Savings Banks See Half Reduction in Lowest Credit Borrowers' Loans in One Year

Card Industry Practically Has No Loans for Lowest Credit Borrowers

"Must Not Be Pushed to Illegal Private Loans... Need to Expand Policy Financial Products"

As savings banks, credit card companies, and other secondary financial institutions raise the bar for loans, concerns are growing that vulnerable borrowers may be driven to illegal private loans.

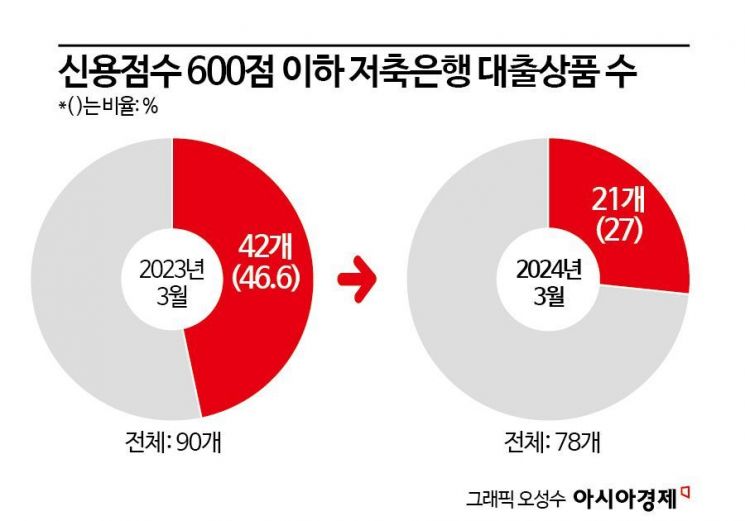

According to the Korea Federation of Savings Banks on the 23rd, 14 savings banks provided unsecured loans to borrowers with credit scores below 600 as of last month. Out of a total of 78 loan products, only 21 (27%) were available to borrowers with the lowest credit scores. This is about half the number compared to the same period last year. As of March last year, there were 42 products available to borrowers with credit scores below 600, accounting for 46.6% of the total 90 products. The number of savings banks offering these products was counted at 23.

The loan threshold is even higher for borrowers with credit scores below 500. The number of savings banks providing loans to borrowers in this credit score range dropped sharply from 9 in March last year to 2 in one year. In terms of products, the number of loan products available to borrowers in this credit score range was 11 in March last year but decreased to 3 last month.

The situation is similar for card loans, which are considered quick cash sources. According to the Credit Finance Association, eight domestic full-service credit card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Hana, BC, and Woori Card) have practically stopped offering card loans to borrowers with credit scores below 500 during February and March. This contrasts with the situation until January, when Samsung Card and Kookmin Card still provided card loans to borrowers with scores below 500.

The reason savings banks, credit card companies, and other secondary financial institutions have reduced loans to the lowest credit borrowers is due to "soundness." A savings bank industry official explained, "Due to existing loans such as real estate project financing (PF), delinquency rates have risen rapidly, so new loans are being issued conservatively." A credit card industry official stated, "With the legal maximum interest rate set at 20%, it is difficult to lend to customers with low credit scores while maintaining soundness."

As a result, there is an analysis that the lowest credit borrowers may be pushed toward illegal private loans. Professor Kang Sung-jin of the Department of Economics at Korea University said, "Since they cannot borrow the necessary funds within the formal financial system, they may take out loans at higher interest rates in unofficial financial markets such as private loans or, in the worst case, face bankruptcy," adding, "Especially, self-employed individuals are more likely to engage in risky loans."

There are also opinions that policy financial products should be expanded for the lowest credit borrowers who need quick cash. Professor Ahn Dong-hyun of the Department of Economics at Seoul National University explained, "In a situation of continued high interest rates, policy financial products should play a role in preventing damage from illegal private loans," and added, "The government needs to expand financial products from the Korea Inclusive Finance Agency, such as the Sunshine Loan (Haetsal Loan) and Microcredit, for borrowers with poor credit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)