Strong Q2 Performance Expected for Major Food Manufacturers

K-Food Gains Overseas Popularity with Double-Digit Growth

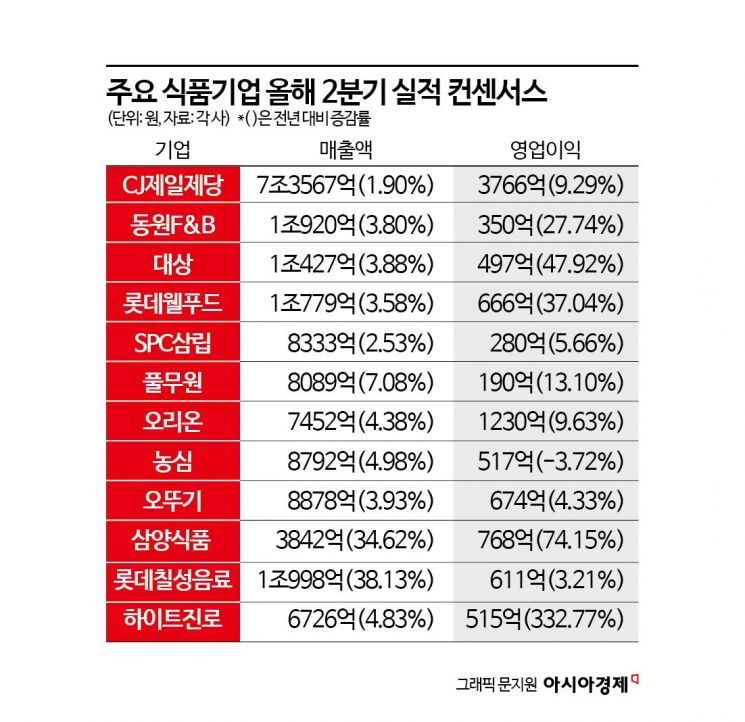

Volume Led by Lotte Chilsung, Profitability by Hite Jinro

Major domestic food manufacturers are expected to continue their performance growth trend in the second quarter of this year. Although this period is considered an off-season with increased outdoor activities and many public holidays, leading to higher dining-out demand and decreased processed food consumption, the ongoing rise in dining-out prices has resulted in more people seeking home meal replacements (HMR), creating a positive ripple effect. Along with the steady popularity of K-food, strong sales performance in overseas markets also contributed to the good results.

Consumers are browsing displayed products at a large supermarket in Seoul. [Image source=Yonhap News]

Consumers are browsing displayed products at a large supermarket in Seoul. [Image source=Yonhap News]

Convenience Foods and Ramen Overcame the Off-Season

According to the Financial Supervisory Service's electronic disclosure system and the securities industry on the 16th, CJ CheilJedang, the top food company, is expected to report a consolidated operating profit consensus of 376.6 billion KRW for the second quarter, a 9.29% increase compared to the same period last year. Sales are projected to rise 1.9% to 7.3567 trillion KRW. The so-called global strategic products such as dumplings, seaweed, and chicken increased their market share in the processed food market in the Americas, and the overseas food business boosted sales by entering major distribution channels in newly entered countries like Australia and Europe. In the bio business, which CJ CheilJedang is focusing on as a future growth engine, growth is expected by restructuring feed amino acids from low-priced lysine to more profitable specialty products.

Daesang is also expected to expand exports of key products such as 'Jongga' kimchi, sauces, seaweed, and convenience foods, and like CJ CheilJedang, increase the proportion of high-profit product groups in its bio business, resulting in a second-quarter operating profit forecast of 49.7 billion KRW, a 47.92% increase from the same period last year. Sales are expected to rise 3.88% to 1.0427 trillion KRW during the same period. Dongwon F&B is estimated to have a 27.74% increase in second-quarter operating profit to 35 billion KRW, and sales up 3.8% to 1.092 trillion KRW, as the cost burden of its main product, tuna, eased and its subsidiary Dongwon Home Food benefited from high-price inflation in the catering and food material supply business. Pulmuone is also expected to see a 13.10% increase in second-quarter operating profit to 19 billion KRW and a 7.08% rise in sales to 808.9 billion KRW, driven by growth in concession (food and beverage consignment operation) businesses at airports and resorts, and improved profitability of overseas subsidiaries in the US, China, and Japan.

Ramen exports in the first half of this year reached 590.2 million USD, a 32.3% increase from the previous year, drawing attention to the performance of major ramen manufacturers. The company expected to see the largest increase is Samyang Foods. Thanks to strong sales of its popular product, Buldak Bokkeum Myun, second-quarter operating profit is estimated to have surged 74.15% year-on-year to 76.8 billion KRW. Sales during the same period are estimated to have increased 34.62% to 384.2 billion KRW.

Ottogi is also expanding its overseas business mainly in the US and Vietnam, with second-quarter operating profit expected to rise 4.33% year-on-year to 67.4 billion KRW and sales up 3.93% to 887.8 billion KRW. However, Nongshim, despite solid growth in North America, Southeast Asia, and Japan, is expected to report second-quarter sales of 879.2 billion KRW, up 4.98% year-on-year, but operating profit is forecast to decline 3.72% to 51.7 billion KRW due to cost burdens.

Confectionery and Bakery Flourish, Alcohol and Beverages Rebound

Confectionery and bakery manufacturers, which achieved strong results in the first quarter, are also expected to maintain a favorable trend in the second quarter. Lotte Wellfood, whose operating profit doubled (100.6%) year-on-year in the previous quarter, is forecast to see a 37.04% increase in second-quarter operating profit to 66.6 billion KRW. Sales are expected to rise 3.58% to 1.0779 trillion KRW during the same period. This is attributed to a 13.1% increase in overseas sales in countries such as India and Russia compared to the same period last year, and a price increase in cocoa-related products last month in the confectionery sector, which helped reduce the burden of rising costs. Orion is also expected to report a 9.63% increase in second-quarter operating profit to 123 billion KRW and a 4.38% rise in sales to 745.2 billion KRW, thanks to steady performance in overseas markets such as the US, China, and Vietnam. Additionally, SPC Samlip is forecast to record a 5.66% increase in second-quarter operating profit to 28 billion KRW and a 2.53% rise in sales to 833.3 billion KRW, driven by increased B2B (business-to-business) transactions and consumption of general bread as meal replacements.

Alcohol and beverage companies are also raising expectations for a rebound. Hite Jinro's second-quarter operating profit is expected to increase 332.77% year-on-year to 51.5 billion KRW. Sales are estimated to rise 4.83% to 672.6 billion KRW. Although marketing expenses were incurred after launching the beer 'Kelly' in April last year, which reduced operating profit in the second quarter of the previous year, this effect is expected to be offset this year due to the base effect. Soju sales improved compared to the previous quarter, thanks to new product launches such as Jinro Gold and an improved related industry environment.

Lotte Chilsung Beverage is expected to report a 3.21% increase in second-quarter operating profit to 61.1 billion KRW and a 38.13% rise in sales to 1.0998 trillion KRW amid mixed performance forecasts. Although beverage sales struggled due to weak domestic consumption, profitability improved compared to the first quarter due to new product launches in the alcohol sector and the smooth operation of Philippine Pepsi, which was incorporated as a subsidiary last year.

Meanwhile, the impact of product price increases implemented by food companies in the second quarter of this year on their performance is also a matter to watch closely. Earlier, CJ CheilJedang, Dongwon F&B, Sajo, and Sempio raised prices of seaweed, olive oil, soy sauce, and sesame oil starting in May. Lotte Chilsung Beverage also increased prices of beverage products such as Chilsung Cider and Pepsi last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)