Recently, I reviewed the receipt of Executive Director Kim from Company A, who played golf for client entertainment. Despite it being a weekday, the green fee was 200,000 KRW per person. For a team of four, the green fee totaled 800,000 KRW, with an additional 100,000 KRW for the cart fee. The combined cost of lunch at the start house before golf, snacks at the halfway house, and dinner at the golf course after exercise amounted to 777,000 KRW. Adding 150,000 KRW spent on gifts purchased at the pro shop, the total came to 1,827,000 KRW. This figure excludes the 150,000 KRW caddie fee paid in cash on-site, meaning the cost per person for one round of golf exceeded 450,000 KRW. The payment was made using a corporate card.

Although there is widespread criticism that golf course fees in Korea are among the highest in the world, these fees show little sign of decreasing. On the surface, the increase in golf course fees appears to be driven by the growing number of golf players, but behind this is the rise in entertainment golf since 2020, when the government raised the deductible limit for corporate card entertainment expenses (business promotion expenses) to stimulate the domestic economy amid the COVID-19 pandemic. The corporate tax law applied to companies only allows a certain deductible limit for entertainment expenses based on revenue.

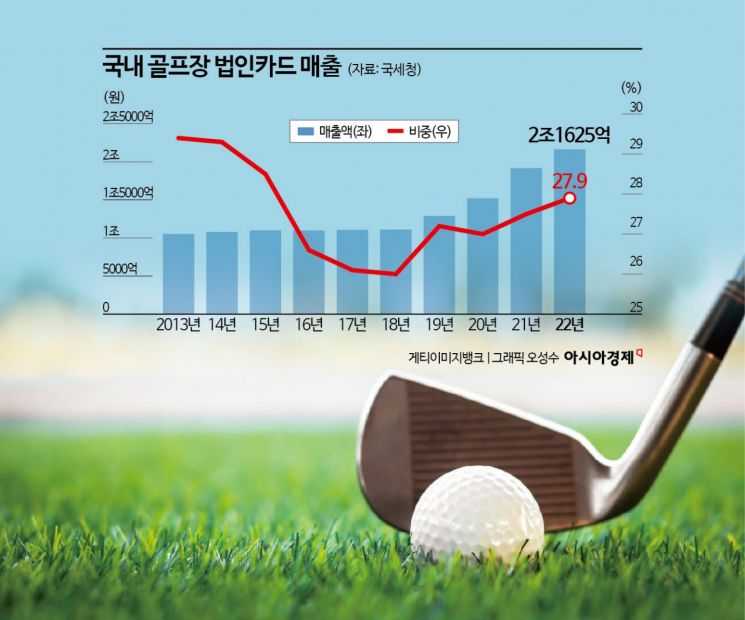

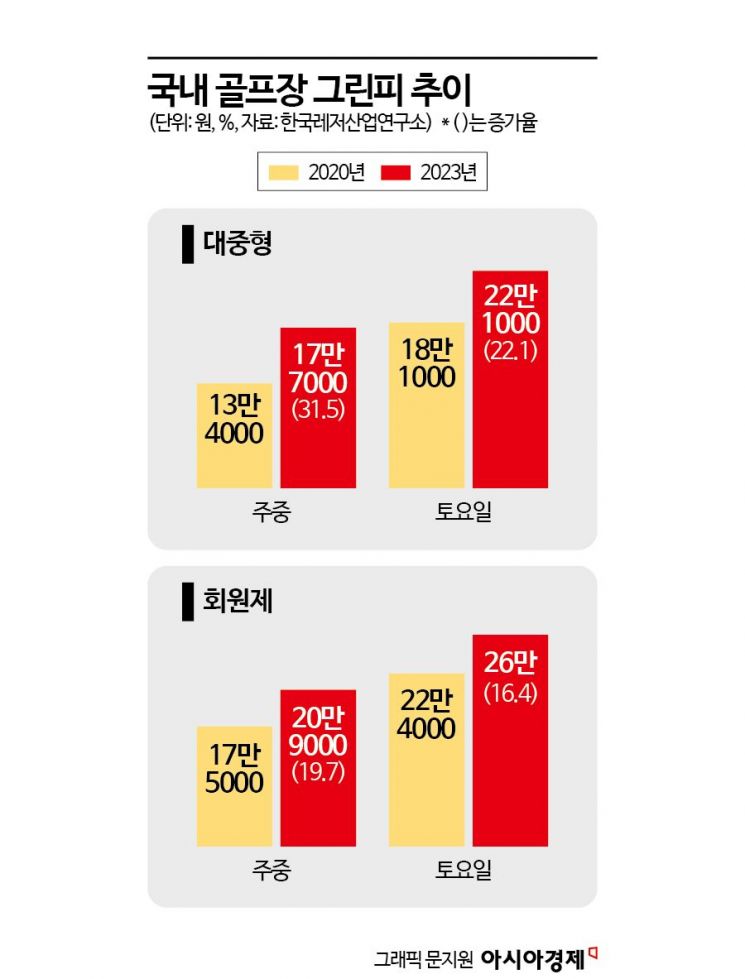

With overseas travel restricted during the COVID-19 period and indoor gatherings limited, major entertainment venues shifted to golf courses, causing corporate card spending at golf courses to increase to 2.1625 trillion KRW in 2022?the largest scale ever recorded. The share of corporate card sales at golf courses reached 27.9%, nearly one-third of total sales. The average weekend green fee at domestic golf courses rose 22.1% over four years, from 181,000 KRW in 2020 to 221,000 KRW in 2023.

However, due to the recent prolonged economic downturn and the resulting restrictions on corporate card payments for golf courses mainly by large corporations, coupled with the lifting of overseas travel restrictions, the golf industry, which had enjoyed a golden era, is now faltering. In fact, golf courses that benefited most from the increased entertainment expense limits in 2020 have seen a decline in visitors since last year, worsening their business conditions. The number of golf course visitors nationwide dropped 5.7% from 50.58 million in 2022 to 47.72 million last year.

Accordingly, there are concerns that if the golf industry continues to rely on corporate card sales to maintain high fees, it may follow in the footsteps of Japan, where the industry shrank amid a crackdown on entertainment golf.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)