Interview with Ma Seung-cheol, Chairman of the Korea Liquor Importers Association

"Rapid Increase in Overseas Direct Purchase of Liquor... Online Sales Ban Ineffective"

"High Liquor Tax is the Cause, Need to Change from Ad Valorem Tax to Specific Tax"

"Due to the current liquor tax system that does not meet global standards, our consumers are crossing over to Japan and Hong Kong to purchase whiskey and wine directly. This not only infringes on consumer welfare but also exacerbates difficulties for our liquor and food service industries. We can no longer delay reforming the liquor tax system to allow quality alcohol to be enjoyed at reasonable prices."

Ma Seung-cheol, Chairman of the Korea Liquor Importers Association, recently emphasized in an interview with Asia Economy that converting the liquor tax system from the current ad valorem tax to a specific tax is the top priority to advance Korea’s liquor industry and culture.

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

Whiskey and Wine Overseas Direct Purchases... Online Sales Ban Rendered Ineffective

Chairman Ma pointed out the need to pay attention to the rapid increase in overseas direct purchases (direct import) of liquor by domestic consumers.

According to the Korea Customs Service, the scale of direct purchases of overseas liquor such as wine and whiskey has rapidly increased since the COVID-19 pandemic, rising from 2.6 billion KRW in 2018 to 34.4 billion KRW in 2022, a 13-fold increase. In particular, whiskey is an item where the proportion of overseas direct purchases within domestic imports is rapidly increasing. In 2022, 74,950 direct purchase cases were made, more than seven times the amount from the previous year. Compared to 2019, before the COVID-19 pandemic (786 cases), this represents a 95-fold surge.

Chairman Ma cited the regulation banning online sales of liquor in Korea under the National Tax Service’s "Order Delegation Notice on Liquor Telecommunication Sales" as the background for the surge in overseas direct purchases. He said, "While the domestic e-commerce market has grown dramatically, online sales of liquor are strictly prohibited. As online sales of liquor are banned and related industries and systems remain stagnant, liquor purchases through overseas direct imports are explosively expanding the market."

The ban on telecommunication sales of liquor is considered a representative regulation surrounding the domestic liquor industry. In fact, among the 38 OECD countries, only Korea and Poland prohibit online sales of liquor, while most countries allow online sales but manage them through various systems. Since 1998, Korea has permitted telecommunication sales for traditional liquors if sold directly by the manufacturer, and since 2020, telecommunication sales have been exceptionally allowed for liquor delivered alongside food prepared in restaurants or ordered via smart orders.

The problem is that the telecommunication sales ban, imposed under the pretexts of protecting local businesses and preventing underage drinking, has become practically ineffective as it is circumvented through overseas direct purchases and other means. Chairman Ma lamented, "Currently, online orders are impossible through domestic liquor companies or distributors, but liquor online purchases are possible via Chinese e-commerce platforms like AliExpress and Temu. The purpose of the regulation is fading, and it is acting as reverse discrimination against domestic businesses."

As overseas direct purchases of liquor increase, the issue of resale is also serious. There are growing cases where restaurants, convenience stores, and liquor shops licensed to sell liquor purchase duty-free liquor or cheaply bought liquor locally for resale, either directly or indirectly. Chairman Ma said, "This is an illegal act violating customs law, liquor licensing law, and other related laws, threatening the survival of small liquor businesses that pay taxes properly and operate legitimately. Urgent guidance and crackdowns by the Customs Service and National Tax Service are needed, and especially measures to eradicate suppliers providing overseas direct purchase liquor to these retailers must be established." He added, "These liquors are not guaranteed to be genuine, and above all, their safety cannot be assured, posing a threat to public health."

Chairman Ma emphasized that since the current regulations do not reflect the consumption patterns of liquor and cause various problems, they must be improved in a reasonable direction. He said, "In a global era where boundaries are disappearing, online sales of liquor are an inevitable trend. It is time for regulatory reform that aligns with fairness."

He continued, "If telecommunication sales are allowed under appropriate regulations, it could provide opportunities to increase consumer choice and convenience, enhance transparency and compliance in tax revenue collection, expand a healthy drinking culture, increase competition through the participation of small and medium liquor companies, and secure future competitiveness for traditional liquor distribution industries."

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

Most OECD Countries Use Specific Tax... Gradual Transition to Specific Tax by Liquor Type Needed

Chairman Ma argued that to solve problems such as the online sales ban that encourages overseas direct purchases, reverse discrimination against the domestic liquor industry, and lack of innovation, the tax system imposed on liquor must be changed.

He emphasized that switching from an ad valorem tax to a specific tax is most important. Because the current tax system imposes higher taxes compared to other countries on the same liquor, both producers and consumers suffer losses, and without fundamental reform of the tax system, no problems can be resolved. In fact, the increase in overseas direct purchases is influenced not only by the convenience of online shopping but also by relatively lower prices compared to domestic purchases.

Korea’s Liquor Tax Act basically adopts an ad valorem tax. The ad valorem tax is levied based on the shipment price, so the higher the price of the liquor, the higher the tax. In particular, the tax rate for distilled liquor is 72%, which is higher than that for fermented liquors such as yakju, cheongju, and fruit wine (30%). For example, applying the current tax system to a bottle of whiskey with a domestic shipment price of 100,000 KRW results in a liquor tax of 72,000 KRW. On top of this, an education tax of 30% of the liquor tax (21,600 KRW) is added as an indirect tax, and a 10% value-added tax (19,360 KRW) is also added, making the final price soar above 200,000 KRW. This means the consumer price more than doubles the tax base.

The tax system opposite to the ad valorem tax is the specific tax, which levies tax based on the volume of liquor. Among OECD member countries, except for Korea, Chile, Colombia, Mexico, and Turkey, all have adopted the specific tax. Domestically, since 2020, the tax system for beer and takju has been converted to a specific tax. This was a government response to industry demands to improve the structural problem where taxes rise as the shipment price increases due to the use of quality raw materials.

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

Because of this, the liquor industry argues that the ad valorem tax discourages the production of high-quality distilled soju or whiskey. The longer aging or the more expensive ingredients used to produce quality products, the higher the shipment price, which leads to a significant increase in sales price. The increase in sales price due to taxes rather than production costs means the price rises due to factors unrelated to the actual value of the product, which can reduce the product’s sales competitiveness.

Chairman Ma said, "Recently, the trade deficit in liquor has become serious, and the National Tax Service is making various efforts to expand exports of domestic liquor in response to these concerns, and the Liquor Importers Association is also participating in these activities." He added, "However, for domestic liquor exports, it is necessary for competitive products to be sufficiently recognized in the domestic market, and the starting point is premium product development, which is fundamentally blocked by the ad valorem tax system. It is important to create a foundation for developing competitive products through the introduction of a specific tax."

However, if converted to a specific tax, taxes on high-priced liquors such as whiskey will decrease, lowering prices, but low-priced liquors like diluted soju will face increased tax burdens and inevitable price hikes. Moreover, since soju is a representative liquor enjoyed by the general public and is a key item the government monitors when implementing price stabilization policies, this makes the transition to a specific tax difficult. Therefore, voices are calling for a phased transition starting with fermented liquors following beer and takju, then moving on to distilled liquors. Chairman Ma said, "In beer and takju, where the specific tax has already been introduced, craft beers and premium products based on local regions are being launched one after another, creating change. The ad valorem tax should be introduced starting with liquor types such as yakju, cheongju, and fruit wine, where there is no industry disagreement, considering the market impact."

The Korea Liquor Importers Association, established in 2002, has been making various efforts to develop the liquor industry and establish a healthy drinking culture, with about 60 liquor import companies distributing various imported liquors such as wine, beer, and whiskey as member companies.

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

Masungcheol, Chairman of the Korea Liquor Importers Association, is being interviewed by Asia Economy at Down Space in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

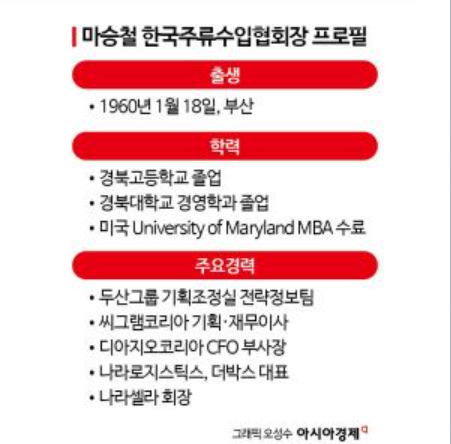

Chairman Ma Seung-cheol

Born in 1960 in Busan, Chairman Ma entered the liquor industry in 1984 when he joined Doosan Seagram, a Doosan Group affiliate. He later served as CFO of Diageo Korea and CEO of Nara Logistics, and currently holds concurrent positions as chairman of Nara Sella, a wine importer, Nara Logistics, and The Box.

While working at Doosan Seagram, Chairman Ma was responsible for prominent brands such as Windsor and Chivas Regal. Based on this experience, he founded the wine logistics company Oakline (now Nara Logistics) in 2005. In 2015, he made headlines by acquiring Nara Sella, which imports Montes Alpha, known as the "national wine" with the highest sales volume in Korea. In June last year, he also led Nara Sella to become the first wine company in Korea to be listed on the KOSDAQ market. He has been serving as the 5th chairman of the Korea Liquor Importers Association since 2021, leading the association for four years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)