Securities Firms Lower Q4 Earnings and Stock Price Forecasts

High Possibility of Earnings Recovery Next Year... Expecting a Turnaround in Sentiment

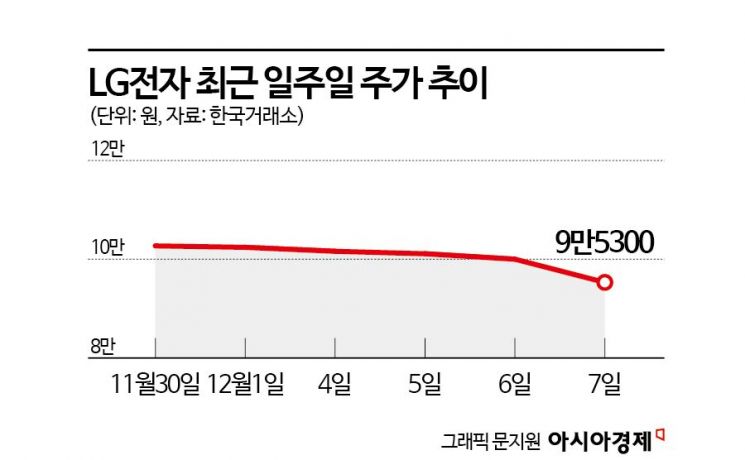

LG Electronics fell below the 100,000 KRW mark again after seven consecutive days of decline on the 7th. Concerns over weak fourth-quarter earnings have led institutions and foreigners to continuously sell, dragging the stock price down. While it seems necessary to lower expectations for the time being, some opinions suggest that the stock price fluctuations should be used as buying opportunities at low prices, given the strong earnings recovery expected next year.

According to the Korea Exchange on the 8th, LG Electronics closed at 95,300 KRW, down 4.7% from the previous day, breaking the 100,000 KRW level again after about a month. The stock has been declining for seven consecutive trading days, with a total drop of 8.8% during this period.

Continuous selling by institutions and foreigners is pulling the stock price down. Institutions have sold LG Electronics for 11 consecutive trading days since the 22nd of last month. During this period, institutions net sold LG Electronics worth 209.1 billion KRW, making it the second largest net sale after SK Hynix (210.2 billion KRW). Foreigners also net sold LG Electronics worth 61.8 billion KRW during the same period. Foreigners showed a selling bias on all but three of the 11 trading days.

Concerns over fourth-quarter earnings are cited as a factor behind the weak stock price. Securities firms have recently lowered their fourth-quarter earnings forecasts and target prices for LG Electronics. Kiwoom Securities lowered LG Electronics' target price from 150,000 KRW to 140,000 KRW the day before, and BNK Investment & Securities also adjusted it down from 150,000 KRW to 130,000 KRW.

Kim Jisan, a researcher at Kiwoom Securities, said, "We are revising LG Electronics' standalone (excluding LG Innotek) fourth-quarter operating profit estimate down from 327.6 billion KRW to -10.3 billion KRW," adding, "While sales are not expected to differ significantly from estimates, this reflects a worsening product mix due to weak demand for premium products and increased marketing expenses." He continued, "Along with the earnings estimate adjustment, the target price is also lowered to 140,000 KRW," and added, "Improving LG Display's financial soundness remains a challenge."

BNK Investment & Securities forecast that LG Electronics' fourth-quarter operating profit, excluding LG Innotek, will record 130.5 billion KRW, significantly below the previous estimate of 339 billion KRW. Lee Minhee, a researcher at BNK Investment & Securities, said, "This is due to marketing expenses increasing more than expected amid a slowdown in consumer spending and intensified competition." She added, "H&A (home appliances) sales are similar to previous estimates, but the operating profit margin was lowered from 2.9% to 1.2%. The HE (TV) division's sales were revised down by 3% due to sluggish sales of high-end TVs including OLEDs. The operating profit margin is expected to turn negative, dropping from 1.6% to -0.3%."

Although this year’s performance is expected to be weak, the outlook for next year is different. Park Kangho, a researcher at Daishin Securities, said, "Next year, LG Electronics' consolidated operating profit is expected to reach 4.3 trillion KRW, a 4.8% increase from the previous year, marking the highest performance. LG Electronics alone, excluding LG Innotek, is also estimated to record an operating profit of 3.32 trillion KRW, the highest level." He added, "Home appliances are expected to show strong sales and profit growth driven by new products and targeting the volume zone (mid-price market), while TVs are expected to see expanded premium demand amid expectations for the Paris Olympics and replacement demand." Researcher Kim Jisan also said, "A strong earnings rebound momentum will be valid in the first half of next year," adding, "The peak domestic season and efficient cost management effects will be concentrated, combined with a recovery cycle in IT set demand, and the contribution of automotive parts profits will expand."

Since earnings recovery is expected next year, stock price fluctuations are anticipated to present buying opportunities at low prices. Researcher Lee Minhee said, "Considering that LG Electronics is increasing its market share in the home appliance market and showing differentiated performance through cost improvements, its growth potential will be significant when the economy recovers," and explained, "It is necessary to take advantage of stock price fluctuations to seek low-price buying opportunities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)