Song Youngsuk Chairman "Supports Professional Management System"

Im Jongyun Director, Unfair Internal Trading Suspicion 'Crisis'

"Caution on Stock Price Volatility, Focus on Intrinsic Value"

The management dispute within Hanmi Group has entered a new phase, causing increased volatility in the stock price of its holding company, Hanmi Science. Securities experts advise caution regarding volatility stemming from governance issues but recommend focusing on corporate value factors such as performance and valuation rather than trying to predict uncertain outcomes like the results of the management dispute.

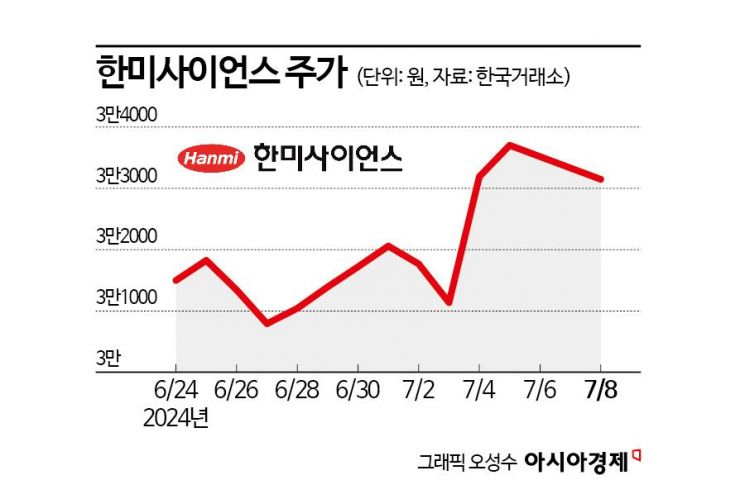

According to the Korea Exchange on the 9th, Hanmi Science closed at 33,150 KRW on the 8th, down 1.63% from the previous trading day. Since the shareholders' meeting in March, when the stock price peaked, it had been steadily declining, but on the 4th of this month, it surged intraday by as much as 13.8%, showing significant volatility.

The recent stock price fluctuations are due to the rekindling of the management dispute among the founding family of Hanmi Pharmaceutical Group. On the 3rd, Shin Dong-guk, chairman of Hanyang Precision and the largest individual shareholder of Hanmi Science, signed a stock purchase agreement and a voting rights joint exercise agreement to acquire some shares from Song Young-sook, chairwoman of Hanmi Pharmaceutical Group, and Vice Chairman Lim Ju-hyun.

In a statement, Chairwoman Song said, "I understand that Chairman Shin recently decided that the next generation management of Hanmi Group should be entrusted to professional managers, with major shareholders supporting this through the board of directors, moving toward an advanced governance structure," emphasizing the intention to reform the founder-family-centered management system into a professional management system.

Chairman Shin, a junior from the hometown of the late founder of Hanmi Group, Lim Seong-gi, sided with Lim Jong-yoon, an inside director of Hanmi Pharmaceutical, and Lim Jong-hoon, CEO of Hanmi Science, during the first management dispute earlier this year, leading to their victory. However, it is reported that Shin was disappointed by the continuous rumors of share sales and the resulting stock price decline after the brotherly management, and thus has now allied with the mother and daughter again.

With this agreement, Shin has joined Chairwoman Song’s side, increasing the combined shares of Song and related parties from 35.76% to 48.19%. Meanwhile, the Hanmi Science shares held by brothers Lim Jong-yoon and Lim Jong-hoon stand at 12.46% and 9.15%, respectively, leading to interpretations that the management dispute, which ended in the brothers’ favor in March, could reignite.

Additionally, industry sources report that Hanmi Pharmaceutical has launched an internal investigation into its subsidiary, Beijing Hanmi Pharmaceutical. This is to verify allegations of unfair internal transactions between Hong Kong’s Core Group, owned by inside director Lim Jong-yoon, and Beijing Hanmi Pharmaceutical.

Lim Jong-yoon, who has long sought the CEO position at Hanmi Pharmaceutical, has consistently expressed his intention to manage directly rather than appoint a professional manager. Initially, Lim planned to convene a board meeting as early as this month to approve his appointment as CEO, but industry voices suggest that persuading the board amid this audit issue will be difficult.

Amid ongoing uncertainty surrounding Hanmi Group’s management rights, securities experts caution about possible stock price volatility in the near term but emphasize that analyzing the essence of corporate value should take priority in investment decisions. A securities firm official noted, "Concerns about mid- to long-term R&D policy uncertainty or investment cuts due to management changes have affected the stock price," adding, "Governance issues that may arise before the group’s mid- to long-term growth strategy is concretized could act as a discount factor on corporate value." He further stated, "Separately from the management dispute issue, some subsidiaries are expected to achieve solid quarterly performance, and valuation indicators are at low points. From a mid- to long-term perspective, there is potential for an increase in corporate value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)