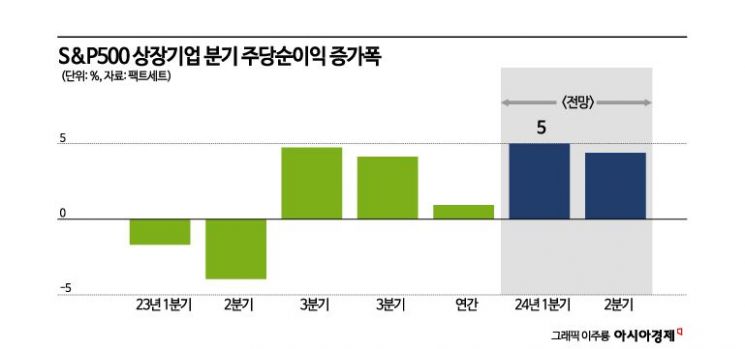

Large corporations listed on the U.S. S&P 500 index are expected to report a 5% year-over-year increase in first-quarter earnings per share (EPS), marking the highest growth in about two years. This strong performance is cited as a key reason why the New York stock market did not plunge as sharply as feared, despite the rapid retreat of expectations for Federal Reserve (Fed) interest rate cuts earlier this year.

On the 6th (local time), financial information firm FactSet analyzed the earnings and earnings estimates of S&P 500 listed companies and projected that first-quarter EPS would increase by around 5% compared to the previous year. This represents the largest growth since the second quarter of 2022 (5.8%). It also significantly exceeds the 3.2% forecast released by Wall Street at the end of March ahead of the earnings season.

So far, about 80% of S&P 500 companies have reported their quarterly earnings, with 77% of them posting EPS that exceeded expectations. Additionally, 61% reported sales above forecasts. FactSet stated, "S&P 500 companies continue to deliver better-than-expected results," adding, "Out of 11 sectors, eight sectors saw year-over-year revenue growth, led by telecommunications, utilities, consumer discretionary, and technology." This week, 56 companies including Disney and UBS are scheduled to announce their earnings.

Wall Street attributes the market's resilience amid persistent inflation and fading hopes for rate cuts to these robust first-quarter earnings. Jean Boivin, head of BlackRock Investment Institute, noted in a weekly investor memo that "high interest rates typically hurt stock valuations," but "despite concerns over high rates, strong first-quarter earnings supported the stock market." The equity strategy team at Citigroup, led by Scott Kroner, also commented, "We remain negative on the Fed and economic conditions," but added, "This earnings season supports the continuation of a bull market based on S&P 500 fundamentals."

Accordingly, market attention is now focused on second-quarter earnings guidance. Among 75 S&P 500 companies that have released second-quarter EPS forecasts so far, 34 companies have exceeded Wall Street expectations. Conversely, 41 companies, accounting for 55% of the total, issued guidance below expectations. However, this proportion is lower than the recent five-year average (59%) and ten-year average (63%), leading to assessments that companies are more optimistic than expected.

Investors have particularly noted that despite recession concerns, Wall Street analysts have been raising EPS estimates for S&P 500 companies. According to FactSet, during April?the first month of the quarter?Wall Street analysts raised the median bottom-up EPS estimate for S&P 500 companies from $59.23 to $59.64, a 0.7% increase.

This trend contrasts with the usual pattern on Wall Street, where EPS estimates are typically lowered in the first month of a quarter. This is the first time since the fourth quarter of 2021 (+0.3%) that EPS estimates have been revised upward in the first month of a quarter. Over the past five years, the average downward revision across 20 quarters was 1.9%. Yahoo Finance reported that "analysts have maintained an unusually optimistic stance this quarter."

Jessica Love, co-founder of DataTrek, said, "Despite all the uncertainties surrounding monetary policy, earnings outlooks remain positive," and predicted, "In such a situation, it would be difficult to see large-cap stocks on the New York stock market plummet."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)