LG Energy Solution, Samsung SDI, and SK On, the three domestic battery companies, all ranked within the top 5 globally last year in terms of both shipment volume and sales revenue in the electric vehicle battery market. Analysis suggests that the market is becoming entrenched, with the top 5 companies holding a 78.4% share of the global electric vehicle market.

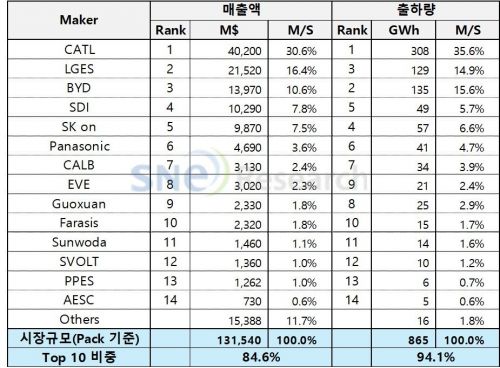

According to energy market research firm SNE Research on the 15th, the total electric vehicle battery shipment volume last year was 865 gigawatt-hours (GWh). Total sales revenue based on battery packs was approximately $132 billion (182.6 trillion KRW).

In terms of market share by sales, China’s CATL maintained first place with 30.6%, followed by LG Energy Solution (16.4%) in second, Samsung SDI (7.8%) in fourth, and SK On (7.5%) in fifth, with all three domestic companies ranking within the top 5.

BYD, expanding beyond the Chinese domestic market to overseas markets, ranked third with 10.6%.

By shipment volume, CATL (35.6%) and BYD (15.6%) ranked first and second respectively, while domestic companies LG Energy Solution (14.9%) ranked third, SK On (6.6%) fourth, and Samsung SDI (5.7%) fifth.

Among Japanese companies, Panasonic ranked sixth with a 3.6% market share by sales and 4.7% by shipment volume.

From seventh to tenth place, Chinese companies such as CALB, Eve Energy, Guoxuan, and Farasis are competing for rankings.

The top 10 companies accounted for 94% of total electric vehicle battery shipments, with the top 5 companies holding 78.4%. SNE Research explained, "The market dominance of first-tier battery companies is quite high, and this structure is unlikely to be disrupted easily in the near future."

SNE Research forecasted that amid the ongoing high interest rate environment, early adopters’ demand has ended, and automakers are focusing on profitability, causing the pace of electrification worldwide to slow down, a trend expected to continue until 2025.

They added, "As all major electric vehicle markets enter moderate growth in 2024, securing a stable supply chain in Europe and North America within the next 2 to 3 years to gain price competitiveness will be the greatest advantage in the future battery market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)