Financial Supervisory Service to Hold Subcommittee Meeting on 13th

Five Representative Cases of Incomplete Sales of Hong Kong ELS Disclosed

Compensation Ratio Guideline Expected... Autonomous Compensation Likely to Accelerate

The Financial Supervisory Service (FSS) held a Dispute Mediation Committee (DMC) meeting and on the 14th disclosed five representative cases that can be referenced for determining compensation ratios related to the incomplete sales of Hong Kong H Index equity-linked securities (ELS). As voluntary compensation by banks has been sluggish, this can be seen as a kind of guideline, drawing attention to whether the compensation process will accelerate going forward.

The FSS held a DMC meeting on the previous day at 2 p.m. regarding five major commercial banks?KB Kookmin, Shinhan, Hana, NH Nonghyup, and SC First Bank?concerning representative cases of Hong Kong ELS. The DMC is a dispute mediation body that financial consumers use to resolve disputes with financial institutions. It encourages settlements to prevent disputes from escalating to lawsuits. If both the financial consumer and the bank accept the DMC’s decision, it has the same effect as a court settlement.

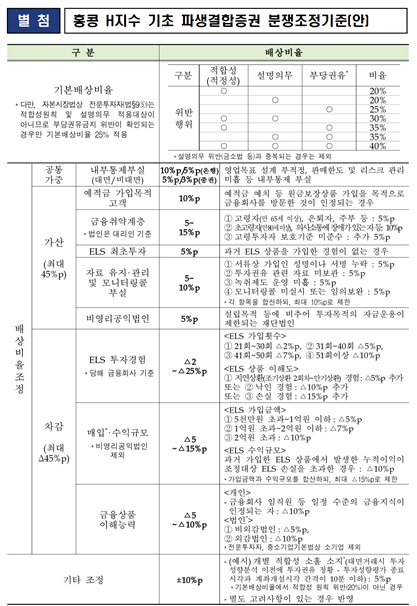

Based on the "Dispute Mediation Standards for ELS Investor Compensation" announced on March 11, the DMC determined compensation ratios for five representative cases. Mr. A, a person in his 70s, subscribed to two equity-linked trusts (ELT) at Nonghyup Bank in January and February 2021. The FSS found that Nonghyup Bank violated the suitability principle, the duty to explain, and the prohibition of unfair solicitation during Mr. A’s subscription process, recognizing the highest basic compensation ratio of 40%. Additionally, because Mr. A is a financially vulnerable elderly person aged 65 or older, subscribed face-to-face, and intended the product for deposit purposes, an additional 30 percentage points were added. However, 5 percentage points were deducted because Mr. A had prior experience with delayed repayments (early repayment from the 2nd installment to maturity) in previously subscribed ELTs, indicating some understanding of the product. Consequently, the DMC set the final compensation ratio for the two ELTs Mr. A subscribed to at 65%.

Mr. D, who subscribed to an ELT through Hana Bank, was recognized with a 30% basic compensation ratio due to confirmed violations of the suitability principle and duty to explain by the bank. Since he visited the branch and subscribed via mobile, face-to-face subscription was acknowledged, and 10 percentage points were added considering the bank’s internal control deficiencies. However, 10 percentage points were deducted because Mr. D had prior experience with delayed repayments in ELTs and his investment amount exceeded 50 million KRW. The DMC proposed a final compensation ratio of 30% for Mr. D.

For other cases, the DMC decided compensation ratios ranging from 30% to 65%. The DMC stated that based on facts confirmed during the complaint investigation process, they specifically applied additional factors such as deposit purpose and financial vulnerability, as well as deduction factors like ELS investment experience and purchase/income scale, as outlined in the ELS dispute mediation standards, to calculate the final compensation ratios for each case. A DMC official pointed out, "Sales staff conducted investment propensity analyses in a formalistic manner during the investment solicitation stage and recommended products unsuitable for the subscriber’s objective situation. They also used scenario analysis periods for loss risk that were shortened to 10 or 15 years excluding the 2008 global financial crisis period instead of 20 years, thereby reducing the perceived loss risk and guiding customers accordingly."

This dispute mediation will be established if financial consumers and banks accept the mediation proposal within 20 days from the date it is presented. Separately from accepting the mediation proposal, banks are expected to accelerate the calculation of compensation ratios through voluntary compensation referencing this mediation proposal. A banking industry official said, "Since the authorities have presented representative application cases regarding the standards, we plan to proceed with the compensation process while closely monitoring the Hong Kong H Index trends and loss amounts."

However, investors demanding 100% compensation are expected not to accept the DMC mediation proposal and instead pursue class-action lawsuits, so conflicts are unlikely to subside. The Hong Kong ELS Victims Association has secured about 600 participants for the class-action lawsuit so far and plans to proceed with criminal charges and civil lawsuits through law firms in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)