Taeyoung Construction, Kolon Global, Doosan Construction, SGC E&C, Shinsegae Construction, Lotte Construction, etc.

PF balance exceeds 200% of equity capital

As of the end of last year, among the top large construction companies, nine exceeded 100% of their equity capital solely with real estate project financing (PF) loan amounts. This is an increase of two companies compared to seven at the same time last year. Including Taeyoung Construction, which is in a capital erosion state, six companies?Kolon Global, Doosan Construction, SGC E&C, Shinsegae Construction, Lotte Construction, and others?had PF balances exceeding 200% of their equity capital.

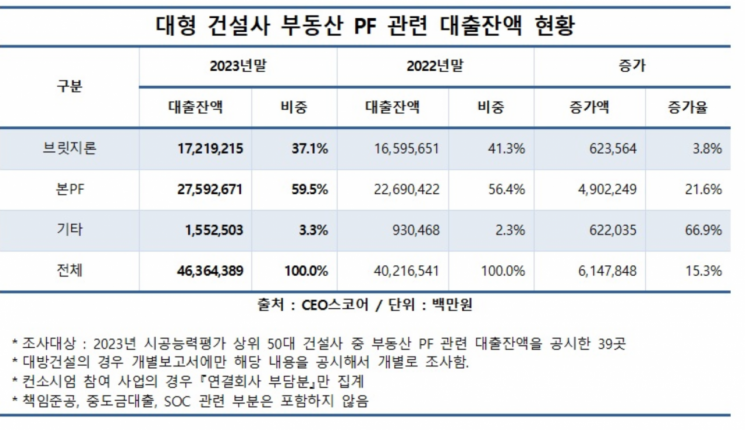

On the 5th, CEO Score, a corporate data research institute, investigated the status of real estate PF-related borrowings (guarantee limits, guarantee amounts, loan balances, on a consolidated basis) for 39 construction companies among the top 50 in construction capacity evaluation in 2023, which could be compared with the previous year. As of the end of last year, the total loan balance of the 39 construction companies was 46.3644 trillion KRW, an increase of 6.1479 trillion KRW (15.3%) compared to 40.2165 trillion KRW at the same time last year.

The main PF, which refers to loans for construction and development cost financing after permits, was the largest at 27.5927 trillion KRW (59.5%), an increase of 4.9023 trillion KRW (21.6%) compared to the same period last year. Next, bridge loans, which are loans to secure early-stage project funds such as land purchases, amounted to 17.2192 trillion KRW (37.1%), up 623.6 billion KRW (3.8%) from the previous year. Other loan costs amounted to 1.5525 trillion KRW (3.3%), increasing by 622 billion KRW (66.9%) compared to the previous year.

As of the end of last year, nine construction companies had real estate PF borrowings exceeding 100% of their total equity. Including Taeyoung Construction, which is in a capital erosion state, the companies were: Kolon Global 351.7%, Doosan Construction 300.8%, SGC E&C 289.6%, Shinsegae Construction 208.4%, Lotte Construction 204.0%, Ssangyong Construction 192.4%, Kumho Construction 158.8%, Seohan 129.9%, among others. This is an increase of two companies compared to seven companies (Kolon Global, Taeyoung Construction, Lotte Construction, Doosan Construction, Seohan, Ssangyong Construction, Kumho Construction) from the previous year.

On the other hand, construction companies with borrowings less than 10% of total equity were: HJ Heavy Industries 2.2%, Hanwha 2.7%, Hyosung Heavy Industries 3.2%, Doosan Enerbility 3.3%, Gyeryong Construction Industry 5.0%, Samsung C&T 5.9%, and Hoban Construction 8.5%, totaling seven companies. Compared to 10 companies at the end of 2022 (Hanwha, HJ Heavy Industries, Gyeryong Construction Industry, Doosan Enerbility, Hyosung Heavy Industries, Samsung C&T, DL Construction, Hoban Construction, SK Ecoplant, Seohui Construction), this is a decrease of three companies.

As of the end of last year, Hyundai Construction had the largest loan balance at 9.9067 trillion KRW. This was followed by Lotte Construction (5.3891 trillion KRW), GS Construction (3.3015 trillion KRW), Taeyoung Construction (2.692 trillion KRW), and HDC Hyundai Development Company (2.5302 trillion KRW).

The construction company with the highest proportion of bridge loan balances was Hoban Construction, with 100% of its loans (422.7 billion KRW) classified as bridge loans. This was followed by Lotte Construction (88.0%, 4.7411 trillion KRW), Shinsegae Construction (88.0%, 220 billion KRW), Cheil Construction (68.3%, 388 billion KRW), and HL D&I Halla (58.3%, 140.2 billion KRW).

Construction companies with a main PF loan balance proportion of 100% were Samsung C&T (2.364 trillion KRW), Kumho Construction (746 billion KRW), Doosan Enerbility (353.3 billion KRW), Hwaseong Industry (254.3 billion KRW), Yangwoo Construction (65 billion KRW), Hyosung Heavy Industries (39 billion KRW), and HJ Heavy Industries (7.7 billion KRW), totaling seven companies. Twenty-three companies had a PF loan balance exceeding 50%, including KCC Construction (98.5%, 256.5 billion KRW).

Additionally, as of the end of last year, the construction company with the largest amount of real estate PF borrowings maturing this year was Hyundai Construction at 7.279 trillion KRW, accounting for 73.5% of its total loan balance of 9.9067 trillion KRW. This was followed by Lotte Construction with 4.5351 trillion KRW (84.2%), GS Construction with 2.0393 trillion KRW (61.8%), Daewoo Construction with 1.4233 trillion KRW (86.6%), and Kolon Global with 1.3642 trillion KRW (70.0%).

Construction companies with borrowings maturing in 2025 exceeding 1 trillion KRW were HDC Hyundai Development Company (1.2685 trillion KRW), GS Construction (1.1107 trillion KRW), and Samsung C&T (1.0359 trillion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)