Three 100 Billion-Won Funds Formed Since April

VCs Seek Exit Paths, LPs Attracted by Appealing Returns

Government Supports Through Mother Fund and Legal Revisions

A 'secondary boom' is occurring in the venture capital (VC) industry. While there was only one secondary fund worth over 100 billion KRW until last year, three such funds have been launched this year alone. Attention is focused on whether this can provide new momentum for the recovery (exit) of VC investments, which have reached their limits.

According to the electronic disclosure system for venture investment companies (DIVA) and the VC industry on the 14th, three firms?IMM Investment, Shinhan Venture Investment, and DSC Investment?have formed secondary venture funds exceeding 100 billion KRW this year. All were established after April. IMM Investment formed a 120 billion KRW fund and Shinhan Venture Investment a 100 billion KRW fund, both in April. Recently, DSC Investment reached a peak by raising a record 300 billion KRW.

Until last year, the only secondary venture fund worth over 100 billion KRW was LB Investment’s 'LB Innovation Growth Fund (124.5 billion KRW)' formed in 2019. A secondary fund refers to a fund that reacquires portfolios previously invested in by VCs, private equity funds (PEFs), or asset management companies. The main investment targets are shares (old stocks) that other funds failed to recover within their maturity period. It is a concept of 'intermediate recovery.' The first venture secondary fund was formed in 2002 by Neoplus, the predecessor of Shinhan Venture Investment, and although it has occasionally been highlighted since then, it has never become mainstream in the domestic VC market, which heavily relies on initial public offerings (IPOs) and mergers & acquisitions (M&A). However, signs of a shift in the landscape are emerging.

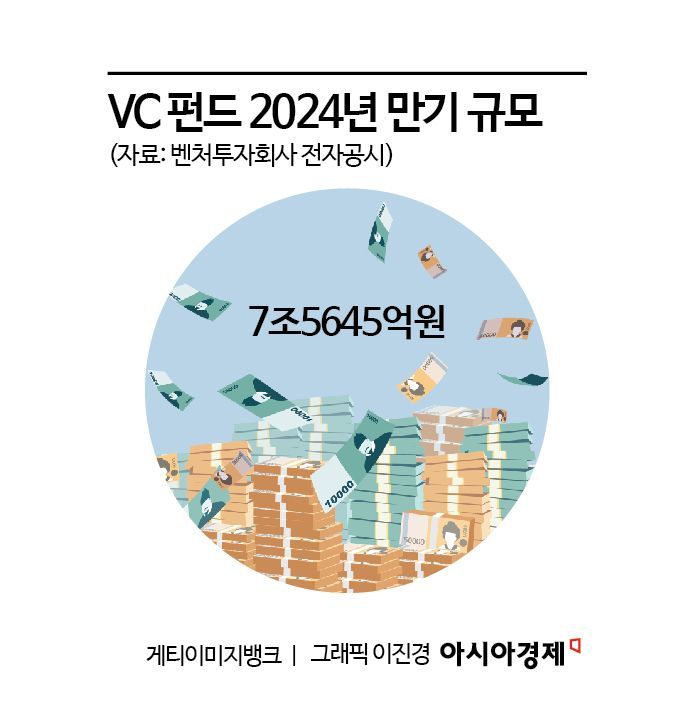

Reasons for Attention... Record-Breaking VC Fund Maturities of 7.5 Trillion KRW This Year

Institutional investors (LPs) such as pension funds and mutual aid associations are also actively investing in secondary funds. In IMM Investment’s 'IMM Secondary No.6,' Korea Development Bank, Military Mutual Aid Association, and Private School Teachers’ Pension Fund participated as major LPs. Shinhan Venture Investment’s 'Shinhan Market-Frontier Investment Association' included Korea Development Bank and the Korea Fund of Funds, while DSC Investment’s 'DSC Secondary Package Acquisition Fund No.1' had Korea Development Bank, Military Mutual Aid Association, Private School Teachers’ Pension Fund, and Korea Post as participants. All three VCs share the commonality of managing assets under management (AUM) exceeding 1 trillion KRW.

The biggest reason secondary funds are gaining popularity domestically is the difficulty in recovering investment capital through traditional exit methods in the venture industry. In the past, VC new investments continued to grow, and IPOs were smooth, so exits were not a major issue. However, according to the Korea Venture Capital Association, new investments peaked at 7.6802 trillion KRW in 2021 and have shrunk for two consecutive years. Last year, it was 5.3977 trillion KRW, about 70% of the peak two years ago. Typically, VC fund maturities range from 5 to 7 years. The total amount of venture funds maturing this year is 7.5645 trillion KRW, the largest ever. This volume is difficult to handle with IPOs and M&As alone.

Attractive Discounts on Old Shares... Policy and Legislation Also Provide Support

From the LP perspective, secondary funds have clear advantages. Lee Sang-min, Chief Investment Officer (CIO) of the Construction Workers’ Mutual Aid Association, said, "VCs are facing difficulties in exit and fund liquidation due to the triple challenges of high interest rates, high inflation, and high exchange rates, as well as a weak IPO market. Secondary funds allow purchasing old shares at attractive prices discounted by tens of percent compared to the original price, enabling a decent internal rate of return (IRR)." The Construction Workers’ Mutual Aid Association has also resumed VC investments after three years since 2021, keeping the 'secondary market' in mind. They are currently selecting asset managers and plan to invest a total of 20 billion KRW. The CIO added, "Unlike advanced countries where the venture secondary market is active, we were at a beginner stage. This is a movement to fully emerge, so it can be seen as a noteworthy trend."

Policy support is also helping. The Korea Fund of Funds, under the Ministry of SMEs and Startups, revived the 'general secondary' category last year for the first time in 10 years. It invested in three small-to-medium-sized funds and one large fund. The large fund was Shinhan Venture Investment. The state-run Korea Development Bank also allocated 12 billion KRW to venture secondary funds from its 'policy support fund' last year. Additionally, in December last year, the Ministry of SMEs and Startups introduced an enforcement decree to the Venture Investment Act that exempts secondary funds from the mandatory new share investment rule (which requires at least 20% investment in new shares). This means the entire raised amount can be invested solely in old shares.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)