of Espinature’s total annual operating profit. The FTC stated, "Based on unfair internal transactions, Espinature has strengthened its business foundation by maintaining a high market share in the domestic powder market."

Espinature is the leading company in the domestic powder market. In 2022, based on fly ash, Espinature’s market share was 25%, more than two to three times the gap with the second and third-ranked companies, Boryeong Fly Ash Cement Industry (8%) and Korea FA (7%).

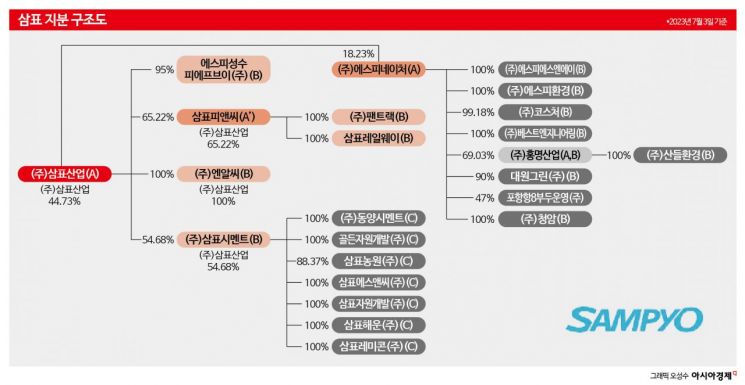

The FTC views these unfair support actions as part of establishing a foundation for group succession. Espinature is 71.95% owned by Vice Chairman Jeong, who is at the top of the Sampyo Group succession structure. Since establishing Espinature in 2013 to make it the group’s parent company, Sampyo Group has absorbed and merged multiple affiliates into Espinature, resulting in an expansion of Espinature’s scale and significant improvement in profitability.

During this process, the benefits were concentrated on Vice Chairman Jeong. Based on its retained funds, Espinature participated in paid-in capital increases of Sampyo and Sampyo Industrial to increase its shareholding, and paid 31.1 billion KRW in dividends to Vice Chairman Jeong from 2015 to 2021. This accounted for 76% of the total dividends (40.6 billion KRW) paid by Espinature to shareholders during this period.

The FTC stated, "This case is an example of sanctioning unfair support where the representative company of the corporate group Sampyo purchased products under significantly favorable conditions from a company owned by the second generation of the same controlling shareholder, providing excessive economic benefits during the process of preparing the management succession base for the second generation."

It added, "This action is significant as it is the first case to use economic analysis to estimate the normal price that would have been formed without unfair support, calculating the normal price and the amount of unfair support in collaboration with the Korea Fair Trade Mediation Agency’s Fair Trade Research Center."

Sampyo Group was designated as a publicly disclosed corporate group for the first time in 2023. According to the 2024 status of publicly disclosed corporate groups, Sampyo Group ranks 84th in the business world with assets totaling 5.281 trillion KRW. It is a construction materials specialized corporate group centered on Sampyo Industrial, focusing on cement and concrete, with affiliates including Espinature, Sampyo P&C, Sampyo Cement, and NRC.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)