Battery 3 Companies Unveil All-Solid-State Roadmap

46mm Diameter Cylindrical Battery Scheduled for Release

LFP Battery Also Ready for Launch

Visitors are exploring the InterBattery 2024 exhibition booths. Photo by Korea Battery Industry Association

Visitors are exploring the InterBattery 2024 exhibition booths. Photo by Korea Battery Industry Association

The long-awaited realization of the so-called "dream battery," the all-solid-state battery, seems to be approaching. Next-generation batteries such as lithium metal and lithium sulfur have also been slowly but steadily progressing. The 46mm diameter cylindrical battery ignited by Tesla is being prepared by almost all battery cell companies and many component and material companies.

This was the trend observed at InterBattery 2024/EV Trend Korea 2024 held at COEX, Seoul, from the 6th to the 8th.

First, although there were differences in speed, all-solid-state batteries are becoming increasingly concrete. On the 7th, Go Ju-young, Vice President and Head of the Medium and Large Product Planning Team at Samsung SDI, revealed a detailed roadmap for all-solid-state batteries during the keynote speech at the side event, The Battery Conference 2024. Vice President Go said, "At the end of last year, we supplied the first prototype samples to three OEMs (automobile manufacturers) and are currently conducting evaluation work," adding, "We plan to start supplying A-samples this year and aim for mass production by 2027."

All-solid-state is no longer a dream

Typically, when a battery cell company produces samples, they supply A-samples → B-samples → C-samples sequentially to automobile manufacturers to test performance and safety. This process takes 3 to 4 years. Samsung SDI completed a pilot plant last year to produce samples. Once the sample tests are passed, full-scale mass production preparations begin.

The samples Samsung SDI sent to manufacturers are small cells with a capacity of 20 ampere-hours (Ah). To be installed in vehicles, the capacity must be increased to 90Ah. The mass production line will also be completed accordingly. For mass production, a solid supply chain including materials and equipment is also a challenge to be addressed.

Samsung SDI is preparing an anode-free solid electrolyte. "Anode-free" does not mean there is no anode at all. It means the anode active material is removed to reduce volume. Instead, a silver carbon layer that can accept lithium ions migrating from the cathode is applied to the anode. Through this, Samsung SDI announced it achieved an energy density of 450Wh/kg.

Vice President Go Ju-young stated that the cathode of the all-solid-state battery can use not only high-nickel but also lithium iron phosphate (LFP).

LG Energy Solution also announced plans to launch all-solid-state batteries, but the timeline is later than Samsung SDI’s, targeting 2030. Kim Je-young, Executive Vice President and Chief Technology Officer (CTO) of LG Energy Solution, said in the keynote speech at The Battery Conference, "Regarding all-solid-state, our mass production timing may be later than competitors because we want to conduct proper research and development (R&D)." LG Energy Solution President Kim Dong-myung also emphasized to reporters that "even if it takes time, we want to release something done properly" regarding all-solid-state batteries.

LG Energy Solution is also conducting research applying various materials such as lithium metal, anode-free, and pure silicon to the anode.

SK On exhibited sulfide-based solid batteries developed in collaboration with the U.S. venture company Solid Power. SK On announced plans to establish a solid battery pilot line by 2025 and produce up to 30,000 electric vehicle cells with a capacity of 60Ah or more. They also plan to commercialize all-solid-state batteries by 2029.

Everyone is rushing to 46mm cylindrical... Dry electrodes remain a challenge

All three major battery companies announced plans to launch cylindrical batteries with a diameter of 46mm. Kim Je-young, Executive Vice President of LG Energy Solution, emphasized, "The 4680 battery (46mm diameter, 80mm height) that will soon be mass-produced has many advantages," adding, "It is price competitive and advantageous for high-end cells." LG Energy Solution plans to mass-produce the 4680 battery in August and supply it to Tesla.

Kim Jeyeong, Executive Vice President (CTO) of LG Energy Solution, is delivering the keynote speech at The Battery Conference, a side event of InterBattery 2024. Photo by Korea Battery Industry Association

Kim Jeyeong, Executive Vice President (CTO) of LG Energy Solution, is delivering the keynote speech at The Battery Conference, a side event of InterBattery 2024. Photo by Korea Battery Industry Association

LG Energy Solution especially plans to apply dry electrode processes to the 4680 battery. Currently, cathodes and anodes are produced by a wet process, mixing active materials, conductive agents, and binders with solvents to make slurry, then coating and drying on the current collector. The dry electrode process omits the slurry-making step with solvents. There are methods to coat powder-form active material mixtures directly onto the current collector or make a film and attach it to the current collector.

Applying dry electrodes can save electricity needed for drying and optimize space, significantly reducing costs. It is environmentally friendly because it does not use organic solvents required for slurry production. Using dry electrodes also allows thicker active material layers, increasing energy density. However, the manufacturing process is complicated, and Tesla is currently known to apply the dry method only to the anode.

LG Energy Solution is understood to have almost completed development of dry electrodes for the cathode. Kim Je-young said in his keynote speech that "pilot development is almost finished and is quasi-mass production level" regarding electrode processes.

After Tesla announced plans to launch the 4680 battery, automobile manufacturers in North America and Europe have also shown interest in the 46mm cylindrical battery. GM, BMW, Volvo, and Stellantis have announced or are considering launch plans.

However, the height is expected to vary depending on each automaker’s specifications. Samsung SDI exhibited two types of 46mm cylindrical batteries at the exhibition. A company official explained, "Besides these two, we are preparing various sizes of 46mm cylindrical batteries." Samsung SDI reportedly has four lineups: 4680, 4695, 46110, and 46120, and is in discussions with customers such as GM and BMW.

Samsung SDI plans to complete preparations for mass production of 46mm cylindrical batteries by the end of this year. Samsung SDI CEO Choi Yoon-ho told reporters at InterBattery 2024, "46mm diameter batteries can be mass-produced by early next year," adding, "The exact timing will be adjusted according to customers."

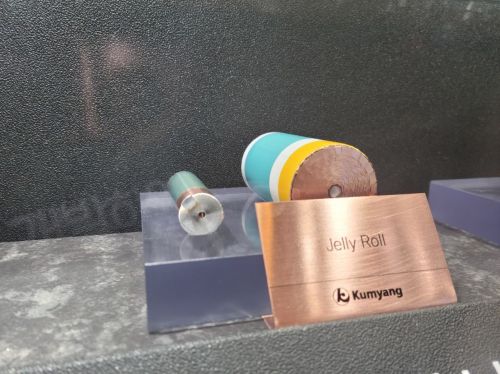

SK On is also preparing 46mm cylindrical batteries, but specific specifications or technology levels have not been disclosed. At this event, Kumyang also attracted attention by showcasing the 4695 cylindrical battery. A Kumyang official explained, "The 4695 battery applies a wet process, and since we have the value chain from mineral extraction to materials and cathode active materials, we have price competitiveness compared to competitors."

Companies related to 46mm cylindrical batteries also drew attention. Phil Energy, which supplies stacking equipment to Samsung SDI, developed a winding machine (equipment that rolls in a round shape) capable of producing 46mm cylindrical batteries and attracted attention during the exhibition. Dongwon Systems exhibited aluminum cans capable of producing 46mm cylindrical batteries.

K-Battery launches LFP, but what about the price?

Interest in lithium iron phosphate (LFP) batteries was also high at this exhibition and conference. As electric vehicle companies expand LFP battery adoption to survive fierce price competition, domestic battery companies are also preparing in earnest.

Jeong Won-seok, an analyst at Hi Investment & Securities, said, "To improve profitability for automakers and offer electric vehicles at consumer-desired reasonable prices, the price competitiveness of LFP batteries is highlighted," adding, "LFP battery adoption is expected to expand further around 2025-2026, when major automakers launch second-generation electric vehicle platforms."

LG Energy Solution introduced energy storage systems (ESS) using LFP at its exhibition booth. The plan is to first target the ESS market with LFP batteries and then expand to vehicle applications.

At the center of the exhibition booth was a pouch-type Cell To Pack (CTP). CTP is a design method that installs cells directly into vehicles without modules. Originally, the Chinese battery company CATL devised this to compensate for the low energy density of prismatic LFP batteries. BYD also applies LFP batteries to vehicles using the prismatic CTP method.

A mock-up car equipped with a pouch-type Cell-to-Pack (CTP) unveiled by LG Energy Solution at InterBattery 2024. Photo by Kang Hee-jong

A mock-up car equipped with a pouch-type Cell-to-Pack (CTP) unveiled by LG Energy Solution at InterBattery 2024. Photo by Kang Hee-jong

LG Energy Solution is expected to emphasize that pouch-type LFP batteries can achieve higher energy density than prismatic CTP when provided in the CTP method. Typically, pouch cells show higher energy density than prismatic cells. LG Energy Solution explained that it applied heat transfer delay materials to pouch-type CTP to reduce fire risk.

SK On unveiled the 'WinterPro LFP' battery at the exhibition, which improves low-temperature performance and energy density. Generally, LFP batteries see driving range drop sharply to 50-70% at low temperatures (-20°C). SK On explained that it increased energy density by 19% while improving charging and discharging capacity at low temperatures by 16% and 10%, respectively, compared to conventional LFP.

Samsung SDI, which had been passive about LFP, also appears to be actively entering the LFP market. Samsung SDI CEO Choi Yoon-ho told reporters, "We aim to unveil LFP batteries in 2026." Samsung SDI did not showcase LFP at its booth, but displayed a mock-up car equipped with prismatic CTP at the front of the booth, seemingly targeting LFP batteries.

Ko Ju-young, Vice President of Samsung SDI (Head of the Medium and Large Product Planning Team), is delivering the keynote speech at InterBattery 2024 The Battery Conference. Photo by Korea Battery Industry Association

Ko Ju-young, Vice President of Samsung SDI (Head of the Medium and Large Product Planning Team), is delivering the keynote speech at InterBattery 2024 The Battery Conference. Photo by Korea Battery Industry Association

Vice President Go Ju-young also said in his keynote speech, "Although we were late in developing LFP compared to Chinese companies, we are technically ready, and only the mass production method remains. There is no problem with mass production."

As LFP battery adoption is expected to expand, a related ecosystem is forming domestically. Cathode material companies such as Ecopro, L&F, and LS also exhibited cathode materials for LFP. However, whether domestically produced LFP will be adopted depends on price competitiveness against Chinese products.

L&F is exhibiting various cathode materials such as all-solid-state, LFP, and sodium-ion at InterBattery 2024. Photo by Kang Hee-jong

L&F is exhibiting various cathode materials such as all-solid-state, LFP, and sodium-ion at InterBattery 2024. Photo by Kang Hee-jong

Sungil Hightech announced plans to establish a pilot plant for LFP recycling and mass-produce on a large scale by 2026. In LFP recycling, only lithium is extracted, so it is less economical compared to NCM recycling, which extracts expensive nickel and cobalt together, posing a challenge to be solved.

"Consumers are thirsty for fast charging"

At this year’s event, battery cell companies uniformly emphasized fast charging technologies. As the demand for driving range has been somewhat met, fast charging has become the biggest barrier consumers face when choosing between internal combustion engine vehicles and electric vehicles.

Samsung SDI Vice President Go Ju-young said, "According to consulting results from external organizations we internally refer to, the biggest concerns customers have about electric vehicles were driving range and charging infrastructure in 2022, cost in 2023, and fast charging in 2024," adding, "While demand for driving range has been somewhat fulfilled, as electric vehicle adoption widens, consumers feel the need for fast charging."

Battery cell companies analyze that if 300km can be driven with a 5-minute charge, electric vehicles can compete with internal combustion engine vehicles. Samsung SDI’s announcement to mass-produce a battery capable of 600km on a 9-minute charge by 2026 is based on this analysis.

However, issues such as reduced charge-discharge efficiency during fast charging and insufficient fast charging infrastructure were presented as challenges to be addressed. Kim Je-young, Executive Vice President of LG Energy Solution, said, "The most important trend in next-generation electric vehicle batteries is fast charging," adding, "It is important whether charging speed can be increased without lowering energy density." LG Energy Solution plans to focus on the market where 500-600km driving range is possible with 20-30 minutes of charging.

SK On showcased the Advanced SF battery capable of fast charging in 18 minutes at this event. This battery increases energy density by 9% compared to the existing SF battery while maintaining fast charging time. SK On Vice President Lee Jon-ha said, "With the currently available 350-kilowatt (kW) fast charger, 15-minute fast charging is possible," adding, "To reduce fast charging time to 10 minutes, at least a 450kW fast charger is needed."

Small and medium ventures also showcase all-solid-state and lithium metal

At this year’s InterBattery, small and medium venture companies and startups also attracted attention by showcasing innovative products. UBATT introduced the 'STRATOS series,' a lithium metal battery targeting the air mobility market. The new product STRATOS600 can achieve a capacity of 7.4 ampere-hours (Ah) and an energy density of 600Wh/kg.

TDL showcased oxide-based all-solid-state electrolytes. The company proposed a technology to manufacture all-solid-state batteries by producing solid electrolytes as sheets with thicknesses of 30-90 micrometers (μm) and using roll-to-roll rolling processes. A company official said, "We are primarily targeting the ESS market, where fire safety is emphasized."

Energy11 unveiled various types of sodium-ion batteries. An Energy11 official said, "We aim to achieve an energy density of 160Wh/kg by the end of the year," adding, "We are discussing with various domestic and international customers to supply for ESS."

Meanwhile, InterBattery 2024 was held on the largest scale ever, with 579 battery companies from 18 countries and 1,896 booths participating. The organizer, Korea Battery Industry Association, tentatively estimated about 120,000 visitors. This is about 20,000 more than the 107,486 visitors at InterBattery 2023 held last year.

There was also high interest from overseas. Battery industry dignitaries such as Gretchen Whitmer, Governor of Michigan, USA; Philip Goldberg, U.S. Ambassador to Korea; Jeff Robinson, Australian Ambassador to Korea; and Pieter van der Fleet, Dutch Ambassador to Korea, visited the exhibition hall.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)