Musinsa Reports 8.6 Billion KRW Operating Loss Last Year... First Since Inception

'New Business' Soldout Investment Hampers Performance

KakaoStyle Also Posts Loss... Ably Turns Profit

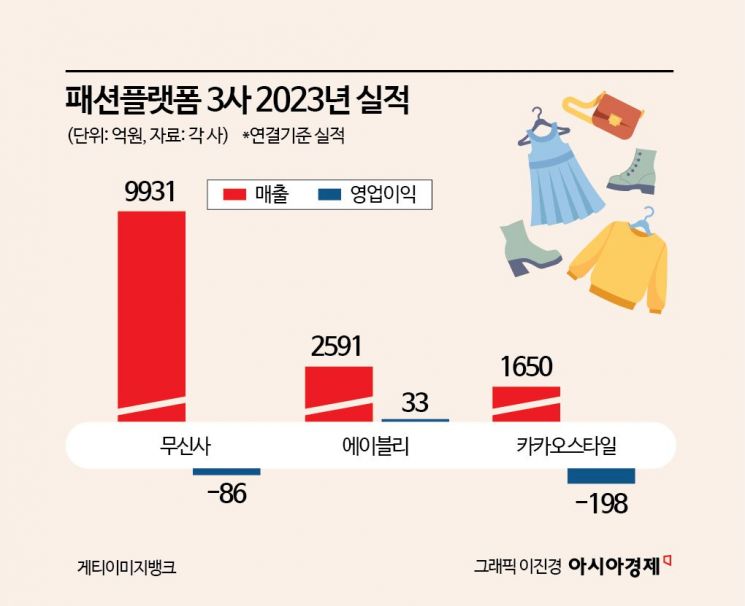

Musinsa, Ably, and Kakao Style, three major domestic fashion platforms, received mixed results last year. Musinsa, the industry leader, posted its first operating loss since its founding, while Ably significantly improved its profitability and achieved operating profit alone.

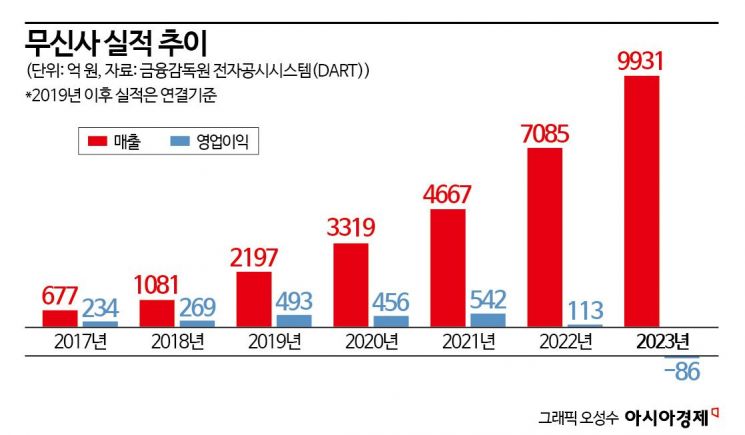

According to each company's audit report disclosed on the electronic disclosure system on the 14th, Musinsa recorded an operating loss of 8.6 billion KRW on a consolidated basis last year, turning to a deficit. This is Musinsa's first operating loss since its establishment in 2012. Its sales have grown every year, expanding to nearly 1 trillion KRW in scale. Last year's consolidated sales amounted to 993.1 billion KRW, a 40.2% increase compared to the previous year.

Musinsa Posts First Operating Loss Since Its Founding in 2012

Musinsa's first operating loss was due to operating losses reflected from subsidiaries such as SLDT, which operates the resale platform SoldOut. SLDT posted an operating loss of 28.8 billion KRW last year. However, the operating loss, which exceeded 42 billion KRW in 2022, has somewhat decreased. SLDT is conducting emergency management by reducing employee welfare and cutting staff. Musinsa explained that operating expenses such as ▲one-time stock compensation costs of 41.3 billion KRW paid to executives and employees ▲increased labor and depreciation costs ▲increased commission fees affected the results.

Excluding subsidiaries, Musinsa's standalone performance achieved sales of 883 billion KRW and operating profit of 37.1 billion KRW. Musinsa's standalone results include only the performance of the fashion platform Musinsa, the private brand (PB) 'Musinsa Standard,' and the online select shop '29CM.' However, standalone operating profit also decreased by 40% compared to the previous year, which Musinsa explained was due to temporary stock compensation costs for employees.

As profitability shrank significantly, Musinsa pulled out the 'responsible management' card of its founder. Last month, Musinsa held a board meeting and approved the appointment of founder and board chairman Jomanho as the Chief Executive Officer. Chairman Jo returned to the front line of management after about two years and nine months.

Previously, Chairman Jo stepped down from the CEO position in June 2021, taking responsibility for Musinsa's coupon issuance gender discrimination and the 'misogyny controversy' over event images. Musinsa decided to split its business into Global & Brand and Platform divisions, each with its own CEO, and the Chief Executive Officer Jo will be responsible for driving the organic growth of both divisions.

Kakao Style Also Posts Losses... Ably Focuses on Profitability

Another fashion platform company, Kakao Style, also recorded an operating loss of 19.8 billion KRW on a consolidated basis last year. Sales reached 165 billion KRW, about a 62% increase from 101.8 billion KRW the previous year, but it could not escape losses. However, it succeeded in reducing the deficit from 51.8 billion KRW to 19.8 billion KRW. Kakao Style operates fashion platforms Zigzag, Fashion by Kakao, and Posty.

Kakao Style also incurred operating losses due to investments in new businesses. Losses occurred as it invested in new platforms such as 'Posty,' targeting senior customers aged 40 and above. The company explained that its main platform, Zigzag, recorded annual operating profit last year, achieving profitability for the first time in four years since 2019. It also stated that it posted company-wide operating profit in the fourth quarter of last year.

Ably was the only one among the three fashion platforms to record a profit. Ably posted an operating profit of 3.3 billion KRW on a consolidated basis last year. It successfully turned a profit from a deficit of 74.4 billion KRW recorded the previous year. During the same period, sales also rose 45.4% to 259.5 billion KRW.

Ably pursued new businesses last year, including the men's platform '4910' and the Japanese fashion app 'Amud,' but succeeded in defending profitability. An Ably official explained, "As the number of users increased, efficient business operations were possible through the user data secured. Connecting users with our self-developed artificial intelligence (AI) recommendation technology led to growth in sales and transaction volume."

Ably recorded the highest monthly active users (MAU) among fashion specialty malls last year. According to WiseApp, Retail, and Goods, Ably's MAU last month was 8.05 million, making it the most used fashion specialty mall app by Koreans. Musinsa recorded 6.76 million users, ranking second. Following were Zigzag (3.27 million), Queenit (1.93 million), 29CM (1.48 million), and Cream (1.48 million).

However, Musinsa still led in estimated payment amount. According to the same survey, last month's estimated payment amount for fashion specialty mall apps was highest for Musinsa at 176.7 billion KRW, followed by Zigzag (69 billion KRW) and Ably (59.5 billion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)