International credit rating agency Moody's downgraded China's sovereign credit rating outlook from 'stable' to 'negative,' prompting Chinese authorities to state that "there is no change in the fundamentals of long-term improvement."

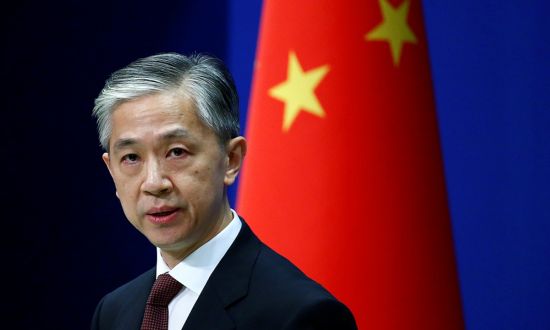

Wang Wenbin, spokesperson for the Chinese Ministry of Foreign Affairs, said at a regular briefing on the 6th regarding Moody's announcement, "This year, the macroeconomic recovery continues, and high-quality development is steadily progressing," adding, "China continuously has the capability to deepen reforms and the ability to respond to risks and challenges."

He also mentioned that the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD) raised their economic growth forecasts for China this year to 5.4% and 5.2%, respectively, explaining that many international organizations are upgrading their economic growth outlooks for China this year.

Spokesperson Wang added, "There is no need to worry about China's economic growth outlook or fiscal sustainability," and "China has already become synonymous with a top investment destination, and we welcome businesspeople from all countries to invest and operate in China."

Moody's maintained China's sovereign credit rating at A1, the fifth-highest rating, but lowered the credit rating outlook from 'stable' to 'negative' the day before.

The head of the National Economy Comprehensive Division at the National Development and Reform Commission, China's main macroeconomic authority, also emphasized in response to a reporter's question about the economic outlook, "Macroeconomic indicators are showing relatively good performance."

The official cited positive economic indicators such as a 5.2% GDP growth rate for the first to third quarters, a 0.4% consumer price increase from January to October, a 5.0% urban unemployment rate in October?down 0.6 percentage points compared to February?and a 5.9% year-on-year increase in third-quarter per capita disposable income.

He also mentioned that the manufacturing Purchasing Managers' Index (PMI) production and business activity expectation index for November rose to 55.8 for the second consecutive month as an example but did not mention that the manufacturing PMI had been below the 50-point threshold?indicating a contraction phase?for two consecutive months.

The official stressed, "Looking ahead, there are still many favorable conditions and supportive factors for China's economic development."

He explained that the downgrade of the sovereign credit rating outlook reflects increased evidence that Chinese authorities need to provide fiscal support to heavily indebted local governments and state-owned enterprises, posing broad risks to China's fiscal, economic, and institutional capacities. He added, "It also reflects structurally and persistently low medium-term economic growth and ongoing contraction in the real estate sector."

The Chinese Ministry of Finance also expressed disappointment shortly after Moody's announcement, stating, "Despite an unstable global economic recovery and weakening momentum, China's macroeconomy has continued to recover this year, with steady progress in qualitative development."

Meanwhile, on the same day, international credit rating agencies Standard & Poor's (S&P) and Fitch maintained China's sovereign credit rating outlook as 'stable.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)