Exchange Rate Exceeding 1300 Won Attractive to Foreigners

Focus on European Funds and Future Yen Trends

Foreign investors have been buying domestic stocks for six consecutive months. As a result, the market's interest is growing in how long the record-high level of net foreign purchases will continue. Experts agree that the current value of the Korean won is at a level that does not burden foreign investors when purchasing domestic stocks. Furthermore, attention should be paid not only to the possibility of an increase in the proportion of European funds, which is currently lower compared to the past, but also to the potential for the yen to strengthen, suggesting that additional foreign capital inflows may occur.

According to the Korea Exchange on the 2nd, foreign investors purchased about 3.3 trillion won in the KOSPI market last month, continuing their six-month streak of net buying since November last year. Although there were strong sell-offs at times due to soaring oil prices caused by the war threat between Iran and Israel, the strong dollar phenomenon, and concerns over delayed interest rate cuts following stronger-than-expected U.S. economic indicators, foreign investors' net purchases in the domestic market have not weakened.

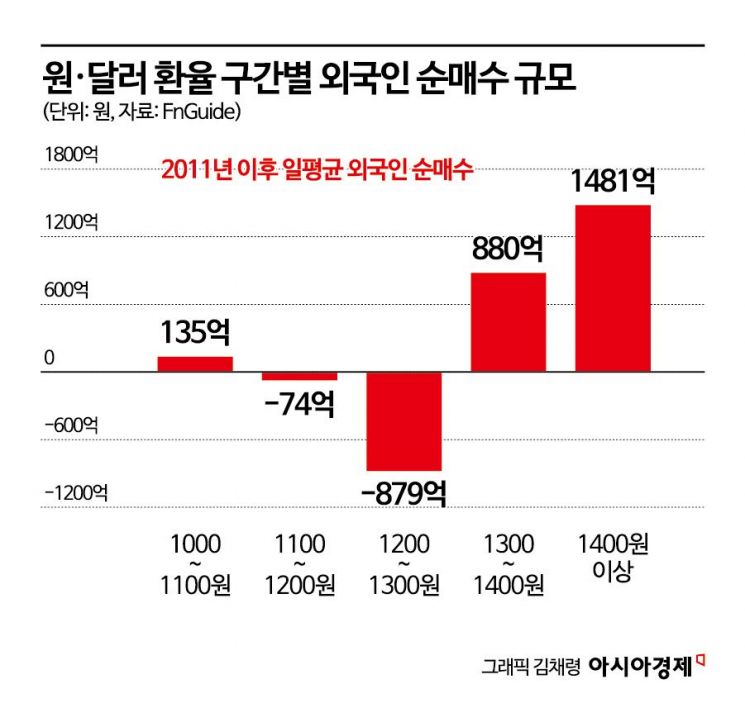

The securities industry evaluates that the undervalued exchange rate level is influencing foreign investors' buying momentum. In fact, foreign investors have consistently purchased domestic stocks when the won-dollar exchange rate was above 1,300 won over the past decade. From the foreign investors' perspective, if the won is undervalued now and its value rises again, they can expect foreign exchange gains. Additionally, the depreciation of the won enhances the export competitiveness of Korean companies. Increased exports can lead to improved corporate earnings in the future, positively impacting stock prices. In other words, if the won's value exceeds 1,300 won, it can be seen as an opportunity to buy Korean stocks at a low price. Huh Jae-hwan, a researcher at Eugene Investment & Securities, said, "Since the end of last year, foreign purchases of domestic assets have increased, and compared to 2022 when the exchange rate surged, the current situation does not have high capital outflow pressure."

Experts are also focusing on the direction of how long the current won-dollar exchange rate will last. Park Soo-yeon, a researcher at Meritz Securities, explained that preemptive interest rate cuts by countries other than the U.S. could act as a factor to curb the dollar's strength in the future. He said, "If countries enter an interest rate cut cycle, expectations for global economic improvement will expand," adding, "This could lead to a shift from the U.S.'s solo growth to increased expectations for economic fundamentals in other countries, resulting in a preference for risk assets." He further noted, "Right after central banks other than the U.S. Federal Reserve (Fed) begin cutting rates, their currencies may depreciate against the dollar, but gradually the extent will narrow, and the dollar may turn weak."

Moreover, the relatively low proportion of British funds in the domestic stock market compared to the past and the historically weak yen phenomenon also influence foreign demand. Yeom Dong-chan, a researcher at Korea Investment & Securities, said, "Since November last year, the country that has most aggressively net purchased domestic stocks is the UK," analyzing, "Although the proportion of British funds in domestic stocks has shrunk since the Southern European debt crisis in 2011, attention should be paid to the fact that their share of the domestic stock market capitalization is currently lower than in the past." He added, "At the same time, funds that witnessed Japan's value-up program are flowing into Korea," and "As Japan's monetary policy normalizes, there remains a possibility of the yen strengthening, so additional buying by European funds, including those from the UK, is expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)