Continuous Upper Limit Period Accounts for 98% of Individual Investor Trading Volume

Exchange Repeatedly Designates as Investment Warning Stock, Suspends Trading for Second Time

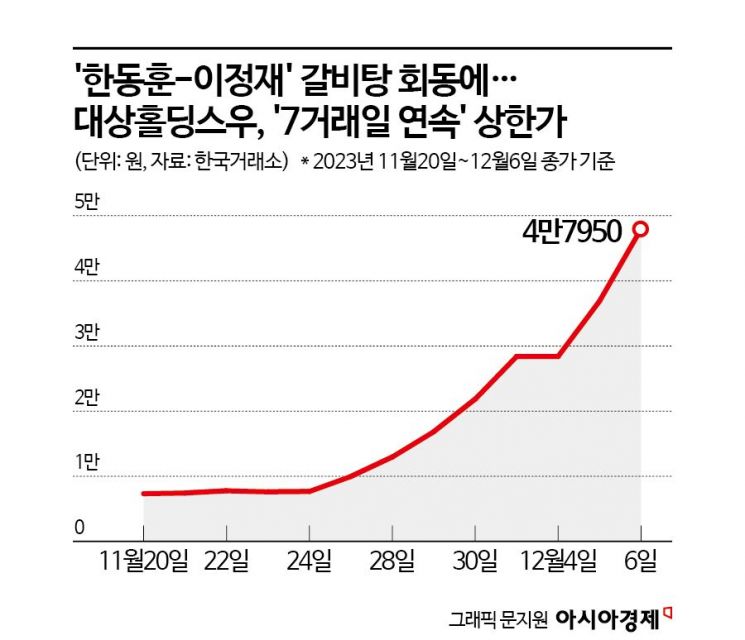

The preferred shares of Daesang Holdings, linked to the so-called 'Han Dong-hoon theme stock,' recorded the upper price limit for seven consecutive trading days. During this period, individual investors showed overwhelming trading volume and led the transactions.

According to the Korea Exchange on the 7th, the price of Daesang Holdings preferred shares closed at 47,950 KRW the previous day. The stock price surged to the maximum price limit for seven consecutive trading days starting from the 27th of last month. The only significant trigger for this surge was the so-called 'Galbitang meeting' photo featuring Minister of Justice Han Dong-hoon and actor Lee Jung-jae. Before the photo was released, the stock price hovered around the 7,000 KRW range but suddenly soared more than sixfold. Lee Jung-jae is known to be in a relationship with Lim Se-ryeong, Vice Chairman of Daesang Holdings.

During the period when the price of Daesang Holdings preferred shares abnormally skyrocketed, individual investors led the trading volume. From the first day the upper price limit was recorded on the 27th of last month until the previous day, the total trading value of Daesang Holdings preferred shares (based on purchases) was 168.79 billion KRW. Of this, 98%, or 166.141 billion KRW, was attributed to individual investors. Other foreign investors, who are effectively individual investors, also accounted for 548 million KRW in trading volume. 'Other foreign investors' refers to general foreigners of overseas nationality who are not overseas institutional investors. This includes overseas individual investors trading stocks domestically. In addition, institutional investors in the financial investment industry accounted for 1.26 billion KRW, and other corporations (non-financial investment corporations) accounted for 787 million KRW.

However, the net purchase volume relative to the trading volume was not large. Other foreign investors had the largest net purchase volume at 54 million KRW, followed by financial investment institutions at 53 million KRW. Individual investors were recorded as net sellers with 24 million KRW.

When Daesang Holdings preferred shares recorded the upper price limit for five consecutive trading days, the Korea Exchange judged the surge as abnormal and suspended trading on the 4th. However, as soon as trading resumed, the stock price again hit the upper price limit for two consecutive days, soaring to unprecedented heights. Daesang Holdings responded to the exchange's inquiry disclosure request by stating, "There are no confirmed important disclosure matters related to significant market fluctuations," but this was ineffective. The exchange designated Daesang Holdings preferred shares as a second investment warning stock the previous day and suspended trading for the second time on this day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)