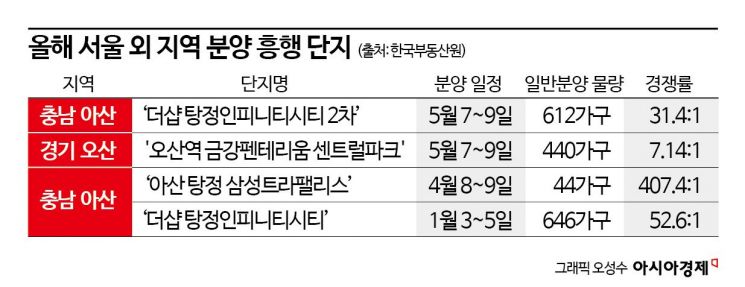

Chungnam Asan 'The Sharp Tangjeong Infinity City Phase 2' Competition Rate 31.4 to 1

Gyeonggi Osan 'Osan Station Geumgang Pentarium Central Park', 7.14 to 1

Abundant Backing Demand from Industrial Complexes and Reasonable Sale Prices

"Suburban Subscription Heat Contributes to Recovery of Local Apartment Market"

Even in provincial areas considered 'sales barren lands,' complexes that have succeeded in subscription sales are emerging. Abundant underlying demand and prices lower than market value are cited as reasons for their success. Experts predict that as the number of successful subscription complexes increases, a virtuous cycle may occur with increased transactions in nearby areas.

Subscription Boom in Asan Tangjeong

According to the Korea Real Estate Board's Subscription Home on the 14th, 'The Sharp Tangjeong Infinity City Phase 2' in Tangjeong-myeon, Asan-si, Chungnam, which held general subscription sales from the 7th to the 9th, attracted 19,235 applicants for 612 units, showing a competition rate of 31.4 to 1. Except for one of the six types, all were closed in the first priority round. The highest competition rate was recorded in the 84㎡ Type A, with 78.94 to 1 (6,552 applicants for 83 units).

The subscription enthusiasm in Asan Tangjeong District has continued since last year. 'Tangjeong Prugio River Park,' which recruited 1,626 units in October last year, and 'Asan Tangjeong Daekwang Roseviang' (186 units) in December were all sold out. 'The Sharp Tangjeong Infinity City,' which held subscriptions in January this year, also succeeded with an average competition rate of 52.6 to 1, receiving 33,969 first-priority applications. On the 8th and 9th of last month, 'Asan Tangjeong Samsung Trapalace,' which recruited 44 units, attracted 17,929 applicants, recording a competition rate of 407.4 to 1. All six types were closed in the first priority round, with the highest competition rate soaring to 618 to 1 in the 99㎡ type.

Subscription Success Formula: Underlying Demand and Low Prices

The industry views that abundant underlying demand and convenient transportation networks are attracting real demand. Since the mid-2000s, Samsung Electronics affiliates have settled in the Asan Tangjeong District, creating a large-scale industrial complex. Based on abundant jobs from Samsung Display City and Asan Tangjeong Techno General Industrial Complex, large-scale residential complexes are being developed. This district is close to the Seoul Metropolitan Subway Line 1 and KTX stations, and the extension of the GTX-C (Great Train Express) has also been confirmed.

Reasonable prices also play a role in attracting real demand. For example, the supply price of Asan Tangjeong Samsung Trapalace was 238.27 million KRW for an 84㎡ unit, about half the market price of a nearby complex, Hoban Summit Grand Mark I (which moved in July 2023), priced at 440 million KRW for the same area.

From the 7th to the 9th, the 'Osan Station Geumgang Pentarium Central Park' in A8 Block, Segyo 2 District, Osan-si, Gyeonggi-do, which received subscriptions, attracted 3,142 applicants for 440 units, achieving an average competition rate of 7.14 to 1 and filling all recruitment for types 84㎡ A to D. The highest competition rate reached 71.86 (84㎡ Type C). This complex's success was also due to its affordable prices, benefiting from the price ceiling system. Prices were set between 436.3 million and 467.6 million KRW, more than 60 million KRW cheaper than the market price of the nearby complex 'The Sharp Osan Elifore' (470 million to 500 million KRW for the same area).

Experts evaluate that subscription success outside Seoul can lead to a recovery in the apartment transaction market in those regions. It can positively influence redevelopment and reconstruction projects around the complexes and attract external demand. According to the Ministry of Land, Infrastructure and Transport's actual transaction data, the number of apartment pre-sale right transactions nationwide in the first quarter of this year was 9,804. Among them, Chungnam accounted for 1,417 transactions, 14% of the total, the largest share nationwide. This is 1.6 times higher than the previous quarter (890 transactions).

Park Jimin, head of the Wolyong Subscription Research Institute, explained, "When pre-sale units are sold out in outlying areas with sluggish sales transactions, interest increases, leading to an influx of purchase demand from outside. As premiums attach to the pre-sale complexes, more people buy relatively affordable nearby new and existing complexes, revitalizing the overall market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)