If Default Is Declared, Trillions in Borrowings May Default Together... Considering Market Chaos

Financial Authorities Expected to Guide 'Orderly PF Restructuring'

Korea Investment & Securities "Taeyoung Construction Must Present Drastic Measures"

It has been confirmed that financial companies recently agreed to defer the repayment of 40 billion KRW in loans for Tae Young Construction's construction sites that have reached maturity. This decision is believed to have been influenced by concerns that if the lending consortium declares a loss of interest benefit (default, EOD) due to Tae Young's debt default (bankruptcy case), the market impact would be too significant.

On the 18th, at the Taeyoung Construction headquarters in Yeouido, Seoul. Photo by Jinhyung Kang aymsdream@

On the 18th, at the Taeyoung Construction headquarters in Yeouido, Seoul. Photo by Jinhyung Kang aymsdream@

According to the financial sector on the 20th, the lending consortium for Tae Young Construction, composed of several financial companies, recently agreed to extend the 40 billion KRW credit loan that had matured. A financial company official stated, "We decided to postpone the principal and interest repayment date without changing the loan conditions such as interest rates," adding, "It is practically equivalent to deferring repayment rather than simply extending the loan."

There are also observations that an unseen force was at work. An industry insider said, "It is understood that the financial authorities requested the financial holding companies to which the lending consortium belongs to extend the loans related to Tae Young Construction," and added, "In a situation where opinions within the consortium were divided, many financial companies that initially demanded 'repayment' changed their stance to 'extension.'"

It is not known what discussions took place within the lending consortium when extending the loan. However, it appears that concerns arose that if the consortium immediately declared bankruptcy, trillions of won in loans and contingent liabilities would simultaneously face cross-default, potentially causing market turmoil at the end of the year. Financial authorities, having declared PF restructuring, are also expected to need time for orderly restructuring through 'sorting out' via business feasibility evaluations.

Meanwhile, on the 19th, Korea Investment & Securities released a report emphasizing the need for drastic measures for Tae Young Construction. Korea Investment & Securities is one of the major creditors providing financial support by converting Tae Young Construction's short-term PF borrowings into long-term borrowings, and the report was published the day after the lending consortium meeting on loan extension, drawing industry attention.

Kang Kyung-tae, a researcher at Korea Investment & Securities, pointed out in a report titled "Tae Young Construction Status Check" that "If the restructuring of PF loans for sites lacking business feasibility begins in earnest next year, the guarantee amount Tae Young Construction must fulfill will reach 720 billion KRW," and stressed, "Tae Young Construction must come up with drastic measures."

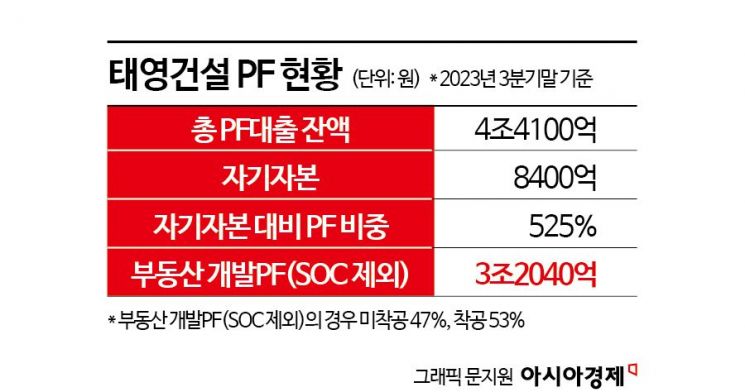

According to the report, as of the end of the third quarter this year, the balance of PF loans guaranteed by Tae Young Construction was 4.41 trillion KRW, of which the pure real estate PF balance excluding PF guarantees for private SOC projects was about 3.2 trillion KRW. Approximately 47% of this amount is in an unstarted state, meaning repayment resources have not been secured. Additionally, 45% of the unstarted sites are located in provincial areas, including the six major metropolitan cities, so if the projects are completed without loan extensions, the guarantee amount Tae Young must immediately fulfill will reach 720 billion KRW.

Researcher Kang evaluated, "As of the end of the third quarter this year, Tae Young Construction's net borrowings (total borrowings minus cash equivalents) stand at 1.93 trillion KRW, and its debt ratio is 479%, the highest among construction companies," adding, "It is a situation where it is difficult to even properly repay interest with operating profit, indicating an extreme shortage of short-term liquidity."

However, he added, "While drastic measures are indeed necessary, considering the ripple effects on the market, it is necessary to observe the self-help efforts of Tae Young Construction and its parent company, TY Holdings," implying hope that the lending consortium will not immediately declare EOD.

Meanwhile, attention is also focused on whether loans related to Tae Young Construction's PF projects that will mature in the future will be extended. On the 22nd, the loan for the 'Eco City' development project on the former military base site in Jeonju will mature. On the 29th, the loan for the Seongbuk Mansion reconstruction project in Wolgye-dong, Nowon-gu, Seoul, is due. In the first quarter of next year, loans for the Gwangmyeong station area development project in Gyeonggi Province, the Samgye-dong urban development project in Gimhae, Gyeongnam, and the officetel development project in Uijeongbu, Gyeonggi Province, will also mature.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)