Financial Services Commission 2024 Work Report

President Yoon Revisits Exchange After 2 Weeks Emphasizing 'Win-Win Finance'

Promises ISA Expansion and Commercial Act Revision, "Boldly Reform Regulations"

Mentions Capital Market Interest Cartel... "Must Prevent Unfair Rent-Seeking"

Points Out Lack of Competition in Financial Sector, "Reduce Citizens' Interest Burden"

Abolition of Financial Investment Tax... Continues to Promote Transaction Tax Reduction

President Yoon Suk-yeol is speaking about this year's financial policy directions at the "Public Livelihood Discussion" held on the 17th at the Korea Exchange in Yeouido, Seoul. (Photo by KTV YouTube)

President Yoon Suk-yeol is speaking about this year's financial policy directions at the "Public Livelihood Discussion" held on the 17th at the Korea Exchange in Yeouido, Seoul. (Photo by KTV YouTube)

The government is taking steps to revitalize the domestic stock market and support asset formation by abolishing the Financial Investment Income Tax (FIIT), allowing individuals subject to comprehensive financial income taxation to open Individual Savings Accounts (ISA), and expanding related benefits. The plan aims to reduce the tax burden on high-net-worth individuals in the capital market to encourage domestic stock investment and support the asset-building role of individual investors.

On the morning of the 17th, President Yoon Suk-yeol presided over the "Fourth Public Livelihood Discussion" at the Korea Exchange in Yeouido, Seoul, and announced, "We will significantly expand the eligibility and tax-exempt limits of ISA." The intention is to diversify the domestic investment market, which is heavily concentrated in real estate, into stocks and bonds, and to attract investment funds from high-net-worth individuals. In particular, President Yoon pointed out the financial market interest cartel and revealed plans to amend the Commercial Act.

Just two weeks after attending the stock market opening ceremony on the 2nd, President Yoon returned to the Korea Exchange and emphasized, "To leap forward in the capital market, we will boldly reform regulations that do not meet global standards and correct tax systems that contradict economic logic." This is to transform the stock market into a "win-win platform" where the public and companies grow together and a "ladder of opportunity" supporting the accumulation of citizens' assets.

To this end, he stressed, "We must break up the financial cartel through competition and prevent unfair rent-seeking." President Yoon added, "We will push for amendments to the Commercial Act, including institutionalizing online electronic shareholder meetings so that small shareholders can raise their voices."

Capital Market Revitalization Focused on 'Win-Win'

He also unveiled plans to more than double the ISA contribution and tax-exempt limits and expand the eligibility criteria. Earlier this year, when visiting the Korea Exchange, President Yoon had already proposed nurturing ISA as a measure to "significantly expand the national asset formation support program."

Sharp remarks were also directed at the financial sector, which recorded record profits. President Yoon pointed out, "A major cause of excess profits in the financial sector is the lack of competition within monopolistic fences," and announced, "To reduce the public's interest burden, we will expand the 'non-face-to-face loan switching platform,' which has been promoted since my inauguration, from credit loans and mortgage loans to include jeonse (key money) loans."

He introduced support measures to alleviate the financial burden on ordinary citizens. Highlighting the "2 trillion won + α win-win package" voluntarily prepared by banks and the "3 trillion won interest reduction plan by the secondary financial sector," he added, "We will delete delinquency history information to support the recovery of those who have faithfully repaid their debts and to reduce disparities."

The president's commitment to capital market revitalization focused on 'win-win' has continued since the beginning of the year. Two weeks ago, he became the first sitting president to attend the stock market opening ceremony and promised to push for the abolition of the FIIT, which was scheduled to be introduced next year. The presidential office explained that this is a choice for long-term coexistence among the public, investors, and the stock market, beyond the controversy over tax cuts for the wealthy. The FIIT imposes a 20% tax (25% on income exceeding 300 million won) on investors who earn financial investment income exceeding a certain amount from stocks, bonds, funds, derivatives, etc., and this measure considers opposition from the financial investment industry and individual investors.

In line with this, Financial Services Commission Chairman Kim Joo-hyun announced policy measures to "expand win-win finance and ladders of opportunity." The plan aims to help citizens build assets through capital market advancement, alleviate the burden of high interest rates through livelihood finance, and support the recovery of vulnerable groups through win-win finance.

Opinions from various financial consumers, including individual investors, finfluencers (a portmanteau of 'Finance' and 'Influencer,' referring to people providing financial information via social networking services), small business owners, mortgage loan borrowers, and young users of livelihood finance, were also shared. Capital market investors voiced difficulties such as tax burdens, illegal short selling damage, and the Korea discount during investment. The government presented measures to enhance fairness in the capital market and protect investors' rights.

Additionally, attendees shared experiences of using loan switching platforms, receiving interest reductions from financial institutions, and utilizing livelihood finance linked with employment support, while expressing concerns about the burden of high interest rates.

Tax Benefits for High-Net-Worth Individuals... Expectation of Fund Movement to the Stock Market

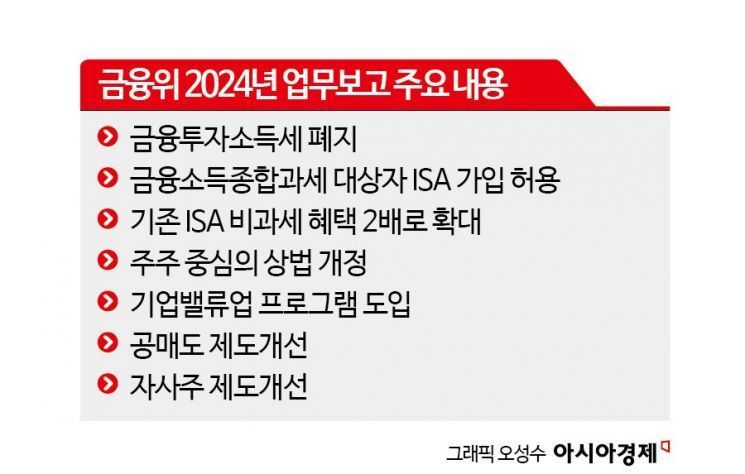

The 2024 work report presented by the Financial Services Commission to President Yoon and attendees summarized three main points: ▲supporting national asset formation through the capital market ▲alleviating high interest rate burdens through livelihood finance ▲supporting the recovery of vulnerable groups through win-win finance.

This year's work report notably focuses on capital market policies. While the Financial Services Commission's policy direction was previously bank-centered, this year it emphasizes revitalizing the capital market. The venue for the work report was also the Korea Exchange, reflecting the government's interest in capital market policies.

The key policies are the abolition of FIIT and allowing individuals subject to comprehensive financial income taxation to open ISAs. FIIT is a system that imposes a 20% tax (25% on income exceeding 300 million won) on capital gains exceeding 50 million won from domestic stock trading (net gains and losses combined).

Originally, FIIT was scheduled to be implemented in 2025, but President Yoon announced its abolition at the stock market opening ceremony. Abolishing FIIT requires amending the Income Tax Act. The Ministry of Economy and Finance and the Financial Services Commission plan to prepare related bills by February at the latest.

Regarding criticism that the policy targets the general election scheduled for April, Jeong Jeong-hoon, head of the Taxation Office at the Ministry of Economy and Finance, said, "Regardless of the election results, we plan to submit the bill by February," adding, "We will explain the necessity when the Planning and Finance Committee convenes and hope it passes the standing committee."

The benefits of FIIT abolition are limited to about 150,000 people, approximately 1% of the total 14 million stock investors. During FIIT discussions, the Ministry of Economy and Finance emphasized the need for capital income taxation. Regarding the sudden change in stance to abolish FIIT, Jeong said, "The situation has changed since then," and added, "It is necessary to operate the taxation system appropriately."

Core Policy is ISA... Inducing High-Net-Worth Individuals to KOSPI and Providing Investment Opportunities

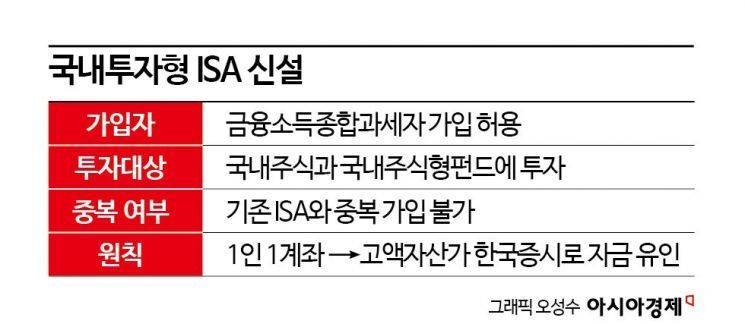

A notable policy is the introduction of the 'domestic investment-type ISA.' Unlike existing ISA accounts, this will allow individuals subject to comprehensive financial income taxation to open ISAs. This is a strategy to attract investment funds from high-net-worth individuals to the domestic stock market. Therefore, the domestic investment-type ISA will be designed to invest in domestic stocks and domestic stock-type funds.

ISA accounts were first designed by the Financial Services Commission in 2016. The Kishida Fumio Cabinet in Japan, promoting its flagship policy of "new capitalism," significantly expanded benefits of a similar product called 'NISA.' The policy goal is to guide financial assets, which are mainly deposits, into investment assets through ISA. It is evaluated that the expansion of NISA's tax exemption policy greatly contributed to the recent revival of the Japanese stock market.

The Financial Services Commission also expanded benefits for existing ISA accounts. This means inducing domestic investment from high-net-worth individuals while supporting asset formation for general investors. The ISA contribution limit will increase from 20 million won per year (total 100 million won) to 40 million won per year (total 200 million won). The tax-exempt limit will also expand from 2 million won (4 million won for the low-income and farming/fishing types) to 5 million won (10 million won for the low-income and farming/fishing types).

Especially, low-income earners and farmers/fishers can receive full tax exemption on interest and dividend income earned through ISA accounts. Assuming an interest and dividend yield of 4% when the 40 million won contribution limit is reached, an annual interest and dividend income of 1.6 million won is generated. Summing six interest and dividend incomes over three years results in a total of 9.6 million won, all of which is tax-exempt.

Kim So-young, Vice Chairman of the Financial Services Commission, said, "The most important purpose of abolishing FIIT and introducing domestic stock-type ISA is to help asset formation through revitalizing the capital market," adding, "We want many people to invest in the domestic stock market so that the capital market is revitalized and asset formation is supported."

'Fiduciary Duty of Directors' and 'Shareholders'... Ministry of Justice Reluctant on Commercial Act Amendment

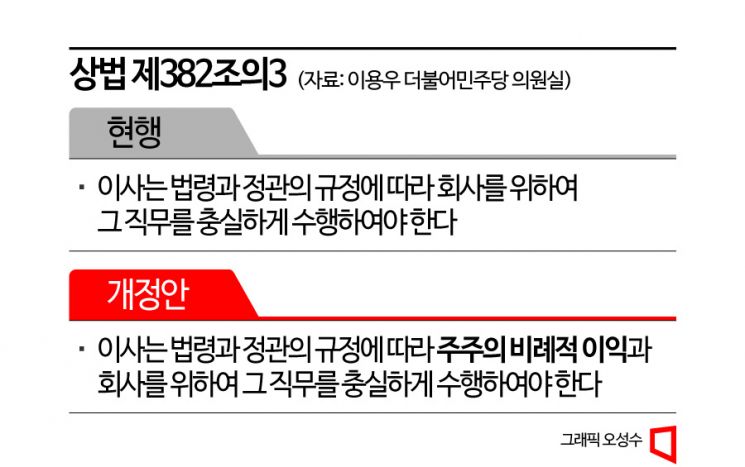

However, the amendment to the Commercial Act directly mentioned by President Yoon does not seem easy. The core of the amendment is changing the 'fiduciary duty of directors' clause. The fiduciary duty of directors refers to Article 382-3 of the Commercial Act, which states, "Directors shall faithfully perform their duties for the company in accordance with laws and the articles of incorporation."

The amendment to the Commercial Act became a notable issue early last year when activist funds, together with individual investors, rejected proposals favorable to major shareholders at shareholder meetings. Under current law, when conflicts of interest arise between shareholders and the company, the board of directors must follow the company's interests. Therefore, the amendment is seen as a contentious issue between the business community (corporate management) and small shareholders/financial investment industry (shareholder rights).

Earlier, Lee Yong-woo, a member of the Democratic Party of Korea, submitted a bill to amend the fiduciary duty clause to include "for the proportional interests of shareholders and the company." At that time, the Ministry of Justice conveyed to the National Assembly's Political Affairs Committee that "the interests of the company and the majority shareholders coincide," effectively opposing the amendment to the Commercial Act.

Meanwhile, President Yoon mentioned pushing for the amendment. However, the Ministry of Justice, which participated in the Financial Services Commission's pre-briefing on the work report, showed a cautious stance. Kim Bong-jin, head of the Commercial Law Division at the Ministry of Justice, said, "We agree with the direction to strengthen shareholders' interests," but added, "Simply revising the 'fiduciary duty of directors' clause will not solve shareholder protection issues." He continued, "Instead, there is a new provision in the Commercial Act, Article 397-2, 'Prohibition of Misappropriation of Corporate Opportunities by Directors.' If this is supplemented, directors can faithfully (fulfill their duty of care) in company management."

Improvements in Short Selling, Treasury Stock, Dividends... Introduction of 'Corporate Value-Up Program'

As in the previous year, improvements in short selling and treasury stock systems will also be pursued. Regarding short selling, the government intends to proceed smoothly with ongoing discussions such as building IT systems and resolving discrimination between lending and borrowing. Regarding the treasury stock system, the possibility of "mandatory cancellation" seems low. Vice Chairman Kim explained, "Nothing has been decided yet regarding mandatory cancellation of treasury stock," adding, "Discussions have included restricting the use of treasury stock in spin-offs and clarifying the use of treasury stock during listing reviews and disclosure processes."

Additionally, a "Corporate Value-Up Program" will be introduced. This requires companies to include plans to enhance corporate value in their corporate governance reports. In line with this, a new index and exchange-traded fund (ETF) composed of companies with high shareholder value will be created.

Furthermore, amendments to the Capital Market Act will be pursued to apply dividend procedure improvements to quarterly and semi-annual dividends. Previously, once dividend rights holders were confirmed, the dividend amount was decided, leading to criticism that investors had to invest without knowing the dividend amount. Going forward, the dividend amount will be decided first, followed by confirmation of dividend rights holders.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)