Tesla Tops Net Purchases This Month with 390 Billion KRW Bought

Nvidia, Most Bought Last Month, Is Selling

Concerns Over Losses as Tesla Stock Price Continues to Decline

So far this month, Seohak Gaemi (domestic individual investors investing in overseas stocks) have been net buying Tesla the most. Investment sentiment, which had been focused on Nvidia, appears to have shifted back to Tesla. This is interpreted as a move to buy at low prices amid Tesla's ongoing stock price decline since the beginning of the year. However, since Tesla's stock price continues to fall and the outlook is not bright, advice has been given to exercise caution in investing.

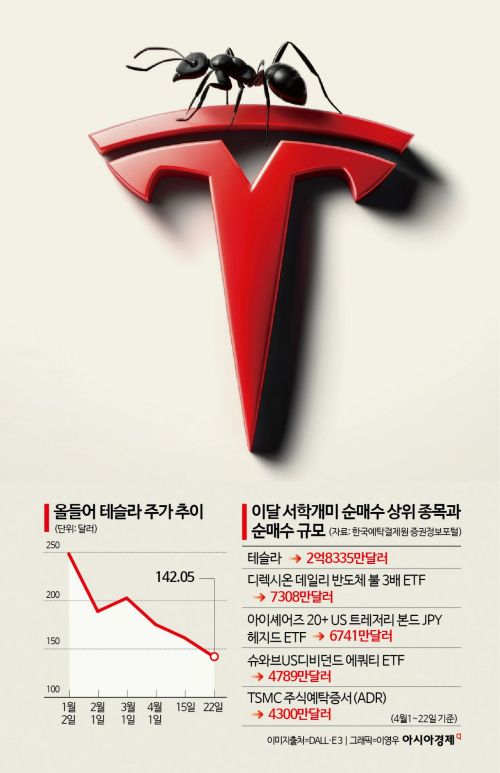

According to the Korea Securities Depository's securities information portal on the 24th, the stock that domestic investors net bought the most up to the 22nd of this month was Tesla. The net purchase amount reached $283.35 million (about 390.5 billion KRW), overwhelmingly higher than other top net purchase stocks. Following were the Direxion Daily Semiconductor Bull 3X Shares (DIREXION DAILY SEMICONDUCTORS BULL 3X SHS) ETF with $73.08 million, iShares 20+ Year US Treasury Bond JPY Hedged (ISHARES 20+ YEAR US TREASURY BOND JPY HEDGED) ETF with $67.41 million, Schwab US Dividend Equity (SCHD) ETF with $47.89 million, and TSMC (TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD) American Depositary Receipts (ADR) with $43 million among the top net purchase stocks.

Nvidia, which was the most purchased last month, disappeared from the top net purchase list. This month, domestic investors net sold Nvidia worth $132.31 million. It is interpreted that domestic investors also started selling as Nvidia's stock price showed volatility last week, including a 10% plunge on the 19th.

Tesla overtaking Nvidia to become the top net purchase is seen as a result of low-price buying inflows. Tesla's stock price has dropped nearly 43% compared to the beginning of the year. On the 22nd (local time), it closed at $142.05, marking the lowest level in 15 months. During the session, it broke below $140, falling to $138.80, setting a new 52-week low again.

With the stock price decline continuing and the future outlook not bright, Tesla investors cannot rule out concerns about losses. Earlier, Tesla announced price cuts for some models in Europe, the Middle East, and Africa following the US and China. Foreign media such as Bloomberg cited increased inventory due to weak US first-quarter sales and intensified competition in China as reasons for the price cuts. Tesla stated that its first-quarter shipments decreased for the first time in nearly four years. The first-quarter earnings, scheduled to be announced after the market close on the 23rd, are also expected to be weak. Wall Street forecasts a roughly 40% plunge in operating profit and the first year-over-year sales decline since the second quarter of 2020. Global investment banks are consecutively lowering Tesla's investment ratings and target prices. Deutsche Bank recently downgraded Tesla's investment rating from 'Buy' to 'Hold' and lowered the target price from $189 to $123. Citigroup lowered Tesla's 12-month target price from $224 to $196 last month, giving a 'Neutral' rating. Wells Fargo also downgraded Tesla's investment rating from 'Overweight' to 'Underweight' and cut the target price from $200 to $125. JP Morgan lowered Tesla's target price from $130 to $115.

As Tesla's stock price continues to fall, concerns about losses in equity-linked securities (ELS) based on Tesla are also being raised. According to the Korea Securities Depository, the outstanding balance of Tesla ELS issued since July last year is about 1.13 trillion KRW. Considering that ELS usually offers early redemption opportunities every three or six months, it is interpreted that the outstanding balance has accumulated due to early redemption failures caused by Tesla's stock price decline. If early redemption continues to be delayed and the price falls below the knock-in price (principal loss threshold), principal losses may occur.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)