Hyundai Motor and Kia Transfer Russian Factory Shares for 140,000 Won

Condition Allows Share Repurchase Within 2 Years

Hyundai Motor Group Ranked No.1 in Russian Market Share in 2021

Possibility of Market Reentry After War Left Open

Hyundai Motor Company is ultimately handing over its Russian factory to a local company. This decision comes as losses have become uncontrollable after production was suspended since March last year due to the prolonged Russia-Ukraine war. However, Hyundai has included a repurchase condition (buyback option) within two years, leaving the door open to re-enter the Russian market if the situation improves.

On the 19th, Hyundai held an extraordinary board meeting and approved the sale of its stake in the Russian factory located in Saint Petersburg (Hyundai Motor Manufacturing Russia·HMMR). The General Motors (GM) Russia factory, acquired in 2020, will also be sold together. The buyer is a local company called Art Finance, which also purchased Volkswagen Group’s Kaluga plant after Volkswagen withdrew from Russia.

Currently, Hyundai holds 70% of the shares in the Russian factory, while Kia holds 30%. The book value of the 70% stake alone amounts to 287.3 billion KRW. However, Hyundai and Kia have agreed to sell 100% of the shares for a mere 10,000 rubles (approximately 145,000 KRW). At the same time, they have set a 'buyback' condition allowing them to reacquire the shares within two years. This keeps open the possibility of re-entering the Russian market once the war situation ends.

Previously, other automakers such as Renault, Nissan, and Ford also sold their assets to Russian state-owned companies at nominal prices like 1 ruble or 1 dollar. These companies also included buyback options allowing them to reclaim their assets within 5 to 6 years. The reason automakers sell assets at such low prices while attaching buyback clauses lies in the unique nature of the automotive market. Due to the large-scale capital investment required in the automotive industry, once a company withdraws, re-entry is practically difficult.

Hyundai Motor Group was virtually the last automaker to hold out in Russia. Given the international situation, local production became impossible, and losses ballooned beyond 1 trillion KRW. However, it was difficult to easily give up the Russian market, where Hyundai had even recorded the number one market share.

Hyundai officially entered the Russian market by establishing a local corporation in 2007. In 2010, it completed the Saint Petersburg plant, its sixth overseas production base, and began local production in 2011. By 2020, cumulative production exceeded 2 million units. Riding this momentum, Hyundai also acquired GM’s Russian factory. The plan was to build a production base with an annual capacity of 300,000 units by combining the existing Hyundai Saint Petersburg plant with the nearby GM plant in Shushary.

In August 2021, Hyundai and Kia combined to achieve a 28.7% market share, becoming the number one automaker in the Russian market. Just before the Russia-Ukraine war in 2021, they maintained an annual production volume exceeding 230,000 units. Popular models included the locally tailored compact car Solaris, the export-oriented compact SUV Creta, and the Kia Rio.

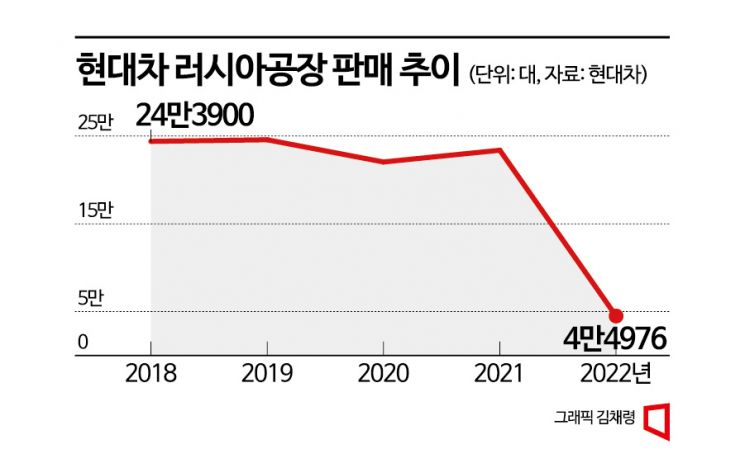

However, all plans were disrupted when the war began in February last year. Production at the Russian factory plummeted to about 44,000 units last year, which is one-fifth of the 2021 level. This year, the factory has not operated at all.

Local sales also dropped sharply. According to the Association of European Businesses (AEB), Hyundai’s sales in the Russian market fell from 2,892 units last year to just 6 units by August this year. In effect, sales became impossible. Hyundai Motor Group’s cumulative losses related to the suspension of the Russian factory are estimated to exceed 1 trillion KRW.

However, Hyundai plans to continue after-sales service (A/S) for vehicles already sold locally, considering the local situation. This appears to be an effort to minimize damage to the brand image while keeping the possibility of re-entering the market open in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)