Rapid Growth Through 'Daechul Galatagi' Refinancing

The loan balances of internet-only banks, which recorded record-breaking performance in the first quarter, have shown a 'stormy growth' of nearly 15 trillion won. It is analyzed that they have significantly benefited from the effect of refinancing, where loans are switched from commercial banks to internet banks.

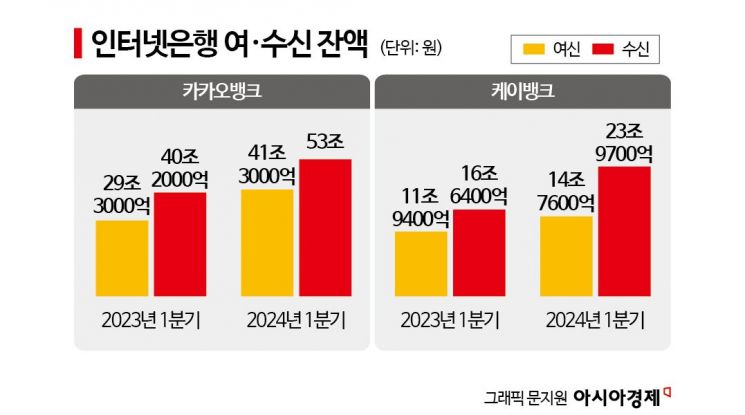

According to the financial sector on the 14th, the loan balances of KakaoBank and K Bank as of the first quarter amounted to 56.06 trillion won, an increase of 14.82 trillion won (about 36%) compared to the same period last year. Considering that most loans from internet banks are household loans, this amount is nearly 2 trillion won larger than the increase in household loans (12.8023 trillion won) from the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?during the same period.

Looking at each bank, KakaoBank's loan balance in the first quarter was 41.3 trillion won, an increase of 12 trillion won compared to 29.3 trillion won in the same period last year. In particular, the balance of mortgage loans increased by 9.4 trillion won to 11.8 trillion won from 2.4 trillion won in the previous year. KakaoBank explained that they not only expanded the scope of mortgage loans from mainly apartments to include villas and multi-family houses but also saw significant refinancing demand switching from commercial banks.

According to KakaoBank, 50% of new mortgage loan disbursements last year were for refinancing purposes. This proportion rose to 62% as of the first quarter this year. KakaoBank's market share in the one-stop refinancing loan infrastructure service, implemented since early this year, also reached 31%.

The situation at K Bank is similar. K Bank's loan balance increased by 2.82 trillion won from 11.94 trillion won in the first quarter of last year to 14.76 trillion won in the first quarter of this year. A K Bank official explained, "As a result of improving the application and screening process in line with the government's refinancing loan infrastructure implementation, interest in apartment mortgage loans and jeonse loans has expanded, attracting many customers." For K Bank, 67% of all new apartment mortgage loans were refinancing loans.

The deposit balances of internet banks also increased significantly. The deposit balances of KakaoBank and K Bank reached 76.97 trillion won, an increase of 20.13 trillion won compared to 56.84 trillion won last year. In KakaoBank's case, low-cost deposits increased due to the popularity of group accounts, while K Bank saw an increase in deposit balances influenced by special high-interest savings and time deposit promotions.

An official from the banking sector said, "Internet banks already had their own refinancing products, and by enhancing interest rate competitiveness last year, there was a significant demand for switching from commercial banks. Although internet banks have been criticized as the main cause of household debt by increasing mortgage loans, it is also true that they played a 'catalyst' role in the growth of non-face-to-face mortgage loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)