As the Trump trade (the phenomenon of money flowing into stocks benefiting from Trump's election) weakens in the financial market, market attention is expected to shift back to the U.S. Federal Reserve (Fed) and the fundamentals of the U.S. economy. However, volatility in the financial market is expected to increase for the time being due to changes in the U.S. presidential election landscape.

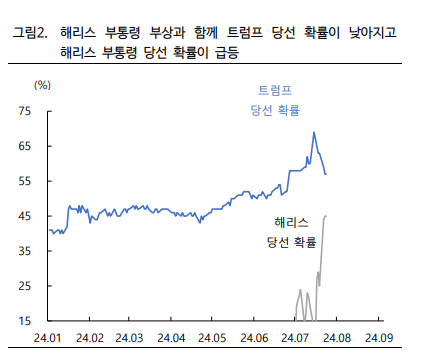

Park Sang-hyun, a researcher at Hi Investment & Securities, stated in a report on the 24th, "With Vice President Harris emerging as the likely Democratic presidential candidate following President Biden's withdrawal, the Trump dominance theory is showing signs of weakening," adding, "As the Harris effect appears in the U.S. presidential race, expectations or concerns about the Trump trade within the financial market are also subsiding."

Park further explained that a representative example is the pause in the rising trend of government bond yields, which had been increasing due to concerns about 'Trumflation' (Trump + inflation).

He predicted that volatility in the financial market will increase for the time being depending on the developments in the U.S. presidential election landscape. Park said, "Depending on how public opinion forms or changes, especially in swing states, the Trump dominance theory or Trump trade could shrink. Therefore, volatility in the financial market is also expected to increase for the time being due to changes in the U.S. presidential election landscape. The financial market has no choice but to move while watching public opinion trends."

As signs of the Trump trade weakening appear, market attention is expected to ultimately shift back to the Fed and the fundamentals of the U.S. economy.

He said, "With the Trump dominance theory, which had shaken the financial market along with the Trump incident, temporarily weakening, the market's focus will move to the Federal Open Market Committee (FOMC) meeting scheduled for July 30-31. Although the possibility of a surprise rate cut at the July meeting is low, the key interest lies in whether signals for a rate cut in September will be given."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)