Consecutive Acquisitions of Management Rights in Food and Beverage Companies

PEF Emerges as the 'Golden Hand' in Fostering Food and Beverage Franchises

Will the 'Gongcha Myth' Continue with Sulbing and Terarosa?

Domestic private equity fund (PEF) UCK Partners is establishing itself as a prestigious name in the food and beverage franchise industry by consecutively acquiring management rights of food and beverage companies such as Gongcha (milk tea), Sulbing (bingsu), and Terarosa (coffee). After acquiring the milk tea brand Gongcha and growing it into a global franchise, UCK plans to apply its successful know-how to Sulbing and Terarosa as well.

Food and Beverage Franchise Powerhouse UCK Partners: Criteria for Selecting M&A Companies

UCK Partners recently acquired the management rights of Haksan, the operator of the Terarosa (TERAROSA) brand, famous for its original Gangneung coffee. UCK secured a total stake of 50.1% by acquiring an additional 13% stake in Haksan from former CEO and founder Kim Yong-deok. Previously, in November 2021, UCK had acquired a 37% stake in Haksan for approximately 65 billion KRW. The additional stake acquisition this time is reported to have cost about 23 billion KRW, bringing the total investment to approximately 88 billion KRW.

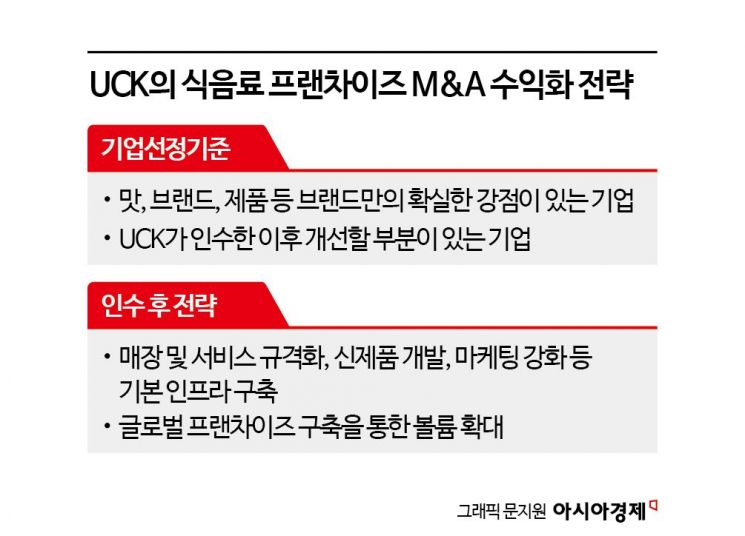

Kim Soo-min, CEO of UCK Partners, emphasized two important factors when selecting companies. Kim said, "There must be at least one clear strength unique to the brand, such as taste, brand, or product," and added, "Another factor is whether there are areas that UCK can improve by participating in management after acquisition." UCK is interested in companies that have clear strengths but are not perfect and have room for improvement. Companies that meet these criteria include Gongcha, Sulbing, and recently Terarosa.

Terarosa started in 2002 in Gangneung as a specialty coffee shop. Specialty coffee refers to coffee made from high-quality beans that score 80 points or higher out of 100 according to the Specialty Coffee Association (SCA) standards. Terarosa differentiated itself by placing its roasting factory inside the store, providing a unique coffee flavor, and has established itself as a leading specialty coffee shop in Korea. Especially after UCK's acquisition, Terarosa became the only company in Korea to internalize all stages from specialty bean sourcing to manufacturing and distribution. Going forward, it plans to actively pursue new businesses such as domestic store expansion, overseas entry, and chocolate production.

UCK Partners’ Food and Beverage Franchise M&A Monetization Strategy

UCK is known for establishing mid- to long-term management strategies that can increase corporate value from the acquisition review stage. Kim Soo-min, a former Bain & Company consultant, explained, "Food and beverage dining requires a lot of hands-on work, which deters other PEFs from entering this sector. We see this as an opportunity."

When acquiring Gongcha Korea in 2014, UCK implemented a phased strategy including performance recovery, entry into the Japanese market, acquisition of the Taiwanese headquarters, and global market expansion. At the time of acquisition, the Korean entity was a small company holding the Korean business rights for the Taiwanese milk tea brand. UCK built a management team from large corporations and established the basic infrastructure as a franchise. Instead of aggressively pushing for short-term performance, they focused on standardizing stores and services, developing new products, and strengthening marketing to solidify the foundation.

After reorganizing the domestic business, UCK opened its first store in Japan in 2015 and acquired a 70% stake in Gongcha’s Taiwanese headquarters the following year, gaining management control. Subsequently, the three entities in Korea, Japan, and Taiwan were integrated, propelling Gongcha into a global franchise with stores in 17 countries worldwide. The number of stores increased from 126 in 2013 to over 1,200 in 2019. During the same period, sales surged from 26.9 billion KRW to 208.2 billion KRW. In 2019, UCK sold 70% of Gongcha’s shares to a US-based private equity fund for 280 billion KRW, achieving more than five times the initial investment of 50 billion KRW.

Last year, UCK acquired Sulbing, the number one bingsu franchise in Korea. UCK purchased a 70% stake in Sulbing from the founding family, led by Chairman Jung Yong-man, for 105 billion KRW. Established in 2013, Sulbing operates about 600 stores nationwide. It has shown an annual sales growth rate exceeding 10% over the past five years domestically. While the domestic business has shown strong growth, overseas operations have been relatively sluggish. Industry experts note that Sulbing’s fusion bingsu, which includes various toppings such as strawberry, melon, mango, cheese, brownie, and injeolmi (roasted soybean powder rice cake), has become a year-round dessert beyond the traditional bingsu made with shaved ice, red beans, milk, and condensed milk. This variety makes it easier to introduce diverse menus tailored to each country when expanding overseas, which is advantageous for global business. The brand name 'KOREAN DESSERT CAFE, Sulbing' is also expected to attract attention alongside the popularity of K-dramas, K-pop, and other aspects of the Korean Wave.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)