Hana Tour Listed as 'Management Rights for Sale', Overseas SIs Interested in Securing Korean Customers

Record-Breaking Performance Since COVID-19 Pandemic, Undervalued Stock Seen as 'Investment Opportunity'

Multiple overseas strategic investors (SIs) have shown interest in the sale of Hana Tour's management rights, increasing the likelihood of an overseas sale.

On the 7th, a senior official from the investment banking (IB) industry stated, "There is strong interest from overseas SIs in the sale of Hana Tour," adding, "From the perspective of companies in China, Japan, Singapore, the United States, and Europe, acquiring Hana Tour means securing Korean travelers?who love to travel?as customers all at once."

For example, if a Chinese SI acquires the company, it would instantly gain a massive platform to effectively offer Chinese travel products (hotels, restaurants, transportation, tourist attractions, etc.) to Korean customers.

The current sale involves a 27.7% stake, which includes the transfer of management rights. Hana Tour's largest shareholder, IMM Private Equity (PE), has appointed Citi Global Markets Securities as the lead manager for the sale and is proceeding with the process.

IMM PE holds a 16.68% stake in Hana Tour through a special purpose vehicle, and including the shares held by related parties such as Chairman Park Sang-hwan (6.53%) and Vice Chairman Kwon Hee-seok (4.48%), a total of 27.7% of shares are up for sale.

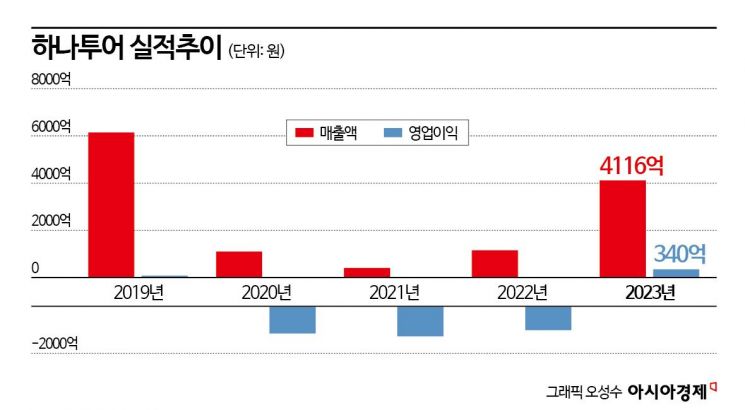

Other major shareholders of Hana Tour include the National Pension Service (8.64%), treasury shares (3.42%), and various minor shareholders. Last year, the company recorded sales of 411.6 billion KRW and an operating profit of 34 billion KRW, with a current market capitalization of approximately 1 trillion KRW.

Industry experts estimate Hana Tour's current corporate value to be around 2 to 3 trillion KRW. This figure is calculated by comprehensively reflecting the market capitalization levels of listed companies in the same industry and financial metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

IMM PE became the largest shareholder in 2020 by investing 128.9 billion KRW through a third-party allotment capital increase, acquiring a 16.67% stake in Hana Tour. At that time, the new share issuance price was 55,000 KRW. Recently, Hana Tour's stock price has fluctuated around 57,000 KRW. The consensus target price from securities firms is 80,400 KRW.

Overseas Travel Demand Surges, Operating Profit Recovers, but Hana Tour's Stock Price Remains 'Undervalued'

Despite overseas travel demand recovering to pre-pandemic levels and recording record-breaking performance in the first quarter, Hana Tour's stock price has not recovered as much as expected. In the securities industry, there is analysis suggesting that Hana Tour is likely to achieve its best-ever performance this year, and considering its high dividend yield, it is a good buying opportunity.

Hana Tour started the year at 52,200 KRW, and with the recovery in travel demand and expectations for strong performance, it surpassed the 70,000 KRW mark in March. However, as uncertainty increased due to the management rights sale, most of the gains this year were given back. The current stock price is about 19% lower than the peak price of 70,200 KRW.

Nevertheless, securities firms forecast that Hana Tour will deliver 'record-breaking' results this year. Since travel demand is rapidly increasing, Hana Tour's current stock price is considered undervalued. In the first quarter, Hana Tour posted an operating profit of 21.6 billion KRW and sales of 183.3 billion KRW, achieving its highest-ever performance.

Researcher Lim Su-jin from Daishin Securities said, "Despite better-than-expected performance improvements, the current stock price trend shows undervaluation," adding, "This is due to excessive concerns about the major shareholder sale, but there is no need to view the sale negatively." Lim also noted, "The package tour segment is growing rapidly, and with the advancement of the mobile application, growth in the individual free travel segment is expected in the future," concluding, "The current high growth rate is likely to continue not just in the short term but also in the medium to long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)