1Q Export Volume Up 28% YoY... Prices Down 37%

US "25% Tariff Should Be Imposed"

Chile Decides 33.5% Tariff Due to 'Fishing Halt'

Bloomberg reported on the 23rd (local time) that China's steel exports are surging, triggering global trade tensions. This is because China is exporting its surplus domestic steel at low prices in a 'dumping' manner, causing a global oversupply of about 100 million tons.

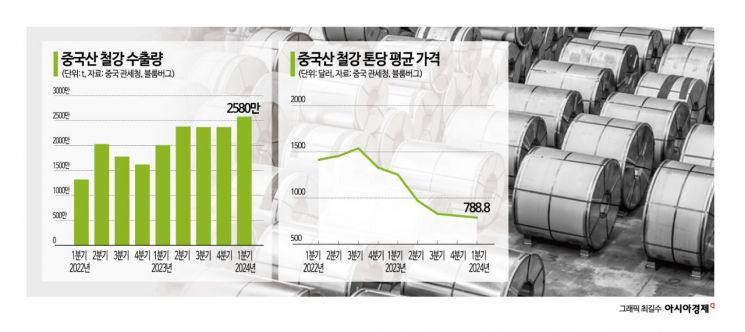

Since 2019, China has been producing about 1 billion tons of steel annually. However, due to the real estate crisis shrinking construction demand, the Chinese steel industry is expanding exports to reduce inventory. In the first quarter of this year, about 26 million tons of steel were exported. This is an approximately 28% increase compared to the same period last year and the highest since 2016. In March alone, exports reached 9.9 million tons, a 25% increase year-on-year.

According to the Wall Street Journal (WSJ), from March last year to February this year, China's steel exports totaled 95 million tons, a 33% jump compared to the previous year. This exceeds the total steel consumption of the United States in 2022.

Meanwhile, prices have dropped significantly. According to data compiled by Bloomberg, the price per ton of Chinese steel is $788.8, which is 37% cheaper than the same period last year ($1,254.5).

East Asia remains the largest export destination for Chinese steel, but shipments to India, the Middle East, and Latin America have noticeably increased recently. According to raw material company Kalanish, China's steel exports to Brazil in the first quarter rose 29% year-on-year, Colombia by 46%, and Chile by 32%. Bloomberg reported that during the same period, Chinese steel exports to Egypt surged 95%, and exports to the United Arab Emirates jumped 81%.

The rapid increase in Chinese steel exports is intensifying trade frictions worldwide. U.S. President Joe Biden has called for imposing tariffs of up to 25% on Chinese steel products. On the 17th, President Biden recommended the U.S. Trade Representative (USTR) raise tariffs on Chinese steel and aluminum products to 25%, accusing Chinese steel companies of "unfair practices" by dumping products at low prices with government subsidies. Currently, the average tariff on Chinese steel and aluminum products is 7.5%, so if Biden's directive is followed, tariffs would triple.

Although the U.S. imports a smaller share of Chinese steel compared to other countries, this statement is interpreted as an effort to curb China's oversupply. Previously, China’s overproduction in industries such as solar power, secondary batteries, and electric vehicles has been repeatedly criticized. At the same time, this is seen as a move to protect the domestic steel industry and appeal to voters ahead of the November presidential election.

In response, the Chinese government called the accusations of unfair trade practices "groundless" and urged the immediate withdrawal of the U.S.'s punitive tariffs.

Chile decided on the 22nd to impose anti-dumping tariffs of up to 33.5% on Chinese steel, ahead of the U.S. This strong measure was taken after major Chilean steel company CAP halted operations due to the massive import of subsidized, low-priced Chinese steel products. According to the Latin American Steel Association (Alacero), the market share of Chinese steel in the regional steel market soared from the 15% range in 2000 to 54% in 2023.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)