Entered KOSDAQ in January last year... IPO price 3,100 KRW

Shareholder allocation method for capital increase planned... New share issuance price 1,760 KRW

Stock price declined due to poor performance last year

Hanju Light Metal has launched a large-scale fundraising effort just over a year after its listing. The company is raising capital to invest in expanding production capacity amid growing demand for lightweight automotive parts. If there are remaining shares after the public offering, KB Securities will underwrite them.

According to the securities registration statement submitted to the Financial Supervisory Service on the 12th, Hanju Light Metal will issue 0.636 new shares for every one existing share, raising 22.9 billion KRW. The planned issue price for the new shares is 1,760 KRW.

Founded in 1987, Hanju Light Metal supplies lightweight parts to major domestic and international automakers. The company is recognized for its technological expertise in the automotive industry, where lightweighting is essential for improving fuel efficiency, reducing exhaust emissions, and shortening braking distances. Last year, it was selected as a supplier of lightweight parts for Hyundai Motor Company's next-generation electric vehicle-exclusive 'eM' platform. The eM platform is Hyundai Motor Group's second-generation electric vehicle-exclusive platform, succeeding the existing 'E-GMP.' While the existing E-GMP is dedicated to passenger cars, the new eM platform applies to all electric vehicle types.

The ultra-lightweight cross member parts supplied by Hanju Light Metal are currently installed in some high-end internal combustion engine vehicles. The automotive industry views vehicle lightweighting as a means not only to improve fuel efficiency but also to reduce exhaust emissions and enhance driving stability and braking performance. Based on the assessment that there is a high possibility of expanding application to internal combustion engine and hybrid vehicles as well as electric vehicles, Hanju Light Metal has planned expansion investments.

Aligned with the eM platform project timeline, the company plans to invest a total of 57.894 billion KRW over three years in two phases. The first phase of facility investment is expected to cost 26 billion KRW, which will be funded through the capital increase. The second phase, amounting to 31.9 billion KRW, is planned to be financed through bank loans. Hanju Light Metal expects that operating under a mass production system through the eM platform project will improve production efficiency.

Although the expansion investment is necessary for Hanju Light Metal's growth, convincing shareholders may not be easy. At the time of its listing in January last year, the public offering price was set at 3,100 KRW. With expectations for electric vehicle growth, the stock price surpassed the 8,000 KRW mark within three months of listing. However, as the electric vehicle market growth slowed and Hanju Light Metal's financial investors (FIs) began to recover their investments, the stock price declined. Coupled with poor performance last year, the stock price fell below the offering price this year. Hanju Light Metal recorded sales of 220.9 billion KRW and an operating loss of 13.4 billion KRW last year. Sales slightly decreased compared to the previous year, and operating profit turned negative.

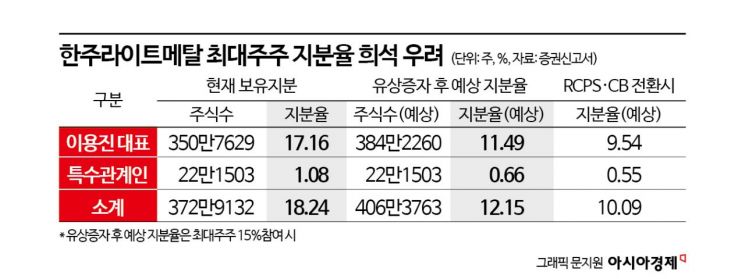

After the board of directors resolved the capital increase on the 5th, the stock price dropped below 2,000 KRW, hitting a post-listing low. Shareholders who invested with expectations for Hanju Light Metal's growth are unlikely to welcome the sudden capital increase decision. CEO Lee Yong-jin, the largest shareholder, will subscribe to 15% of the newly allocated shares. It has not yet been decided whether major shareholders holding more than 5% will participate in the capital increase.

Following the capital increase decision, the conversion price of previously issued convertible bonds (CB) will be adjusted from 3,869 KRW to 3,339 KRW. This will increase the number of shares issued upon exercising conversion rights. Given the current stock price, investors are likely to demand redemption.

KB Securities, the lead underwriter, explained that Hanju Light Metal parts are used in Hyundai's Santa Fe and Palisade, as well as Kia's Telluride and Genesis G80 and G90. Furthermore, from next year, parts will be supplied for the Genesis GV90, the new electric vehicle model succeeding the GV80, and other projects. They expect that if the sales scale grows and the cost of sales decreases through new projects, a turnaround to operating profit is possible.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)