Financial Services Commission Approves Amendments to Asset Securitization Business Supervision Regulations and Accounting Standards for Securitization Companies

The Financial Services Commission announced on the 27th that it has approved amendments to the 'Asset Securitization Business Supervision Regulations' and the 'Accounting Standards for Securitization Companies.'

This revision of subordinate regulations aims to specify delegated matters following the amendment of the 'Act on Asset Securitization' and its enforcement decree. The amended law and subordinate regulations will take effect from January 12 next year.

Number of Companies Meeting Asset Holder Requirements Increases 3.8 Times

The financial authorities have relaxed the asset holder requirements to expand funding opportunities for general companies. Previously, only companies meeting the asset holder requirements could utilize the registered securitization system, with conditions such as a credit rating of 'BB or higher' cited as obstacles.

Accordingly, instead of credit rating regulations for asset holders, companies that meet all of the following will be recognized as asset holders: ▲corporations subject to external audits with assets of 50 billion KRW or more ▲capital impairment ratio below 50% ▲unqualified audit opinions. As a result, the number of companies meeting the asset holder requirements will expand from 3,000 to over 11,000, a 3.8-fold increase.

The scope of asset holders in the mutual finance sector will also be expanded. Until now, only some mutual finance central associations, credit unions, Saemaeul Geumgo central associations, and agricultural and fisheries cooperative units were designated as asset holders, but from now on, central associations and cooperatives across the entire mutual finance sector will be recognized as asset holders. This has been effective since the 19th of this month.

The scope of securitized assets will also be expanded. The range will be broadened from bonds, real estate, and other property rights to include future receivables and intellectual property rights. This is to reduce the burden on companies and increase the utilization of the registered securitization system.

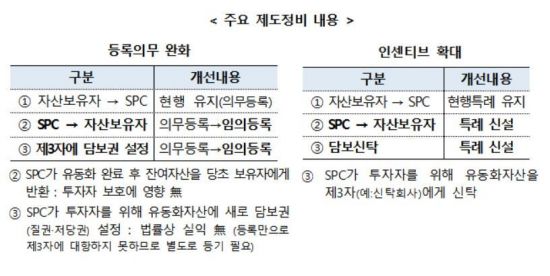

Additionally, the obligation to register asset securitization plans has been relaxed to allow voluntary registration when securitized assets are returned or when security interests are established on securitized assets. Legal incentives have been expanded so that the acquisition of security interests (pledge or mortgage) will take effect without separate registration even when pledged or mortgaged bonds are returned or trust collateral is established on those bonds.

Securitization Companies to Fully Disclose Securities Issuance Details

To enhance transparency in the securitized securities market, an information disclosure obligation has been introduced for both registered and unregistered securitized securities. Securitization companies, etc., must disclose details of securities issuance, information related to securitized assets and asset holders, matters concerning business delegation, credit ratings of securitized securities, and credit enhancements on the Korea Securities Depository website. Upon request by the Korea Securities Depository, supporting documents such as contract copies must also be submitted. Violations will incur fines of up to 10 million KRW.

To increase the accountability of funding entities and the soundness of securitized securities, a risk retention obligation for funding entities has also been introduced. Those who transfer or trust assets to securitization companies and those who provide income generated from assets to securitization companies through contracts must hold 5% of the outstanding amount of securitized securities issued. However, to maintain market autonomy, various methods such as horizontal, vertical, and mixed holdings of securitized securities are permitted. Violations will result in fines of up to 5% of the issued amount of securitized securities, capped at 2 billion KRW if exceeding that amount.

However, the risk retention obligation is exempted for securitized securities deemed to have low credit risk or potential conflicts of interest. For example, cases where the state, local governments, or public institutions underwrite securitized securities as credit enhancement are included. Other exemptions include ▲P-CBOs for corporate funding support ▲securitized securities backed by bank term deposits ▲NPL securitized securities for financial company restructuring ▲securitized securities backed by corporate purchase-only cards and checking accounts.

The qualification requirements for trustees who actually operate so-called 'paper companies'?nominal securitization companies?and manage funds have also been revised. To be entrusted with general administrative tasks, the trustee must be ▲a corporation ▲have at least 500 million KRW in equity capital ▲have at least three full-time staff including two professionals. To be entrusted with fund management, the trustee must be a financial institution licensed for trust business under the Capital Markets Act, excluding real estate trust companies. However, an exception is allowed where a professional investor under the Capital Markets Act holds all securitized securities issued by the securitization company, exempting the need for trust business licensing. When concurrently serving as an asset manager, a conflict of interest prevention system must be established.

The Financial Services Commission stated, "Together with the Financial Supervisory Service and the Korea Securities Depository, we will support the smooth settlement of the amended Asset Securitization Act in the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)