SSG.com Prepares for IPO... Securities Industry Expresses 'Doubt'

Oasis, Kurly, and CJ Olive Young Also Lukewarm About Going Public

Although the initial public offering (IPO) market, which had been frozen cold, is showing signs of recovery, major distribution companies have failed to proceed with listing procedures and will carry over into the new year.

According to the distribution industry on the 26th, no distribution companies appeared in this year’s IPO market. Curly, which postponed its listing due to last year’s IPO market cooling, along with SSG.com, Oasis Market, 11st, and CJ Olive Young, all failed to proceed with IPOs. Although the domestic and international stock markets are on the rise and the IPO market is stretching its legs, major distribution companies remain lukewarm about going public.

Most of the companies that have thrown their hats into the ring are e-commerce firms. However, the market atmosphere has tightened since the endemic phase, making them more cautious about IPOs. This is because consumers who used to enjoy shopping online have started visiting offline stores, lowering expectations for e-commerce companies. The fact that Coupang succeeded in turning a profit for the first time after ending its ‘planned deficit’ also had an impact. Market investors’ focus has shifted from future growth potential to whether companies can monetize like Coupang, and how quickly they can do so.

Among them, SSG.com currently appears to have a relatively strong willingness to go public. Around July to August, Lee In-young, CEO of SSG.com, visited the Korea Exchange to discuss various matters related to listing with the goal of pursuing an IPO next year. At that time, Lee reportedly also provided explanations about SSG.com to the listing department of the exchange. Lee, a former CFO of Gmarket’s finance division, is directly overseeing SSG.com’s listing. He even holds a certified public accountant license, demonstrating his deep experience in finance.

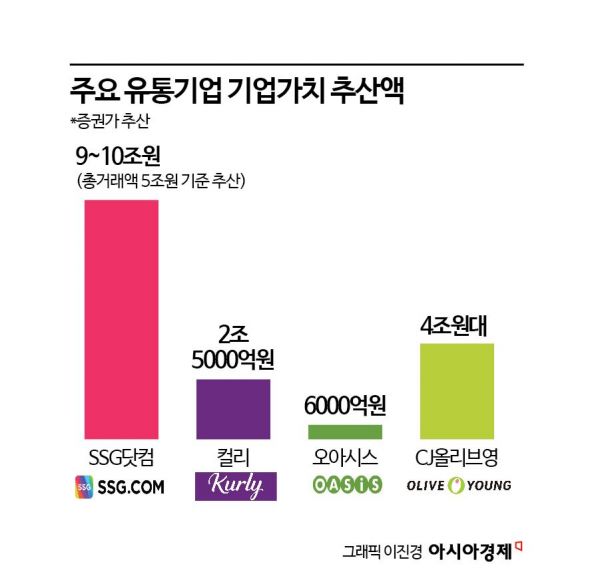

Whether the listing will proceed smoothly remains to be seen. Assuming preparations for listing begin targeting the second half of next year, the performance in the first half of next year will become crucial. SSG.com’s standalone operating loss (excluding W Concept, etc.) is 30.7 billion KRW, and the cumulative operating deficit for this year reaches 64.6 billion KRW. Considering that the company is pursuing a strategy to balance profitability and scale (total transaction amount), it is questionable whether SSG.com’s financial investors (FIs) can be persuaded to accept the market valuation they expect. When SSG.com first received investment from FIs in 2018, its valuation was 3.3 trillion KRW, but the industry estimates SSG.com’s value at 10 trillion KRW based solely on total transaction volume (over 5 trillion KRW). A securities industry insider explained, “Either the FIs need to lower their expectations, or SSG.com’s profitability must improve dramatically. Without one of these, it will be difficult to proceed with the listing.” SSG.com stated, “Nothing has been decided regarding the listing.”

The listings of Oasis Market and Curly are expected to be further delayed. In the case of Oasis Market, UCK (Unison Capital Korea), which invested in Oasis through pre-IPO equity investment, still claims a corporate valuation in the 900 billion KRW range. At the beginning of this year, Oasis Market’s market valuation was around 600 billion KRW. The industry views that to bridge this gap and achieve the desired valuation, expanding scale and discovering new businesses are necessary. Curly’s valuation was 4 trillion KRW when it raised funds through pre-IPO from FIs, but it is currently in the 2 trillion KRW range.

CJ Olive Young is surrounded by rumors about going public. The company has dismissed speculation about an IPO in the first half of next year, stating, “We will go public at an appropriate time.” It appears to be considering a time when it can receive a higher valuation than when it withdrew its IPO in August last year. Olive Young’s sales are expected to exceed 3 trillion KRW this year (compared to the 2 trillion KRW range in 2021), so its corporate value is presumed to have increased further.

Beauty companies have made significant strides in this year’s IPO market. Following the positioning of Myeonnyeo Gongjang and Beauty Skin as representative newcomers in the KOSDAQ market in the first half of the year, APR, which is recognized with a corporate valuation of up to 1.5 trillion KRW, is challenging a KOSPI listing next year. Operating six brands in beauty and skin care devices (MediCube, A-Plus Skin, etc.), fashion (Nerdy), and entertainment (PhotoGray), APR’s securities report shows an operating profit of 93.1 billion KRW as of November this year, a 191% growth compared to the same period last year. A beauty industry insider said, “The good performance of small and medium-sized beauty companies is driving many toward the IPO market,” adding, “Investors seem to focus more on whether companies are currently making money rather than just sales.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)