Democratic Party's Commitment to Fostering Virtual Assets

Increase in Card Merchant Fee Rates

Industry Expectations Significantly Diminished

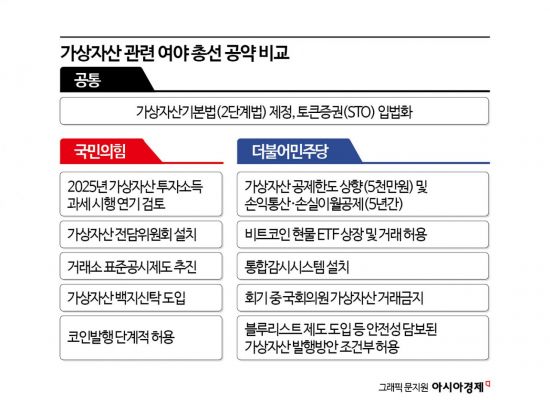

With the Democratic Party of Korea achieving a landslide victory, the pace of easing virtual asset regulations, including the introduction of a domestic Bitcoin spot exchange-traded fund (ETF), is expected to accelerate. In January this year, the U.S. Securities and Exchange Commission (SEC) approved spot ETFs first, leading to many calls for South Korea to align its regulatory standards. However, since financial authorities have not recognized the securities nature of virtual assets and have maintained a negative stance, it is unlikely that the opposition party will be able to push policies aggressively.

Policies to Foster the Korean Virtual Asset Market Included

On the 11th, the Democratic Party of Korea's virtual asset sector pledges included allowing the listing and trading of Bitcoin spot ETFs and permitting market participation by institutional investors and corporations, aiming to foster the Korean virtual asset market. Additionally, the pledges included enacting the Virtual Asset Basic Act (Phase 2 law) as a fundamental law for the industry, establishing an integrated monitoring system, and conditionally allowing virtual asset issuance methods.

A Bitcoin spot ETF is an ETF based on Bitcoin as the underlying asset. In January this year, following a court ruling, the U.S. SEC simultaneously approved the listing of 11 Bitcoin spot ETFs created by BlackRock Asset Management and others. With global institutional funds flowing into the market, Bitcoin recorded a 137.5% return over the past year.

The Financial Services Commission (FSC), the relevant authority, has maintained a negative stance on Bitcoin spot ETFs. In January, the FSC issued a legal interpretation stating that domestic securities firms acting as intermediaries for Bitcoin spot ETFs listed overseas could violate the Capital Markets Act. However, after the Presidential Office stated that "the FSC was told not to have a fixed direction," the FSC softened its stance, saying it is "open and reviewing" the matter. Lee Bok-hyun, Governor of the Financial Supervisory Service, who plans to visit the U.S. in May, also said at a February press briefing that "there are areas to align with Gary Gensler, SEC Chairman, on virtual asset issues and Bitcoin spot ETFs." This has raised market expectations.

Taxation, which has been the biggest concern for domestic virtual asset investors, is scheduled to proceed as planned from next year. According to the current Income Tax Act, virtual asset taxation is expected to begin on January 1, 2025. Virtual asset investors will have to pay 20% income tax on income exceeding the basic deduction amount (KRW 2.5 million) from transactions starting January 1. If the basic deduction is raised from KRW 2.5 million to KRW 50 million as pledged by the opposition party, the number of taxpayers is expected to decrease significantly. Currently, domestic virtual asset exchanges are communicating with the National Tax Service to prepare simplified tax filing services for investors in time for the enforcement date next year. A National Tax Service official said, "The responsibility to prove tax filings basically lies with the investors themselves," adding, "We understand that related documents are provided when requested by overseas exchanges, etc."

Legislation of token securities issuance (STO) is expected to proceed quickly as it was a common pledge of both ruling and opposition parties. The STO market is focusing on the possibility of the Capital Markets Act amendment, which forms the market foundation, being dramatically passed in the extraordinary session of the National Assembly. Although Rep. Yoon Chang-hyun of the People Power Party introduced related legislation in July last year, accelerating the bill's passage, the National Assembly's schedule stalled ahead of the April general election issue. The securities industry, preparing to enter the over-the-counter market, has also been stalled.

Expectations for Merchant Fee Rate Increase in Card Industry Diminished

Meanwhile, in the card industry, expectations for an increase in card merchant fee rates, a long-standing issue, have been significantly dampened due to the opposition's landslide victory, which is friendly to small business owners. This year is the year to recalculate the qualified costs of card fees, which occurs every three years. Qualified costs are the cost basis for various expenses that form the basis of card fee rates. The FSC sets the card merchant fee rates applied from next year based on these qualified costs. Merchant fees have been continuously lowered 14 times from 2007 to 2021. The fee rate, which was 4.5% in 2007 (for small and medium merchants), has now dropped to around 0.5% to 1.5%.

A card industry official said, "The opposition party seems to be preparing seriously for local elections and the presidential election, and it is unlikely they will agree to raise card fees, which would alienate 7.2 million small business owners," adding, "If a fee increase is difficult, we hope the fee increase cycle is extended from three to five years." In this general election, Oh Se-hee, a proportional representative candidate from the Democratic Party of Korea who served as president of the Small Business Federation, a statutory economic organization for small business owners, from 2021 until recently, was also confirmed elected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)