"South Korean REITs Market Must Be Raised to Advanced Country Level"

"Government Should Further Ease Regulations... Expectation of Interest Rate Cuts"

"The size of our country's REITs (Real Estate Investment Trusts) market should grow to account for 2-3% of the Gross Domestic Product (GDP), just like in Japan."

Jung Byung-yoon, Chairman of the Korea REITs Association, recently said in an interview with Asia Economy, "To revitalize REITs, the government must further ease regulations to raise the market size to the level of advanced countries."

"REITs Market Cap to GDP Ratio at 0.3%... Need to Lift Korea-Only REITs Act"

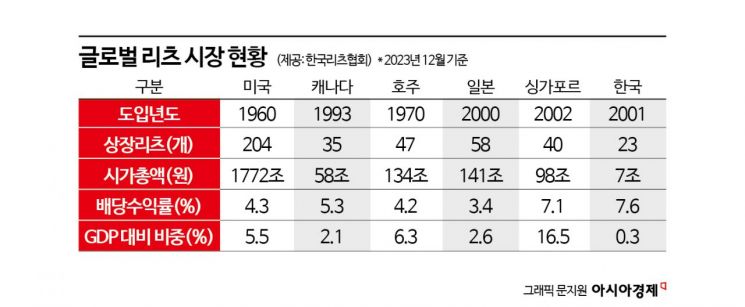

According to the REITs Association, since the system was introduced in 2001, the market capitalization of listed REITs in Korea stood at about 7.4 trillion won as of the end of last year. Compared to Singapore (97.7 trillion won) and Japan (140.7 trillion won), where REITs emerged around the same time, the gap is significant. The market cap to GDP ratio is 2.6% in Japan and 16.5% in Singapore, whereas Korea's is only 0.3%.

Chairman Jung emphasized market growth as essential for REITs revitalization. He stated that additional regulatory easing by the government is crucial in this process. He pointed out, "In the U.S., where REITs are already active, only a few regulations apply as REITs are treated as stock companies under commercial law. In Japan, the Bank of Japan (BOJ) even directly buys REIT stocks to support prices. Korea is the only country that manages REITs under a separate law called the Real Estate Investment Company Act (hereafter REIC Act)." He added, "Not only should tax benefits be provided for monthly dividends, but regulations such as floor area ratio and building coverage ratio should be eased so that REITs can 'draw pictures' in white zones."

Chairman Jung cited the biggest advantage of REITs as the impossibility of 'eating and running' (fraudulent exit). He said, "The buildings REITs purchase are well-known 'prime buildings.' As stock companies, they have disclosure obligations and pay dividends of over 7% annually. Their operations are transparent, and profits go to the public (investors), making them good for policy use and allowing companies to secure liquidity." Unlike real estate project financing (PF), REITs are established and operated by raising 30-40% of equity capital, reducing the risk of loan defaults.

Additionally, investment assets are diversifying, such as Korea Land and Housing Corporation (LH) promoting the country's first healthcare REIT project in Dongtan 2 New Town, Hwaseong City, Gyeonggi Province. In line with this, the government announced a 'REITs Revitalization Plan' in June, which includes changing the licensing system, which takes the most time during the REIT development stage, to a registration system. Related bills are expected to be proposed in the second half of this year.

"REITs Can Help with Housing Supply and Aging Population Issues... Expected to Benefit from Interest Rate Cuts"

Chairman Jung sees REITs as suitable for adjusting market supply and demand, such as in rental housing supply. For example, in redevelopment projects, the floor area ratio could be significantly increased so that owners receive one unit each, and the rest could be built as rental housing owned by REITs, which can be released when supply is needed. He explained, "If such a structure is possible, REIT development profits could be invested in the community to provide jobs for the elderly and educational environments within complexes for children. This could also help address low birth rates and aging population issues."

He welcomed the upward trend in REIT stock prices. REITs have a lot of debt to hold investment assets, so they are greatly affected by interest rate changes. When interest rates rise, interest expenses increase, reducing profits; conversely, profits increase when rates fall. After stagnating under a high-interest rate environment, REIT stock prices are gaining momentum on the possibility that the U.S. may cut rates next month. Lotte REITs' returns have risen over 15% in the past month, and SK REITs hit a 52-week high.

Chairman Jung said, "If we worry about household debt, domestic interest rate cuts will never happen. Instead, strictly managing the Debt Service Ratio (DSR) and lowering interest rates would help economic recovery." He added, "REIT stock prices are still low but recovering, and above all, they have value as stable dividend stocks rather than speculative stocks aiming for quick riches. It's not too late to buy now."

Chairman Jung was reappointed last July after completing a two-year term. He has about one year left in his term. He said, "During the last presidential election, REITs-related issues were included in both major parties' pledges, so I believe the political sphere recognizes the need for revitalization. Although my term is almost over, I want to ensure the passage of the REIC Act amendment within this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)