'Banpo Site', Final Hurdle in PF Settlement... Agreement Reached on 'Gyeonggi Gwangju Site'

'Gyeonggi Gwangju Private Park' Site Changes Lead Manager to Dongwon Development... Construction Progress Payment Made

Last Site, 'Seoul Banpo Urban-Type Residential Housing' Faces Difficulties Due to Korea Technology Finance Corporation-Lenders Conflict

Taeyoung Construction's 'Corporate Improvement Plan' Resolution Pending Submission of 'Handling Measures'

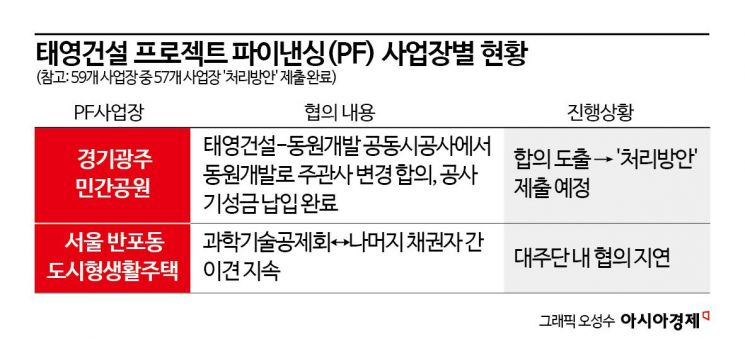

The procedure for submitting project financing (PF) handling plans for each site, the first step in improving Taeyoung Construction's structure, has entered its final stage. Except for the 'Seoul Banpo Urban-Type Residential Housing' construction site, handling plans for the 'Changwon Asset District Redevelopment' and 'Cheongju Sachang B Block Reconstruction' sites, which were delayed due to decision-making delays by the Housing and Urban Guarantee Corporation (HUG), have been received, and the 'Gyeonggi Gwangju Private Park' site has also reached an agreement on details such as the change of the construction company.

On the 18th, according to Taeyoung Construction's creditors and the main creditor bank, the Korea Development Bank, it is reported that an agreement has been reached on the handling plan for the Gyeonggi Gwangju Private Park special project site, after negotiations over detailed matters related to implementation and construction for project progress. The project was promoted by a consortium of Taeyoung Construction and Dongwon Development, but after Taeyoung Construction's workout (corporate financial restructuring), difficulties arose in negotiations due to issues such as joint guarantees. However, Taeyoung Construction recently reached an agreement to transfer the implementation and construction management status to Dongwon Development and continue the project, leaving only the procedure of submitting the handling plan to the Korea Development Bank.

A creditor group official explained, "Taeyoung Construction agreed to maintain its shares in implementation and construction but transfer the management status to Dongwon Development, which was the joint construction company," adding, "The payment for the construction progress has already been completed."

Accordingly, the PF site handling plan procedure now only remains for the Seoul Banpo Urban-Type Residential Housing, where the Korea Technology Credit Guarantee Fund is the senior creditor. This project supplies a total of 85 units, including 72 urban-type residential housing units and 25 officetel units, in Banpo-dong 59-3 and two other parcels in Seocho-gu, Seoul, with buildings ranging from four basement floors to 20 above-ground floors. The project is implemented by Banpo Central PFV, and Taeyoung Construction has been the construction company.

Banpo Central PFV has been conducting construction under a PF loan agreement with a limit of 238 billion KRW with the Korea Technology Credit Guarantee Fund and KB Securities. The Credit Fund signed PF loan agreements with VI Asset Management and Korea Investment Management through funds they invested in, with 152 billion KRW in senior loans and 35 billion KRW in mezzanine loans, while KB Securities provided mezzanine loans of 15 billion KRW and subordinated loans of 10 billion KRW through a special purpose company (SPC).

This project, aiming for completion in November 2025, has recorded a 23% progress rate but has faced difficulties in agreeing on handling plans due to conflicts among the major creditors after Taeyoung Construction's workout. In particular, the Korea Technology Credit Guarantee Fund, which accounts for over 80% of the total construction cost, claims it cannot provide additional construction funds, while the other creditors demand that if they provide additional funds, they must be repaid after the Credit Fund. According to workout regulations, the repayment priority of new funds injected after the workout commencement can be set as the highest priority.

A key creditor group official said, "The Korea Technology Credit Guarantee Fund opposes the repayment priority of new funds injected by other creditors being set as the highest priority while refusing to inject new funds itself," adding, "Negotiations have not progressed for several days." A KB Securities official said, "We are considering various options," but declined to comment further.

Although the main creditor bank, the Korea Development Bank, postponed the schedule for establishing a corporate improvement plan and creditor group resolution in April, it remains uncertain whether the Seoul Banpo project can submit a handling plan. The creditor group resolution procedure may be extended up to one month at the request of the audit accounting firm, which requires more time for due diligence due to delays in submitting handling plans for Taeyoung Construction's PF projects. An industry insider commented, "The creditor group agreed to the workout commencement, and thus the entire creditor group should share the burden together, but this is a regrettable situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)