Fiscal Balance Worsens Beyond Initial Expectations

Fiscal Rules Legislation Unmet

MoEF Cites Sharp Tax Revenue Drop... Fiscal Soundness Remains Distant

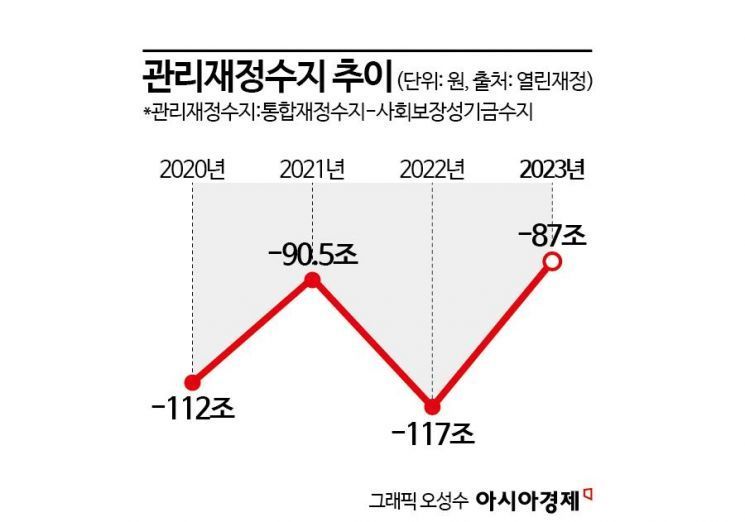

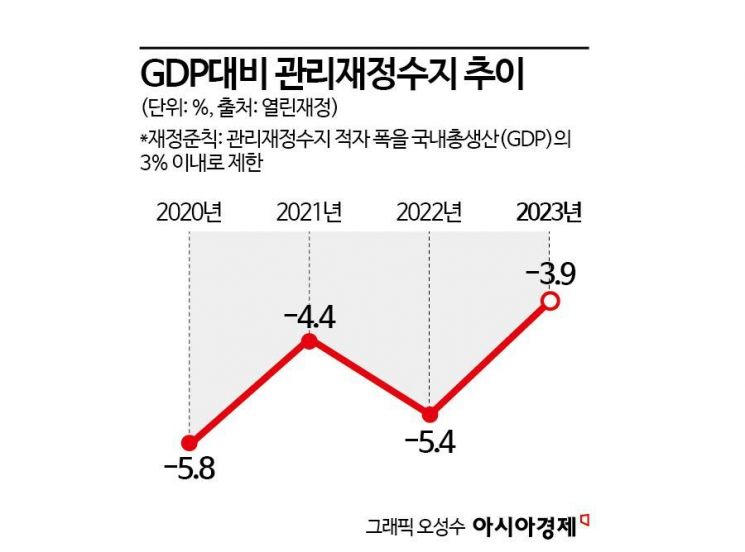

It was revealed that the managed fiscal balance deficit, which shows the country's finances last year, reached 87 trillion won. This is nearly 30 trillion won more than initially expected. The deficit ratio compared to the Gross Domestic Product (GDP) was 3.9%, exceeding the fiscal rule standard of 3%. Although the Yoon Seok-yeol administration has emphasized sound fiscal management since its inception, it failed to meet the self-imposed standard due to sharply decreased tax revenues. This year, with large-scale tax cuts and budget projects anticipated, there are concerns that maintaining sound fiscal management will be difficult.

The Ministry of Economy and Finance announced on the 11th that the '2023 Fiscal Year National Settlement Results,' which include these details, were deliberated and approved at the Cabinet meeting held at the Government Seoul Office. According to the national settlement, the managed fiscal balance deficit last year was 87 trillion won. The managed fiscal balance is the integrated fiscal balance, which is total revenue minus total expenditure, excluding social security fund balances. Since funds such as the National Pension Fund, Private School Pension Fund, Employment Insurance Fund, and Industrial Accident Insurance Fund tend to run surpluses annually, they are excluded to reflect the actual state of the country's finances. Last year, the integrated fiscal balance was a deficit of 36.8 trillion won, while the social security fund balance was a surplus of 50.3 trillion won.

Deficit Size Exceeds Government Expectations... Fiscal Rule Achievement Appears Difficult

The size of the national deficit exceeded government expectations. Although the managed fiscal balance deficit decreased by 30 trillion won compared to 2022, it was 28.8 trillion won more than the 58.2 trillion won forecasted during budget formulation. Kim Myung-jung, the Ministry of Economy and Finance's Fiscal Performance Review Officer, explained, "Tax revenues unexpectedly decreased compared to the time of budget formulation. While reducing expenditures in line with the decrease in tax revenues could have maintained the managed fiscal balance figures, the government minimized expenditure cuts to reduce the impact of the economic downturn."

Further tax reductions are also anticipated. With tax cut measures being introduced one after another ahead of the general election, managing the national finances is expected to become more challenging. Although the opposition securing a majority in the National Assembly will significantly influence the legislative process, if the abolition of the financial investment income tax proceeds as planned, the reduced tax revenue will amount to 800 billion won next year alone. Considering the one-year extension of the temporary investment tax credit for facility investments (1.5 trillion won), expansion of tax benefits for Individual Savings Accounts (ISA) (200 billion to 300 billion won), and the expansion of eligibility for national scholarships, the decrease in tax revenue is expected to be substantial. Notably, the research and development (R&D) budget will be significantly increased next year. One trillion won will be invested in innovation challenge-type R&D, with plans to gradually increase this to about 5% of the government's R&D budget.

Accordingly, achieving the fiscal rule is likely to be difficult under the Yoon Seok-yeol administration. The fiscal rule primarily limits the annual managed fiscal balance deficit (excluding social security fund balances such as the National Pension) to within 3% of GDP. However, it was 5.4% in 2022, and exceeding 3% next year is considered inevitable. Kim stated, "However, since the government plans to manage the managed fiscal balance within 3% after next year according to the National Fiscal Management Plan, there is a commitment to comply with the fiscal rule."

National Debt Hits Record High... National Debt-to-GDP Ratio Surpasses 50%

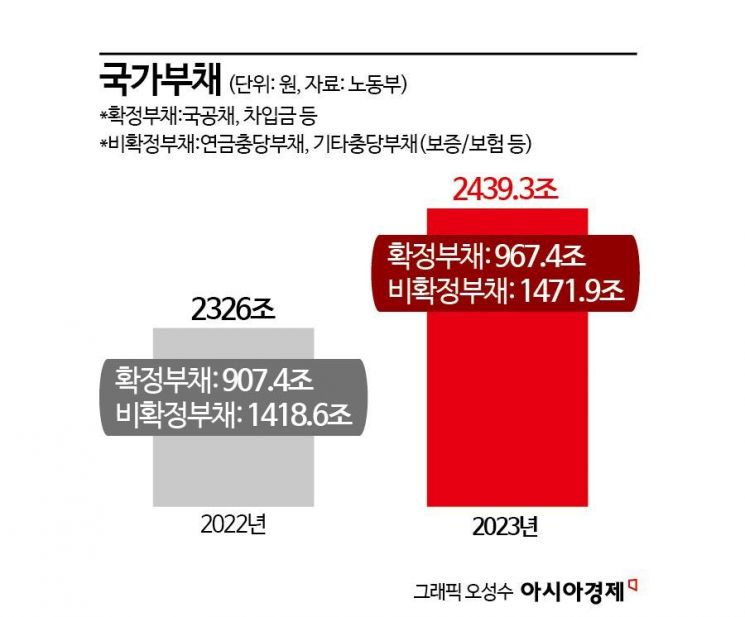

The national debt also reached a record high of 2,439.3 trillion won, increasing by 113.3 trillion won (4.9%) compared to a year ago. Confirmed debt such as government bonds and borrowings rose by 60 trillion won (6.6%) to 967.4 trillion won. This increase is due to the issuance of government bonds rising by 60 trillion won to cover the fiscal deficit amid expenditures (610.7 trillion won) exceeding total government revenue (573.9 trillion won), as well as an increase of 48.9 trillion won in pension liabilities such as the civil servant pension and the National Pension.

Non-confirmed debt, which includes pension liabilities such as the civil servant pension and the National Pension, rose by 53.3 trillion won (3.8%) to 1,471.9 trillion won. Pension liabilities represent the estimated amount of pensions to be paid over approximately the next 70 years, calculated at the current point in time. Since this excludes the pension contributions paid by civil servants and actual expenditures are covered by pension insurance premiums, it is difficult to consider the entire amount as debt the state must repay. The National Pension is not included in national debt because the state is not the employer.

The national debt-to-GDP ratio surpassed 50% for the first time in history, a first since the 1997 settlement. The provisional national debt, which has a strong confirmed debt nature, was 1,126.7 trillion won, an increase of 59.4 trillion won from last year (1,067.4 trillion won). Central government debt recorded 1,092.5 trillion won, up 59 trillion won from the previous year. Net debt of local governments increased by 300 billion won to 34.2 trillion won. A Ministry of Economy and Finance official explained, "National debt increased alongside the managed fiscal balance deficit."

National assets increased by 180.9 trillion won (6.4%) from last year to 3,014.5 trillion won. This was largely influenced by the high returns of the National Pension Fund. The National Pension Fund's investment return rate reached a record high of 13.6%, increasing assets by 138.3 trillion won. However, since the increase in the valuation of investment assets held by the fund was influenced by last year's high exchange rate environment, it is uncertain whether this trend will continue. Kim stated, "Assets and liabilities are calculated on an accrual basis, which led to an increase in net national assets. However, it is necessary to further verify whether this trend will continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)