After Prosecutor's Investigation Notification, Conditions for Imposing Fines Added

Unjust Gains Calculation Specified... Expecting 'Mongdungi' Punishment

Voluntary Reporting Leads to Reduced Penalties and Fines

From the 19th, if unfair trading such as stock price manipulation is detected in the capital market, a surcharge of up to twice the amount of the unjust gains will be imposed. However, this will be done after notifying the results of the prosecution investigation. Since the 'method of calculating unjust gains,' which serves as the sentencing standard, is specified in the law, it is expected that light punishments like in the past will be difficult when prosecuted for stock price manipulation.

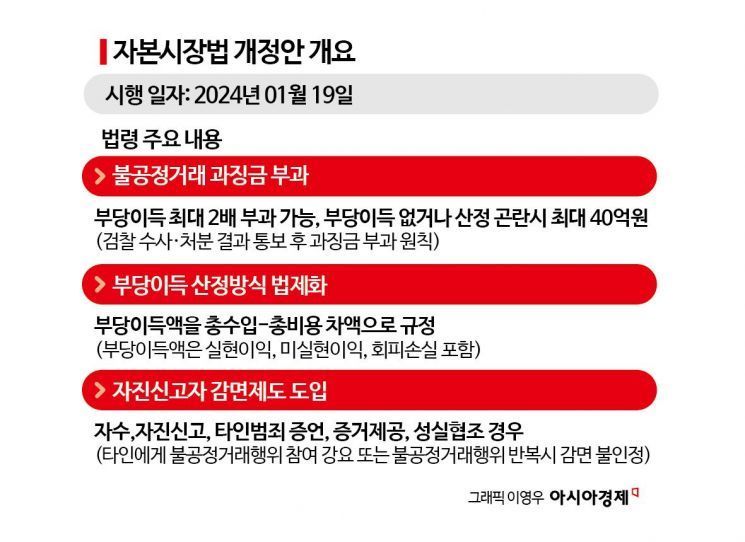

The Financial Services Commission announced that the amendment to the "Capital Markets and Financial Investment Services Act" (Capital Markets Act) will be enforced on this day. The main contents of the amendment are △ introduction of surcharges for unfair trading △ legalization of the method for calculating unjust gains △ introduction of a reduction system for voluntary reporters.

Imposition of surcharges for unfair trading... up to twice the unjust gains

First, surcharges will be imposed on the three major unfair trading practices, including stock price manipulation. Previously, only criminal penalties were possible for the three major unfair trading practices, but the introduction of administrative sanctions is significant. This is expected to enable swift and effective sanctions.

A surcharge of up to twice the amount of unjust gains obtained by the unfair trading actor can be imposed. If there are no unjust gains or if calculation is difficult, a surcharge of up to 4 billion KRW must be paid.

However, unlike the existing surcharge system, the Financial Services Commission cannot decide independently. The Financial Services Commission can impose surcharges only after receiving notification of investigation and disposition results from the prosecution. If the Financial Services Commission and the prosecution have consulted or if one year has passed since the notification of unfair trading allegations, the Financial Services Commission can impose surcharges.

However, even if one year has passed since notification from the prosecution, if there is a reasonable cause for delay in investigation or disposition such as suspension of prosecution, surcharges cannot be imposed. Also, surcharges cannot be imposed if imposing them first may conflict with the prosecution's final investigation (disposition).

Specification of unjust gains calculation in law... Will 'strict' punishment be established?

The core content of the amendment is to specify the standard for calculating unjust gains in the law. Unjust gains refer to the profit obtained from the violation (or the loss avoided as a result). It serves as the basis for surcharges and criminal penalties.

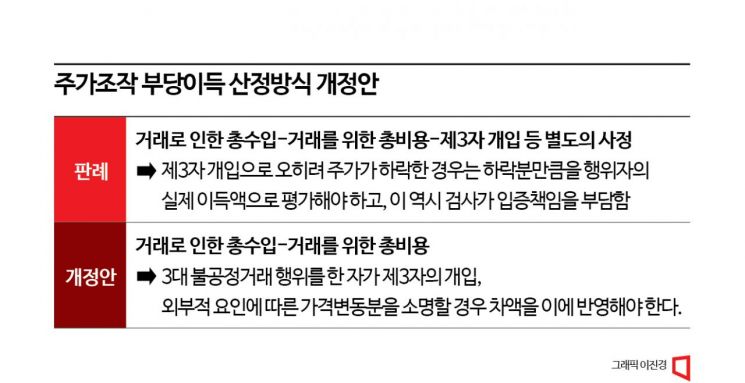

Until now, the method for calculating unjust gains was not regulated, leading to frequent disputes between the prosecution and stock price manipulation offenders in court. This is because the amount of unjust gains, which serves as the sentencing standard, could not be clearly calculated. As a result, even when guilt was confirmed, the level of punishment was low.

According to the Financial Services Commission, the average unjust gains per unfair trading case in history reached 4.6 billion KRW. However, the non-prosecution rate was 55.8%. Among the prosecuted cases, 40.6% were released on probation.

The amendment clearly defines unjust gains as the difference between total revenue and total costs obtained from the violation (total revenue - total costs). The Financial Services Commission stated, "from now on, it is expected that the calculation of unjust gains will be possible, and punishments corresponding to the actual economic benefits obtained by criminals can be imposed."

Reduction for voluntary surrender... No reduction if coercing others into stock price manipulation

If an unfair trading actor voluntarily reports or surrenders stock price manipulation, penalties and surcharges can be reduced. Reduction is also granted when testifying or providing statements about another person's crime.

Specifically, if the unfair trading actor provides new evidence or sincerely cooperates with the investigation, surcharges can be reduced by 50-100%. New evidence can include written agreements such as conspiracies among participants in unfair trading, communication records, financial transaction details, or new materials proving the establishment or execution of unfair trading.

Additionally, surcharges can be reduced even if other unfair trading acts besides the relevant one are voluntarily reported. Voluntary reporters can submit a reduction application form, and if written application is difficult, oral applications are also possible. However, applications via telephone are not accepted.

However, if a person coerces others to participate in unfair trading or repeatedly commits unfair trading over a certain period, reductions will not be granted. This is to prevent abuse of the voluntary reporter reduction system.

The Financial Services Commission stated, "Unfair trading in the capital market is a serious crime that damages market order and causes harm to many investors. Related institutions including the Financial Services Commission will continue to strictly sanction unfair trading under the principle of zero tolerance to create a fair capital market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)