One Year After Financial Services Commission Guideline Distribution

Industry Builds Infrastructure Ahead of STO Market

Attention on Bill Passage During April Post-Election Interim National Assembly

Last year, securities firms that invested billions of won to build infrastructure in line with the government's national agenda to open the token securities issuance (STO) market are now facing deep concerns. This is because the fundamental laws underpinning the token securities market remain pending in the National Assembly, with the timing of their passage uncertain. In particular, there are worries that if the bills are not processed during the extraordinary session after the general election in April this year, they could be stalled for a long time. Securities firms are sighing, saying, "We have already paid billions of won, calling it a future growth engine, but there is great anxiety that the bills might not be passed even during the extraordinary session after the April general election."

According to the financial investment industry on the 23rd, major securities firms such as Mirae Asset, Hana, and Eugene Investment & Securities are building dedicated platforms for issuing and distributing token securities, targeting the second to third quarters of this year. Korea Investment & Securities completed platform construction last year and is preparing for service launch. Koscom, which has signed contracts to provide token securities platforms with Kiwoom, Daishin, and IBK Investment & Securities, is also working on construction with a goal of the first quarter this year. Inquiries from securities firms wishing to use Koscom continue.

Token securities digitalize securities under the Capital Markets Act using distributed ledger technology. They are distinguished from 'virtual assets,' which are digital assets not classified as securities. While similar to electronic securities, token securities are characterized by the use of decentralized blockchain technology. Utilizing this, all products including artworks, real estate, and music copyrights can be securitized and traded like stocks. It is anticipated that the over-the-counter (OTC) market, led by entities such as the Korea Exchange, will become the main trading market rather than on-exchange trading. This is why securities firms have actively invested in infrastructure construction, which requires enormous costs. It is estimated that investments range from as little as 1 billion won to over 6 billion won. When the Financial Services Commission announced the 'Plan to Organize the Regulatory System for Token Securities Issuance and Distribution' in February last year, the securities industry also spotlighted it as a future growth engine. This was because securities firms could participate in the fractional investment market, which had been centered on individual platforms, in the form of 'token securities.'

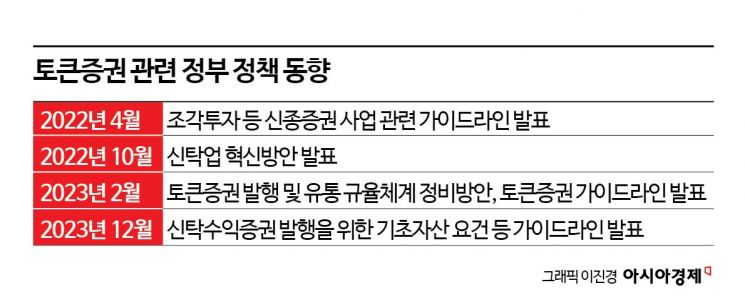

However, policy risks emerged around the end of last year. Discussions on related basic laws were halted in the National Assembly's Political Affairs Committee due to the April general election issue. The 'Electronic Securities Act Amendment' and 'Capital Markets Act Amendment' for implementing the 'Plan to Organize the Regulatory System for Token Securities Issuance and Distribution' announced by the Financial Services Commission in February last year are currently pending in the National Assembly. The Electronic Securities Act Amendment introduces definitions and regulatory grounds for distributed ledger technology, a core technology used in STOs, and establishes a registration system for issuer account management institutions to allow token securities issuers to directly conduct STOs. The Capital Markets Act Amendment includes provisions for regulatory grounds on the distribution of investment contract securities and licensing of OTC trading intermediaries for token securities transactions. The Capital Markets Act Amendment was proposed in July last year and was last discussed in the December bill review subcommittee, but no further progress has been made. Some securities firms have also requested a regulatory sandbox from the Financial Services Commission to start services before the law is passed.

In fact, conservative movements are observed throughout the securities industry. Samsung Securities operates a virtual asset task force (TF) under its digital marketing division in the digital sector but is only monitoring industry trends related to virtual assets, including token securities. Initially, Samsung was known to have secured technology linking the company’s blockchain wallet with securities accounts. A financial investment industry official said, "Samsung can afford to be patient," adding, "With Samsung SDS, an IT affiliate, the group can mobilize its capabilities to easily build infrastructure anytime and enter the market later."

KB Securities, which pioneered the token securities market in the industry, also shows a lukewarm stance. KB Securities signed a memorandum of understanding on the overall formation of a 'Token Securities Consortium of Securities Firms' with Shinhan Investment Corp and NH Investment & Securities at the end of last year, but it has been confirmed that infrastructure construction has not yet started. A Shinhan Investment Corp official said, "The consultative body is ongoing, but we plan to respond after monitoring legal and institutional improvements." SK Securities, which became the second-largest shareholder of Blockchain Global last year, also formed a consultative body related to the token securities business with Woori Bank and Samsung Securities, but infrastructure construction has not yet materialized.

The securities industry is expressing anxiety. A financial investment industry official said, "The Financial Services Commission only issued issuance guidelines at the end of last year and did not provide distribution-related guidelines, which is frustrating," adding, "Since a lot of costs have been invested in platform construction, we are just hoping that the bills will be properly discussed in the extraordinary session of the National Assembly after the April general election this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)