Growth of the Electronic Cigarette Market

'IQOS Iluma' Market Share Rising

'HEETS' Production Halted... Focus on 'TEREA'

Korea Philip Morris has expanded its market share through the generational shift of heated tobacco products. As the domestic electronic cigarette market continues to grow, the company has improved profitability by discontinuing the production of the old device 'IQOS' and its dedicated sticks 'HEETS,' while focusing on the new 'IQOS Iluma' and 'Terea' models.

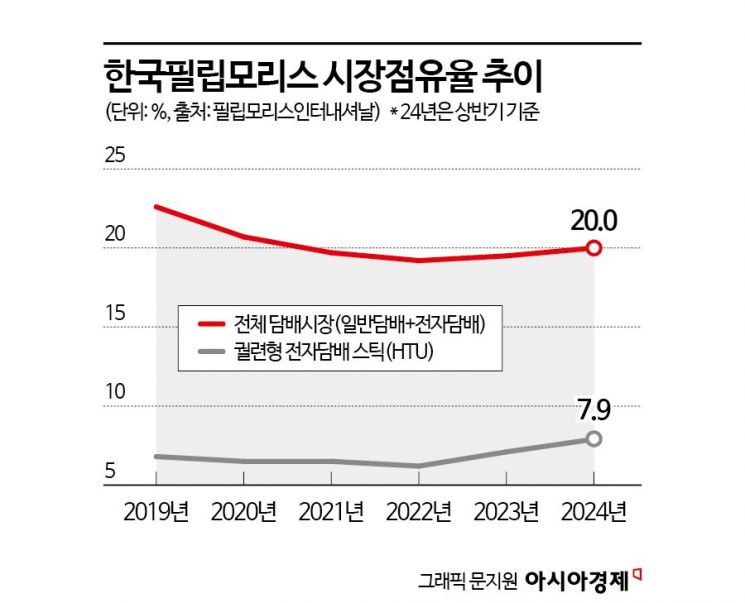

According to Philip Morris International (PMI) on the 6th, Korea Philip Morris's market share in the domestic tobacco market (combining conventional and electronic cigarettes) was 20.0% in the first half of this year, up 0.5 percentage points from 19.5% during the same period last year.

The improvement in Korea Philip Morris's market share was driven by heated tobacco products. In the first half of this year, the domestic market share of heated tobacco sticks (HTU), including Terea, was 7.9%, an increase of 1.0 percentage point compared to 6.9% in the same period last year. This is twice the overall tobacco market share growth rate, indicating that heated tobacco products are leading the increase in market share.

During this period, shipments of heated tobacco sticks also rose by 11.7% to 2.8 billion units from 2.5 billion units the previous year, significantly outpacing the overall tobacco shipment growth rate of 0.5%. Conversely, shipments of conventional cigarettes decreased by 5.6%, from 4.4 billion units to 4.2 billion units compared to the previous year.

Last year, Korea Philip Morris focused on expanding the distribution of the heated tobacco device IQOS Iluma, and this year, it is making every effort to increase its electronic cigarette market share by expanding the portfolio of its dedicated sticks, Terea.

Following the launch of 'Terea Russet' and 'Terea Teak' in December last year to broaden the options for non-combustible products, the company introduced the capsule-type new product 'Terea Arbor Pearl' in March and 'Terea Starling Pearl' in June, expanding the Terea product lineup to a total of 17 variants.

Korea Philip Morris launched the new capsule product "Terea Starling Pearl" for the IQOS Iluma-exclusive tobacco stick Terea in June.

Korea Philip Morris launched the new capsule product "Terea Starling Pearl" for the IQOS Iluma-exclusive tobacco stick Terea in June.

While expanding the Terea lineup, Korea Philip Morris has completely discontinued the production of HEETS, heated tobacco sticks incompatible with IQOS Iluma. 'IQOS' and HEETS were the heated tobacco device and stick products first introduced by Korea Philip Morris in June 2017. In March, the company decided to halt production of all 16 HEETS products manufactured domestically.

The discontinuation of HEETS production is interpreted as a strategy to strengthen profitability by increasing sales of the higher-priced IQOS Iluma and Terea devices compared to the older IQOS and HEETS. The original IQOS is priced at 59,000 KRW, whereas IQOS Iluma costs 99,000 KRW, 40,000 KRW more expensive. The 'IQOS Iluma One (69,000 KRW)' and 'IQOS Iluma Prime (139,000 KRW)' are also sold at higher prices than the older devices. Terea is priced at 4,800 KRW, higher than the existing HEETS at 4,500 KRW.

Previously, Korea Philip Morris launched IQOS Iluma and its dedicated sticks Terea in October 2022. IQOS Iluma was an ambitious product introduced to overturn the electronic cigarette market landscape after losing the top domestic market position, held for about five years since the launch of IQOS in 2017, to KT&G in the first quarter of 2022. Last year, the company focused on distributing devices such as the integrated product 'IQOS Iluma One' and limited editions like 'IQOS Iluma We Edition' and 'IQOS Iluma Stardrift.'

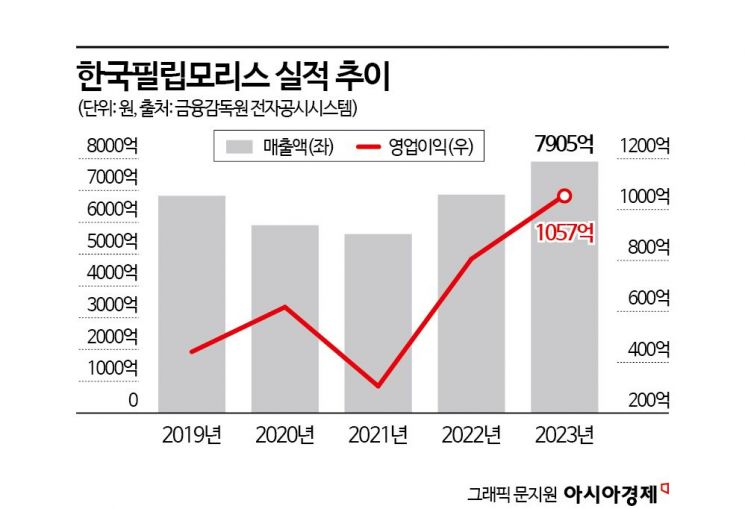

The generational shift in electronic cigarette devices has significantly improved Korea Philip Morris's profitability. According to the Financial Supervisory Service's electronic disclosure system, Korea Philip Morris's operating profit last year was 105.7 billion KRW, a 31.1% increase from 80.6 billion KRW the previous year. Revenue rose 15.1% to 790.5 billion KRW from 686.8 billion KRW, and net profit nearly doubled from 45.3 billion KRW in 2022 to 89.1 billion KRW, a 96.6% increase.

However, with the expansion of the domestic electronic cigarette market, competitor KT&G is also recording growth, making the recapture of the domestic market still a distant goal. Since KT&G officially entered the electronic cigarette market in 2018 with the 'Lil Hybrid,' it has rapidly increased its market share based on electronic cigarette sticks from 16% in 2018 to 34.4% in 2020, 40.4% in 2021, 47.5% in 2022, and 46.6% in 2023. In the first quarter of this year, KT&G's domestic stick sales volume was 1.43 billion units, up 3.6% compared to the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)