Export and Import Prices Rise for 4 Consecutive Months

Impact of Rising International Oil Prices and Won-Dollar Exchange Rate

Export Value Index Rises Due to Semiconductor Price Increase

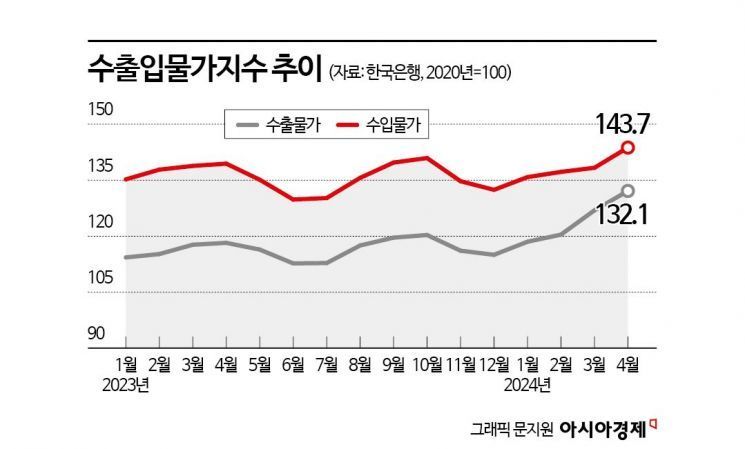

As international oil prices rise, import prices have recorded an upward trend for four consecutive months. There are concerns that the increase in import prices could push up domestic consumer prices with a time lag.

Impact of Oil Prices and Exchange Rates, Export and Import Prices Rise for Four Consecutive Months

According to the 'April 2024 Export and Import Price Index and Trade Index (Provisional)' released by the Bank of Korea on the 14th, import prices last month rose 3.9% compared to the previous month. Import prices have increased for four consecutive months following January (2.5%), February (1.0%), and March (0.5%). The rate of increase is the highest in eight months since recording 4.1% in August last year.

Import prices were significantly affected by the rise in international oil prices and the KRW-USD exchange rate. The average Dubai crude oil price in April was $89.17 per barrel, a sharp increase of 5.9% from $84.18 in the previous month. International oil prices rose significantly last month due to instability in the Middle East involving Israel, Iran, and Palestine. International oil prices have been on an upward trend this year, pushing up the import price index.

The average KRW-USD exchange rate also rose 2.8% from 1,330.7 won in March to 1,367.8 won in April. The exchange rate increased as the dollar, a safe-haven asset, strengthened due to Middle East geopolitical instability and the possibility of a delayed U.S. interest rate cut. When the dollar strengthens, the prices of imported goods also rise.

By item, as oil prices rose, raw material import prices centered on mining products increased 5.5% compared to the previous month. Intermediate goods rose 3.7% month-on-month due to increases in primary metal products, computers, electronics, and optical devices. Since import prices affect consumer prices with a time lag, there are concerns that consumer price instability may continue in the future.

Yoo Sung-wook, head of the Price Statistics Team at the Bank of Korea's Economic Statistics Bureau, said, "Import prices continue to rise as international oil prices increase," adding, "Import prices are greatly affected by Middle East geopolitical risks."

Export prices also rose 4.1% month-on-month last month due to the exchange rate increase. Like import prices, export prices have risen for four consecutive months since January.

Export prices of manufactured goods rose 4.1% month-on-month due to increases in computers, electronics, optical devices, and chemical products. By detailed item, semiconductor export prices rose significantly, with DRAM export prices up 16.4% and flash memory up 11.4%.

Export Volume Index Continues Upward Trend Due to Semiconductor Industry Improvement

With the improvement in the semiconductor industry, the export volume and value indices also continued their upward trend in April. The export volume and value indices are statistics compiled to analyze export and import amount changes by separating price factors and volume factors.

Last month, the export volume index rose 9.8% year-on-year due to increases in computers, electronics, optical devices, and chemical products. The export volume index has been rising for nine consecutive months since August last year. The export value index in April also rose 13.1% year-on-year, continuing its upward trend for seven consecutive months.

The import volume index rose 7.1% year-on-year in April due to the rise in natural gas prices. This is the first increase in the import volume index in 10 months. The import value index rose 4.9%, marking the first increase in 14 months. Yoo explained, "Previously, the import volume index declined mainly due to decreases in natural gas import volume and prices, but last month, the index rose as natural gas prices increased."

The net barter terms of trade index and income terms of trade index rose 5.2% and 15.4% year-on-year in April, respectively. The net barter terms of trade index is the ratio of the price of one unit of export goods to one unit of import goods, indicating how many goods Korea can import with one unit of exports. The income terms of trade index shows the total quantity of goods Korea can import with its total export amount.

Revision of Base Year for Producer Price Index and Export-Import Price Index

Meanwhile, on the same day, the Bank of Korea announced the revision of the base year for the producer price index and export-import price index from 2015 to 2020.

The number of items surveyed for the producer price index based on 2020 was 884, which is 10 fewer than before the revision. Among them, manufactured goods decreased by 12 items, while services increased by 2 items. Eighteen items such as coffee creamer and fruit juice were excluded, and six items such as wireless communication systems and battery packs were added. New items in high-growth industrial sectors, such as eco-friendly vehicles, were split from two items into four: hybrid passenger cars and electric passenger cars, and online content services were divided into online content services and online video services.

The number of items surveyed for the export price index based on 2020 was 210, three fewer than before the revision. While two items, photoresist and clothes dryers, were added, six items including water tube boilers, LCDs for TVs, and TVs were excluded. Eco-friendly vehicles were split from one item into two: hybrid passenger cars and electric passenger cars. The number of items surveyed for the import price index remained the same at 237.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)