Operating Profit of 2.2 Billion KRW in Q1 This Year... Cost Reduction Through AI

Increase in YouTube Shopping Transaction Volume as Live Commerce Market Expands

Cafe24 has been continuing a strong rebound trend since announcing its first-quarter earnings this year. Through its first-quarter results, Cafe24 demonstrated that it is efficiently controlling costs. With the growth of the live commerce market, there are expectations that Cafe24's operating revenue will increase rapidly.

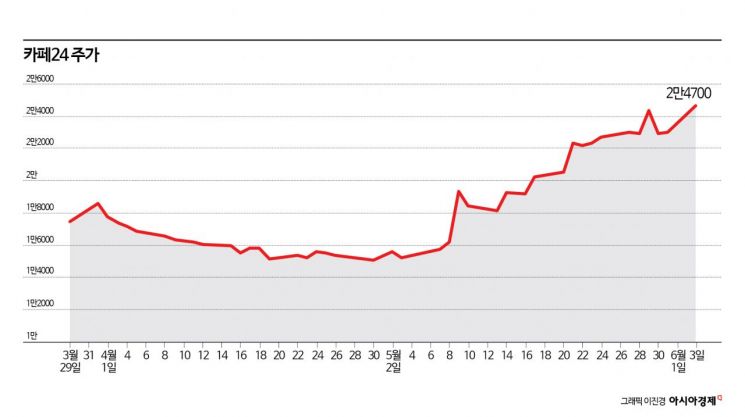

According to the financial investment industry on the 4th, Cafe24's stock price rose 42.5% compared to the closing price on the 8th of last month.

Earlier, Cafe24 disclosed its first-quarter earnings for this year on the 8th. In the first quarter, it recorded operating revenue of 66.9 billion KRW and operating profit of 2.2 billion KRW on a consolidated basis. Compared to the same period last year, sales increased by 1.6%, and operating profit turned positive. After the earnings release, the Yeouido securities market focused on Cafe24's improved profitability.

Aram Kim, a researcher at Shinhan Investment Corp., explained, "Cafe24 focused on reducing fixed costs by reorganizing five overseas subsidiaries and reallocating headquarters personnel," adding, "They proved their cost-efficiency efforts through the first-quarter results." He further noted, "As the cost-efficiency work is entering its final stage, this year's labor costs are not expected to increase significantly from the quarterly level of 25 billion KRW."

Cafe24 has reduced labor costs and increased productivity by utilizing artificial intelligence (AI) technology. By providing services using generative AI to small and medium-sized enterprises (SMEs) and its own mall operators, it is expected to expand the Cafe24 ecosystem. Junho Lee, a researcher at Hana Securities, analyzed, "They are actively introducing AI technology into internal work processes," and "They are also expanding customer services using AI." He added, "Representative examples include the AI content creation platform Ryuten and the AI fashion coordination platform Stylebot," noting that "by adopting AI services, they have strengthened the competitiveness of small and medium-sized enterprises that relatively lack capital and manpower."

Cafe24's external growth also seems possible. Heeseok Lim, a researcher at Mirae Asset Securities, said, "The domestic live commerce market is expected to grow from 30 trillion KRW last year to 100 trillion KRW by 2026, with an average annual growth rate of 50%," and predicted, "YouTube Shopping's domestic gross merchandise volume (GMV) will begin to grow significantly from next year." Additionally, he stated, "The penetration rate of live commerce in the domestic e-commerce market will rise from 1.3% last year to 3.4% by 2026," and forecasted, "The live commerce market will be dominated by Naver and YouTube." As major brands expand their sales channels not only through TV but also video platforms, the growth speed of live commerce is accelerating. With the increase in smartphone penetration, the average monthly YouTube user watch time has increased from 200 minutes in 2014 to 1,600 minutes last year. This is why Google is attempting to develop YouTube as a commerce platform. Content creators, including those producing videos, can easily recommend and promote products on YouTube.

Mirae Asset Securities estimated that Cafe24's YouTube Shopping transaction volume will reach 5 trillion KRW by 2028. Assuming a commission rate of 0.8%, operating revenue could increase to 40 billion KRW. They expect Cafe24 to maintain a near-monopoly position in YouTube-linked services while growing. Cafe24's operating profit is expected to increase at an average annual rate of 51% until 2028.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)