Bio ETF Returns of 20-30% in the Past Month

American Association for Cancer Research Begins... Events Lined Up One After Another

Bio exchange-traded funds (ETFs) have recently shown excellent returns. Expectations are rising as major conferences are scheduled to begin with the American Association for Cancer Research (AACR) next month. The recent added optimism about interest rate cuts has also positively influenced the perception of growth stocks in the stock market.

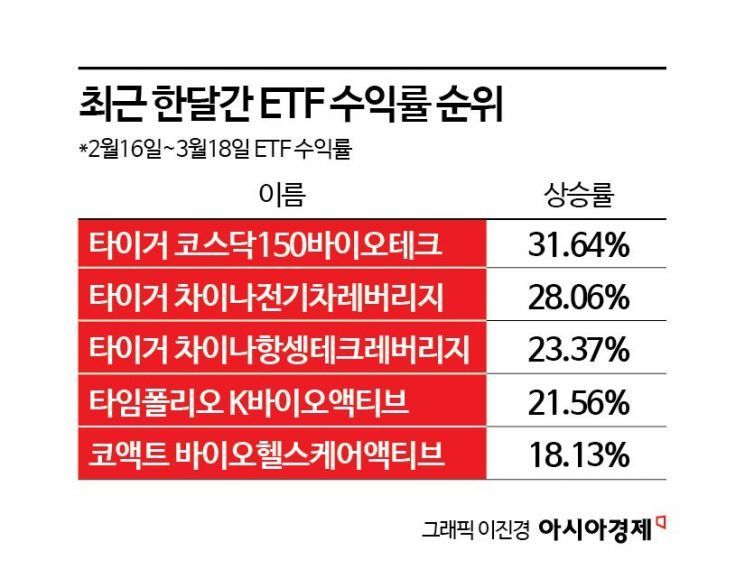

According to the Korea Exchange on the 20th, from the 16th of last month to the 18th of this month, the Tiger KOSDAQ150 Biotech ETF recorded a price increase of 31.64%, the highest among domestically listed ETFs (excluding index leverage ETFs).

The KOSDAQ150 Biotech ETF is based on assets such as HLB (weight 26.97%), Alteogen (18.89%), Celltrion Pharm (4.84%), LegoChem Bio (3.92%), and HLB Life Science (3.82%). Alongside this, the TIMEFOLIO K-Bio Active ETF posted a 21.56% return, and the KoAct Bio Healthcare Active ETF achieved an 18.13% return. Additionally, the TIGER China Electric Vehicle Leverage and China Hang Seng Tech Leverage ETFs recorded increases of 28.06% and 23.37%, respectively. Among the top five ETFs by growth rate, three are bio ETFs.

The rise in bio ETFs is interpreted as due to expectations for the upcoming major cancer conferences. The American Association for Cancer Research (AACR), held next month in San Diego, USA, is considered one of the world's top three cancer conferences alongside the American Society of Clinical Oncology (ASCO) and the European Society for Medical Oncology (ESMO). ASCO is held in June, and ESMO takes place between September and October, with significant events awaiting. Hye-min Kim, a researcher at KB Securities, explained, "Unlike ASCO, which mainly presents mid- or late-stage clinical results, AACR presents early research or preclinical stage content. The momentum strength may be somewhat weaker, but it offers the possibility of new fields and is an opportunity to actively communicate with multinational pharmaceutical companies for future partnering."

Moreover, ongoing expectations for interest rate cuts in the U.S. in the second half of the year are also cited as a factor driving bio stocks higher. Bio companies are heavily influenced by interest rates. Since they develop new drugs without significant sales, they raise funds externally. Issuing convertible bonds (CBs) is one of the main funding methods. It is advantageous to raise funds in a low-interest-rate environment. Recently, Jerome Powell, Chair of the U.S. Federal Reserve (Fed), hinted at confirming interest rate cuts within the year during a Senate hearing.

Hye-min Heo, a researcher at Kiwoom Securities, said, "Global external variables for pharmaceuticals and bio include interest rates and the U.S. presidential election, but interest rate cuts in the second half of the year will be favorable for the sector. If interest rates are lowered in the second half of this year, it could provide relief to biotech companies struggling with funding and positively reflect on stock market investment sentiment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)