Prolonged High Interest Rates and Poor Performance

Eliminating 'Hyeja Card' and Introducing New Products

Companies Focus All Efforts on Strengthening Soundness

Credit card companies have begun restructuring their card offerings by reducing card benefits and increasing annual fees. This move is interpreted as an effort to strengthen asset soundness amid prolonged high interest rates, slowing consumption, and rising credit card delinquency rates, which have led to poor performance.

Hyundai Card ended the issuance, renewal, replacement, and additional issuance of its representative fuel discount credit card, 'Energy Plus Edition 2,' on the 3rd. This card was known among consumers as a so-called 'value card' because it offered a 15% billing discount, allowing up to 40,000 KRW off depending on the previous month's spending.

The next day, Hyundai Card introduced 'Energy Plus Edition 3.' Instead of a discount at the pump, this card accumulates up to 300 M Points per liter. M Points are Hyundai Card's reward points, with 1 M Point redeemable for 0.67 KRW in cash. While Edition 2 provided an immediate discount of 255 KRW per liter based on a fuel price of 1,700 KRW, Edition 3 accumulates 201 KRW worth of points. The annual fee also increased from 10,000 KRW to 30,000 KRW. On the 27th of last month, Hyundai Card also abruptly discontinued the 'Costco Reward Hyundai Card Edition 1' and introduced Edition 2 the following day, raising the previous month's spending requirement and doubling the annual fee. A Hyundai Card official explained, "We are phasing out old cards and introducing new products. Although the cash conversion rate of points has decreased somewhat, the 1:1 ratio remains when using points, and the usage of points has been expanded from only GS Caltex, a partner gas station, to other merchants."

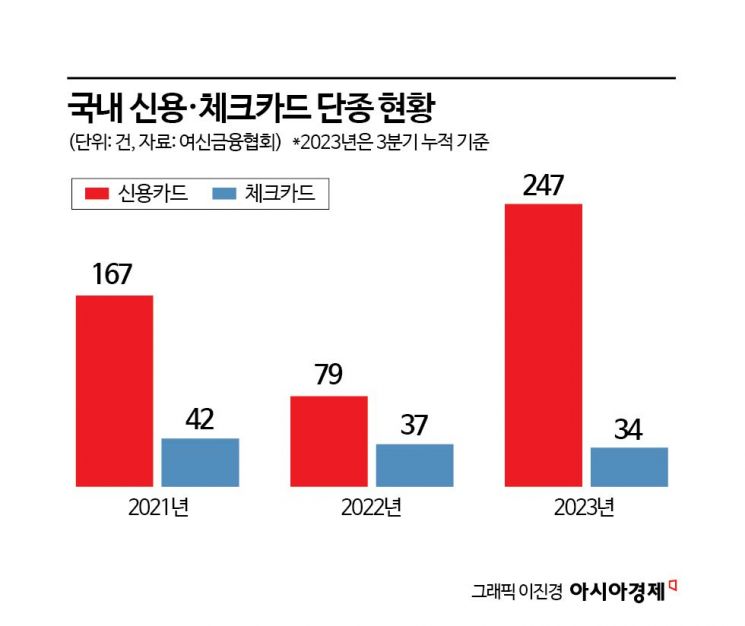

Hana Card also stopped issuing the '1Q Daily Plus Card' last month. This was a valuable card that provided 'Hana Money' worth 5,000 KRW for every 100,000 KRW spent on apartment management fees and automatic transfers of the four major insurance premiums. Additionally, Woori Card, Shinhan Card, and KB Kookmin Card discontinued popular discount cards last year, leaving consumers disappointed. According to statistics from the Korea Federation of Credit Finance, by the third quarter of last year, eight domestic card companies had discontinued issuance of 281 card types, including 247 credit cards and 34 check cards. This is more than double the 116 types discontinued throughout 2022.

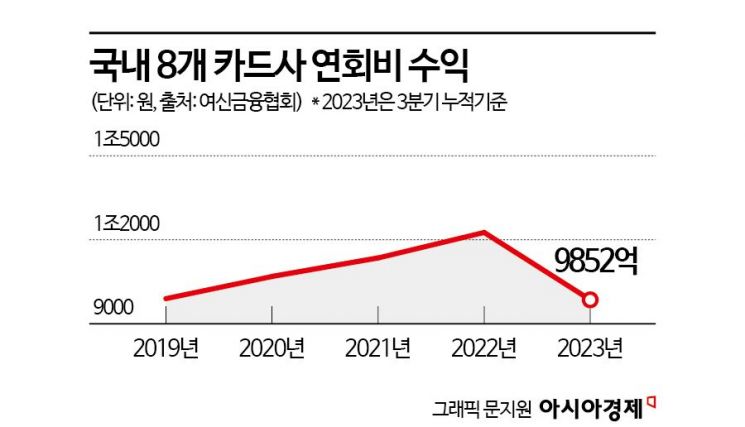

Card companies are subtly raising annual fees by discontinuing existing cards and introducing new ones. As a result, annual fee revenue has actually increased. Based on cumulative data up to the third quarter of last year, the eight card companies earned 985.2 billion KRW in annual fee revenue, a 7.52% increase compared to the same period the previous year. This is the highest figure since the statistics were first compiled in 2018. Annual fee revenue for card companies has steadily increased from 989.4 billion KRW in 2019 to 1.0685 trillion KRW in 2020, 1.1347 trillion KRW in 2021, and 1.2259 trillion KRW in 2022. With the addition of fourth-quarter figures, it is expected that annual fee revenue will exceed 1 trillion KRW for the fourth consecutive year.

The reason card companies are adopting this strategy is that credit card delinquency amounts over one month have recently surpassed 2 trillion KRW, and revolving credit and card loan refinancing balances have surged, signaling a red alert for asset soundness. In a situation where customers are increasingly failing to repay card bills on time, companies are responding by reducing outgoing payments and increasing incoming revenue. Card companies are even focusing on attracting 'big spenders' by launching premium cards with annual fees reaching into the millions of KRW.

Card company performance is worsening. In the third quarter of last year, the net profit of card companies was 2.0426 trillion KRW, down 21.6% (563.7 billion KRW) from the same period the previous year. This decline was due to increased funding costs caused by high interest rates. A card industry official said, "Interest rates remain high, and financial market instability is intensifying due to risks related to real estate project financing (PF), so we are responding conservatively. Overseas business, which was aggressively expanded last year, is also struggling due to decreased travel demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)