Number of Companies Offering Low-Interest Loans Increased Over 2 Years

But Users and Loan Balances Decreased... New Loans Down

"Legal Maximum Interest Rate Cut and Rising Funding Costs Overlap"

Illegal Private Loan Damage Gradually Increasing

Calls for Policy Measures Including Supply of Low-Income Financial Products

The loan industry is facing difficulties as the delinquency rate rises and the number of users decreases. On the other hand, cases of illegal private financing damage are increasing. There are opinions that the maximum legal interest rate should be raised, as low-credit borrowers are being driven to illegal private financing.

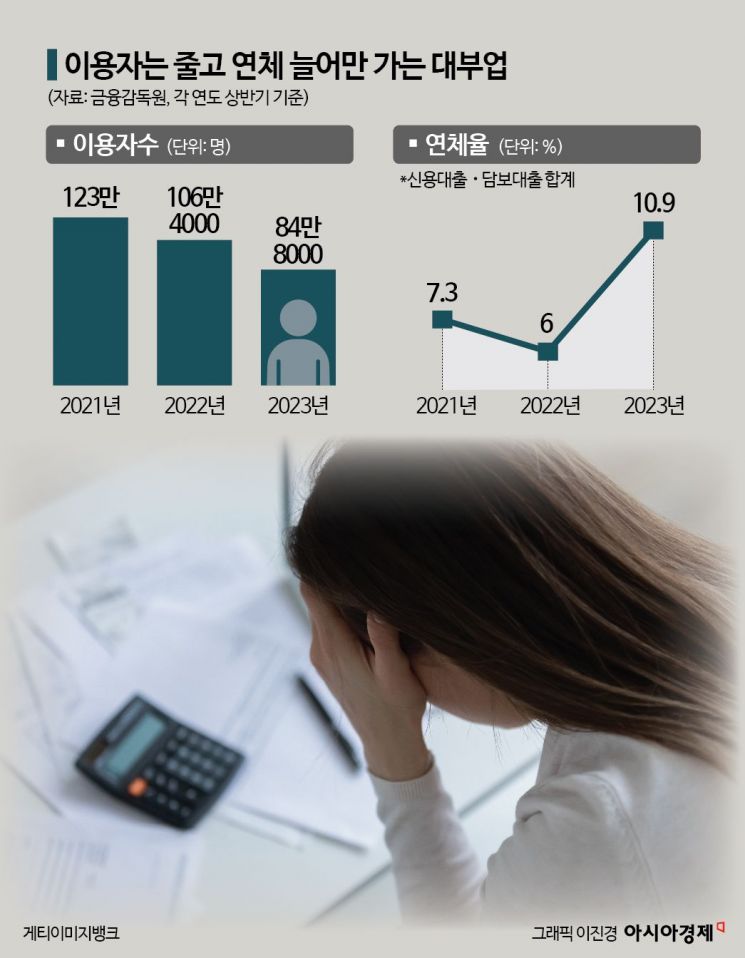

According to data from the Financial Supervisory Service, the number of loan users continues to decline. In the first half of 2021 (January to June), there were 1.23 million users; in the first half of 2022, 1.064 million; and in the first half of 2023, 848,000. The loan balance was similar, at KRW 14.5141 trillion at the end of June 2021 and KRW 14.5921 trillion at the end of June 2023. However, it decreased by KRW 1.2843 trillion compared to KRW 15.8764 trillion at the end of June 2022.

Meanwhile, the average interest rate in the loan industry has steadily declined. The rate, which was 15.8% (combined credit and secured loans) in the first half of 2021, dropped to 13.6% in the first half of 2023. The number of loan companies increased from 8,678 in the same period of 2021 to 8,771 in 2023.

In other words, while the number of loan companies offering money at lower interest rates increased, the number of users and the amount of money loaned by companies decreased. Additionally, the delinquency rate of loan companies has been rising every year. It was 7.3% in 2021, slightly dropped to 6% in 2022, and increased to 10.9% in the first half of 2023.

As the business environment worsened, loan companies have been reducing new loans. The Korea Financial Loan Association reported that the new loan amount of 69 major loan companies decreased by about 78%, from KRW 384.6 billion in January 2022 to KRW 83.4 billion in September 2023.

An official from a loan company cited the rise in funding costs as the biggest difficulty since the legal maximum interest rate was lowered from 24% to 20% in July 2021, stating, "With inflation rising further, the profit margin of loan companies itself has decreased." Although they increased the loan scale focusing on secured loans, which are less risky than unsecured credit loans, the real estate market situation is also unfavorable, making the situation more difficult.

Loans, known as the third financial sector, are called the "last refuge" for low-credit borrowers. For example, households borrowing at high interest rates generally have low income levels. According to data from the Korea Development Institute (KDI) last year, 84.8% of households using high-interest credit loans at 18-20% are vulnerable households.

As the loan industry situation worsens, there is an analysis that low-income people in urgent need of cash are being driven to illegal private financing. Kangsan Kim, a legislative researcher at the National Assembly Legislative Research Office, said, "It is necessary to examine whether the recent decrease in transactions in the loan market has led to an expansion in the use of illegal private financing." As the size of the illegal private financing market grows, user damage will also increase, so it can be indirectly estimated through the number of damage consultations and reports. In fact, the number of illegal private financing damage consultations and reports received by the Financial Supervisory Service's Illegal Private Financing Damage Reporting Center recorded the highest figure in five years. From January to June 2023, there were 6,784 cases, exceeding the total of 5,468 cases in 2019. This is about 62% of the 10,913 cases in 2022.

There are opinions that not only revitalizing the loan market but also protecting financially vulnerable groups requires raising the legal maximum interest rate and supplying policy-based financial products for low-income people. Researcher Kim stated, "The maximum interest rate regulation seems to cause financial exclusion problems for vulnerable groups in the loan market during periods of interest rate hikes."

The loan industry argues that the "Excellent Loan Company System," which allows loan companies to borrow from banks, needs to be revised. This system selects companies with more than 70% of their unsecured credit loan performance as excellent loan companies and allows them to enter loan brokerage platforms. The Financial Services Commission created this system out of concern that low-credit borrowers would be driven to illegal private financing markets due to the lowering of the legal maximum interest rate. Currently, 19 companies have been selected as excellent companies, but none have entered online financial platforms such as KakaoPay, leading to evaluations that the system is "nominal and ineffective." An official from a loan company said, "Since commercial banks hesitate to lend due to criticism that they act as 'loan brokers,' incentives and other inducements are needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)