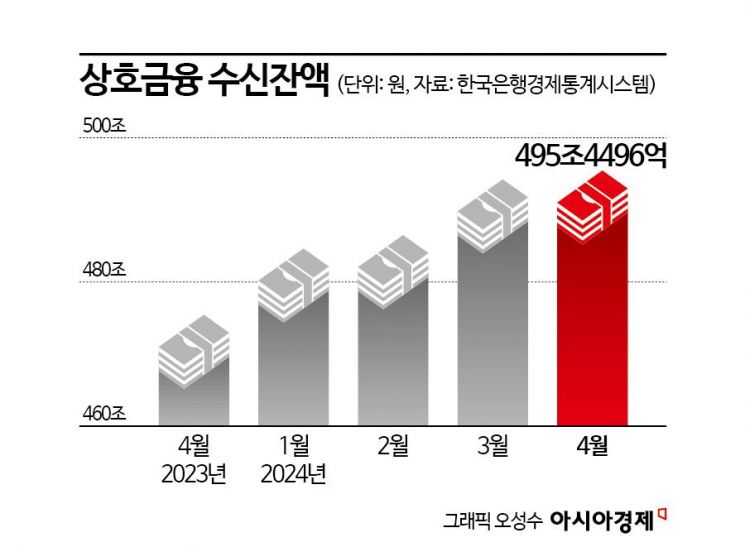

Despite a decrease in high-interest special promotions compared to last year, the deposit growth trend in mutual finance institutions continues. It has been revealed that more than 20 trillion won has flowed in over the past year.

According to the Bank of Korea Economic Statistics System on the 17th, the deposit balance of mutual finance institutions was recorded at 495.4496 trillion won as of the end of April this year. This is an increase of 20.0881 trillion won compared to the same period last year. Compared to the previous month, it increased by 1.228 trillion won. The deposit balance of mutual finance institutions has been steadily increasing this year, with 484.5078 trillion won in January, 486.4901 trillion won in February, and 494.2216 trillion won in March.

Looking at each cooperative, Saemaeul Geumgo's deposit balance was 260.0326 trillion won, showing a slight decrease of 48.5 billion won compared to the previous month, but an increase of 1.7515 trillion won compared to the same period last year. Compared to July last year, when it experienced a bank run (large-scale deposit withdrawal) crisis, it increased by 18.1767 trillion won. Shinhan Credit Union also continues to see an increase in deposit balances. As of the end of April, Shinhan Credit Union's deposit balance was 137.5761 trillion won, up 78.48 billion won year-on-year and 30.3 billion won month-on-month.

This situation is interpreted as customers seeking mutual finance institutions with relatively higher interest rates as high-interest savings and deposit products in banks have decreased compared to last year. Last year, it was not difficult to find deposits with interest rates in the 4% range at banks, but recently, the interest rates of major commercial banks' representative deposit products are around 3.45% to 3.6%. On the other hand, mutual finance institutions still offer deposit products with interest rates in the high 3% range, and some Saemaeul Geumgo branches still offer deposit products in the 4% range. However, mutual finance institutions are also refraining from launching high-interest special promotions recently. Due to efforts to manage soundness, loan operations have been reduced, and it is difficult for each Geumgo to manage funds easily.

Meanwhile, unlike mutual finance institutions, savings banks in the same secondary financial sector continue to see a decline in deposit balances. As of the end of April, the deposit balance of savings banks was 102.9747 trillion won. This is a decrease of 11.6412 trillion won compared to the previous year. Compared to the previous month, it also decreased by 77.02 billion won. A financial sector official said, "Savings banks are also managing soundness, leading to a decrease in loan balances, reducing the need for fund procurement, and there are no suitable fund management options that can generate good profits, making it difficult to maintain high-interest deposits." According to the Korea Federation of Savings Banks, the average interest rate for 12-month fixed deposits at domestic savings banks recorded 3.66% on this day, maintaining a level similar to commercial banks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)