Over 5 Years, an Average of About 3,100 Cases Annually

Increasingly Sophisticated Crimes, Declining Arrest Rates

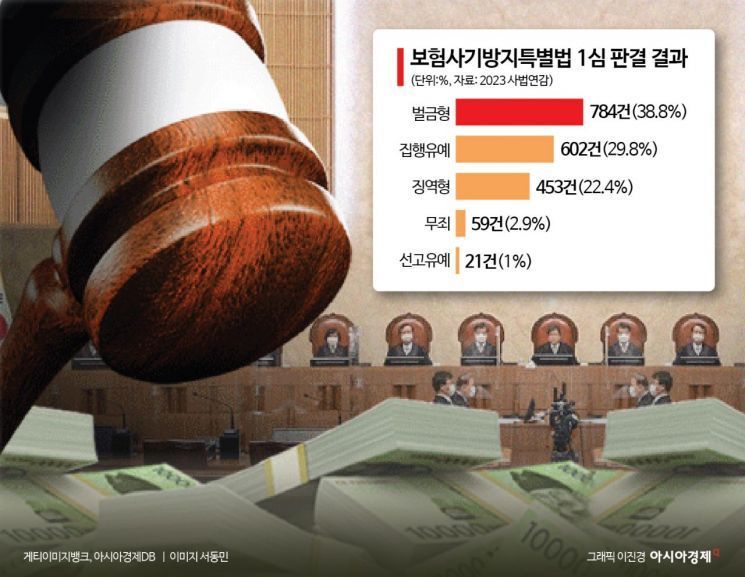

70% Receive Fines or Suspended Sentences in First Trial

Over the past five years, more than 3,100 insurance fraud crimes have occurred annually on average, but most resulted in suspended sentences or fines. Since insurance fraud causes social costs such as financial burdens on insurance companies and increased premiums for honest policyholders, there are calls for stricter penalties.

According to crime statistics from the National Police Agency on the 5th, the number of violations and arrest rates under the Special Act on Insurance Fraud Prevention were 2,559 cases with a 97.7% arrest rate in 2018, 3,163 cases with 97.4% in 2019, 3,465 cases with 96.1% in 2020, 3,638 cases with 92.7% in 2021, and 2,959 cases with 89.8% in 2022. As insurance fraud becomes increasingly sophisticated and cunning, the arrest rate is gradually declining.

Under current law, a person who obtains insurance money through insurance fraud or causes another person to obtain insurance money can be sentenced to up to 10 years in prison or fined up to 50 million won.

However, about 70% of insurance fraud punishments were fines or suspended sentences. According to the first-instance results in the Judicial Yearbook, there were 2,017 insurance fraud crime rulings in 2022. Among them, fines accounted for 784 cases (38.8%), suspended sentences 602 cases (29.8%), imprisonment 453 cases (22.4%), acquittals 59 cases (2.9%), and deferred sentences 21 cases (1%). This clearly shows why there is criticism that punishments are too lenient.

On the 11th of last month, Judge Kim Yeyeong of the Criminal Division 9 at Seoul Eastern District Court sentenced A (31) to a fine of 1.5 million won for violating the Special Act on Insurance Fraud Prevention. A falsely claimed that on July 27, 2021, on a road in Seogwipo City, Jeju, a motorcycle moving to his left hit his arm on the side mirror, causing injury, and received insurance money of 516,540 won.

On August 10, A deliberately collided his torso with a passenger car at a crosswalk in Seogwipo City, Jeju, and fell backward, receiving insurance money of 935,620 won. On the 14th of the same month, in a parking lot in Seogwipo City, Jeju, he pretended to be injured by pressing his upper body against a side mirror and received insurance money of 940,990 won.

Previously, A had been sentenced to 1 year and 6 months in prison with a 3-year suspended sentence at the Seoul Northern District Court last year for fraud and other charges. A claimed to have been treated for schizophrenia since 2021, and the court explained that it considered this when determining the sentence.

In October last year, the Gangnam Police Station in Seoul arrested B (30), a motorcycle rider, on suspicion of deliberately causing accidents by targeting vehicles driving in the wrong direction and embezzling insurance money. B is accused of causing 17 intentional traffic accidents in Nonhyeon-dong, Gangnam-gu, Seoul, from February to July last year, and obtaining about 70 million won in insurance money using forged medical certificates (violations of the Special Act on Insurance Fraud Prevention, fraud, and forgery/use of private documents).

The police began investigating at the request of the insurance company and confirmed through CCTV analysis that B repeatedly committed the crimes. A police official advised, “If you are involved in a traffic accident suspected of insurance fraud, you should promptly keep the black box memory chip containing the recorded accident and report it to the nearest police station.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)